Hi all, I can’t pick up any paper business or otherwise without reading about the latest crypto opportunity or how AI will make us all unemployed. On the subject of AI, I kind of understand where it’s going but we should all realise that AI mimics humans mistakes. Take for example on 08/12/2005 a trader at Mizuho bank who was asked to sell one share at 610,000 Yen. What he actually did was sell 610,000 shares at 1 Yen. One trader called BNF promptly purchased 7,100 shares or 49% of the company. The trade could not be reversed and Mizuho bank lost 27 Billion Yen. Whats this got to do with AI? AI mistakes are basically human mistakes but are much more efficient. I make my living on this and its getting easier, much easier. When the algo’s are turned on at 9.30 US eastern time the computers use 50 year old human models to trade. They are quicker than humans but if you turn up the time frame it’s like taking candy from a baby. Why, because there’s no humans involved. Lots of small mistakes that nobody seems to care about.

Take for example the FT newspaper. The share listings for the last year for Ireland don’t even list any Irish companies. It would be funny but when you point this out to them by e-mail a non human bot replies that they will look into it.

Take Cryptos and the all powerful Bitcoin. In 1938 Ralph Elliot wrote a book on ‘Wave Theory’ that a lot of computer models still use today. Well using it points to a peak of about $122,000 for one bitcoin. Lets see if I’m right. The machines should kick in selling in the next few weeks. The maniacs are running the madhouse. Lets see what happens?

The market keeps going up no matter what. I closed and went short a lot of positions after Trumps Liberation Day. I was crushed in the ensuing rally and have now reversed most of the positions. That’s what they call a whipsaw and the price I pay for trend following with a slow model.

Bonds have begun to pique my interest, especially as they performed so well during the 2008 Financial Crisis. Mainly the short term 1-3 year US government bonds. I read recently that the OECD had stated that western bond debt will exceed 84% of most western countries GDP. I’m not an economist but if another large correction happens that means to me that western governments will not be able to use QE(Quantitive Easing) to effectively get out of a mess as who will buy their debt? Print the money all you like but if no-one buys your bonds, your in serious trouble. All you can do is cut your interest rates. Anyway that’s for another day.

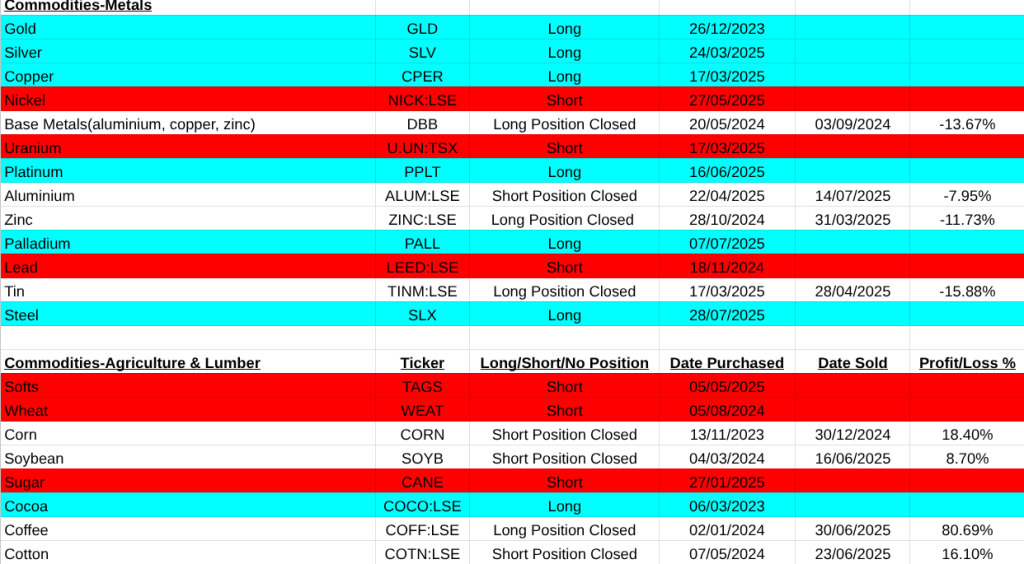

On my main asset list the miners are certainly coming alive, even Lithium(LIT:NYSE), my short position was closed for a profit of 56%. This highlights the disconnect between news and reality. You would imagine that lithium miners would have been a safe bet over the last few years but on average miners have dropped on average by over 64% since July 2023. Aluminium, Palladium, Steel are all now long’s and with that Canada and Emerging Markets.

All my trades are below for the last three weeks and recommendations, all the best, Pearse.

