Hi all, I was as we say in Dublin ‘Malavogued’ over the last two weeks, translated it means punished or trounced severely. Well I’m licking my wounds. I was short a lot of positions after Trumps so called ‘Liberation Day’ announcement on April 5th. The signals appeared and I took them. There are disadvantages of trend following but overall performance in good.

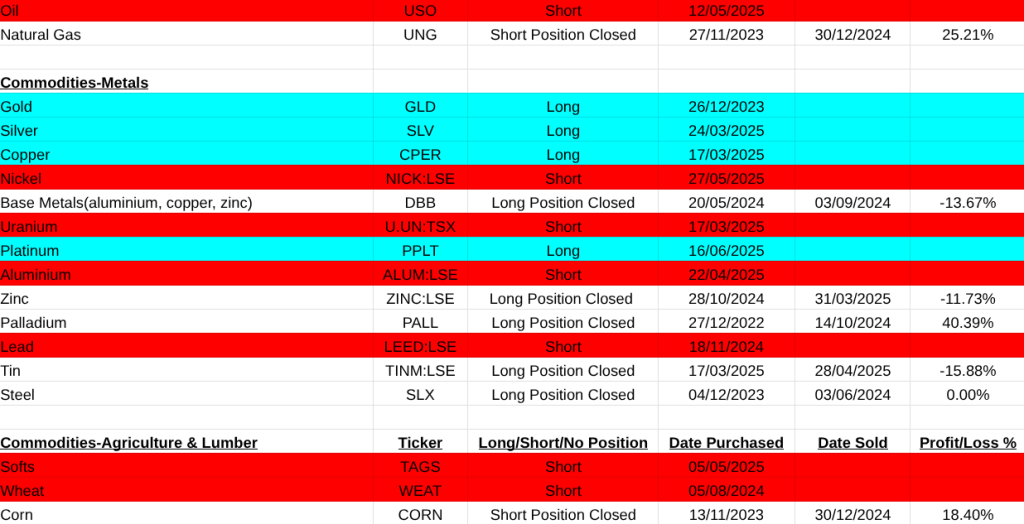

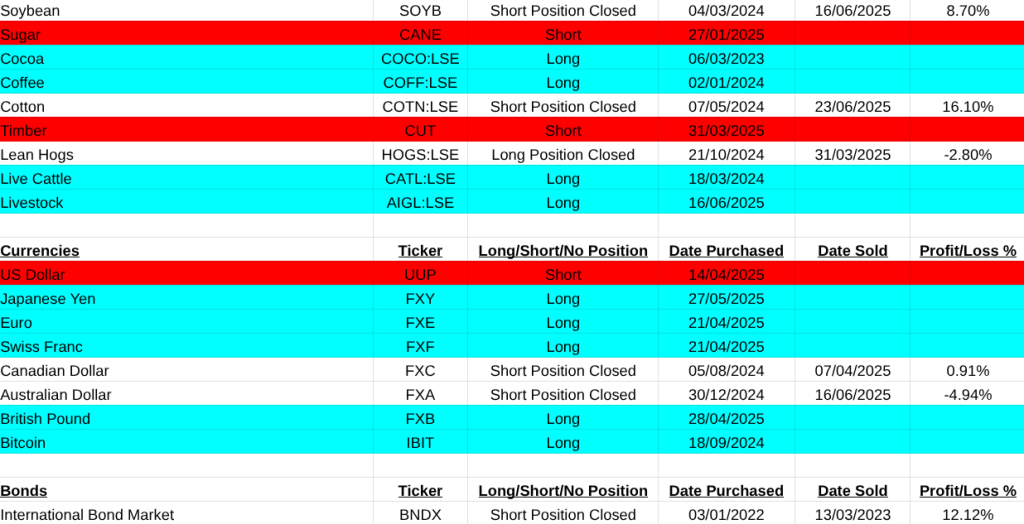