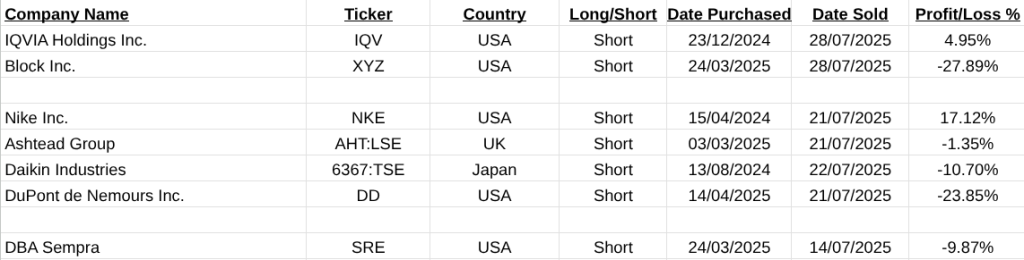

MSCI Large World Cap. Closed Trades

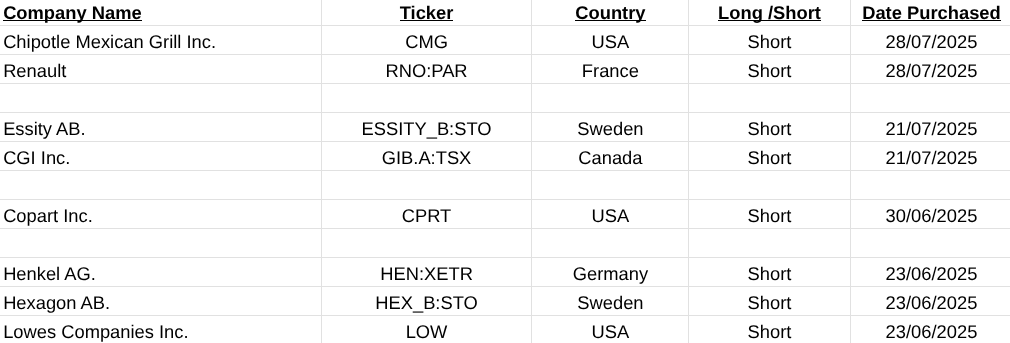

MSCI Large Cap Long Signals

MSCI Large Cap Short Signals

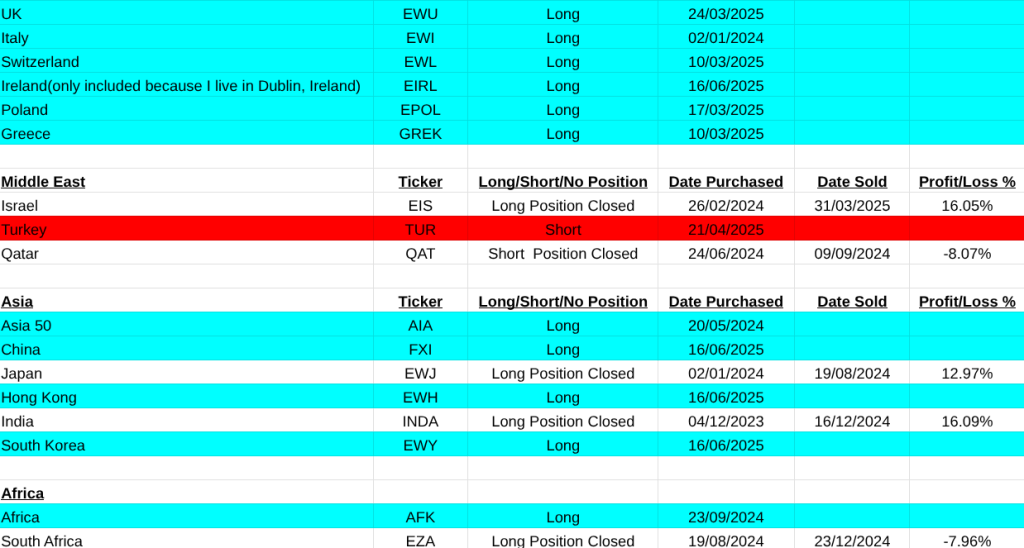

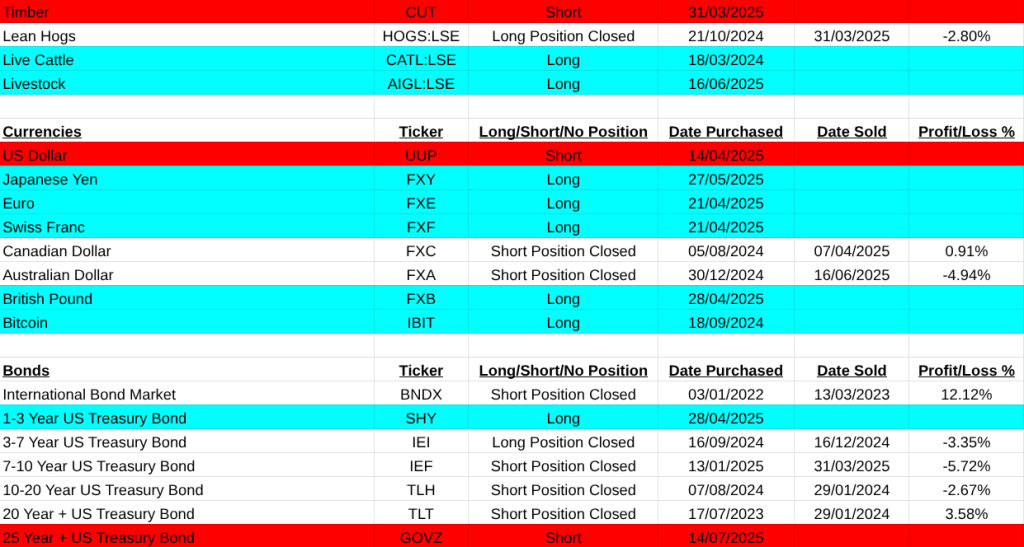

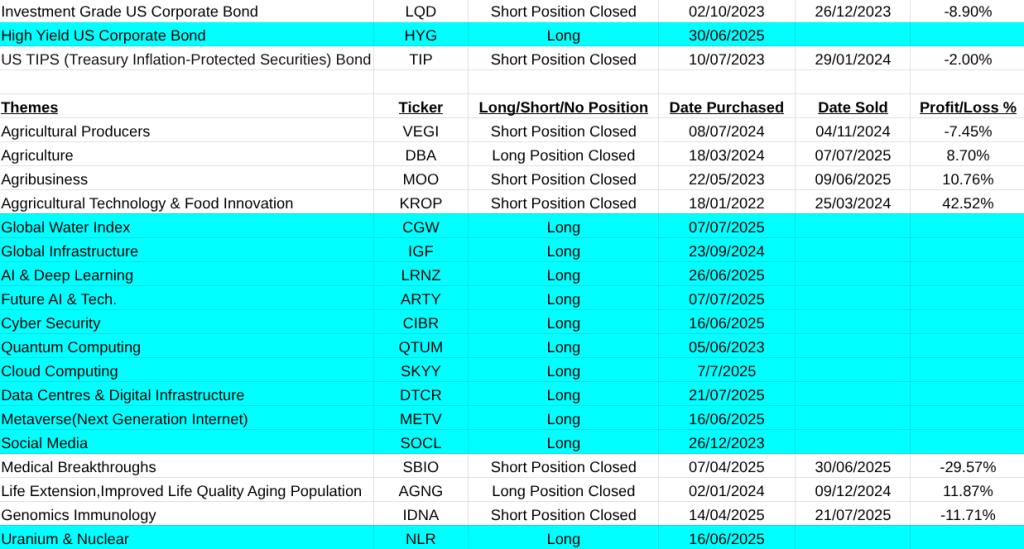

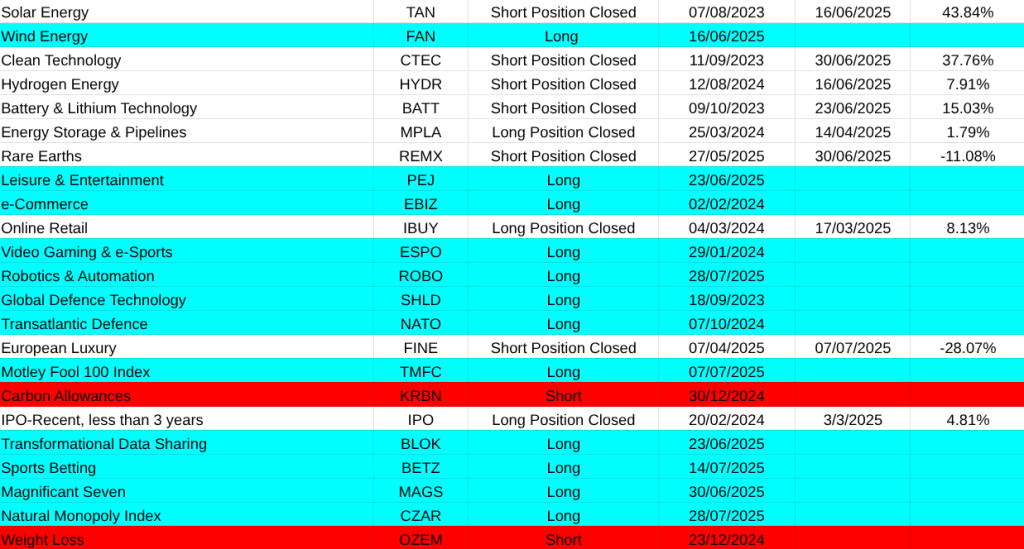

Main Asset List, Short positions are marked in red, long in blue, neutral in white.

Note:The above trades do not take into consideration dividends on shares or coupons on bonds. This is important because if you short a stock or bond the dividend will be taken from you. Therefore the safest strategy is never to short any instrument only buy an upwardly trending security and simply close your position when this ends. These trades are my view on the market and not me advising you to take any of these positions. Closed positions have losses and profits listed in percentages. Mainly as a record to myself so I keep honest in evaluating my strategy.

The list of stocks analysed are from the MSCI Large Cap list as of 01/01/2025.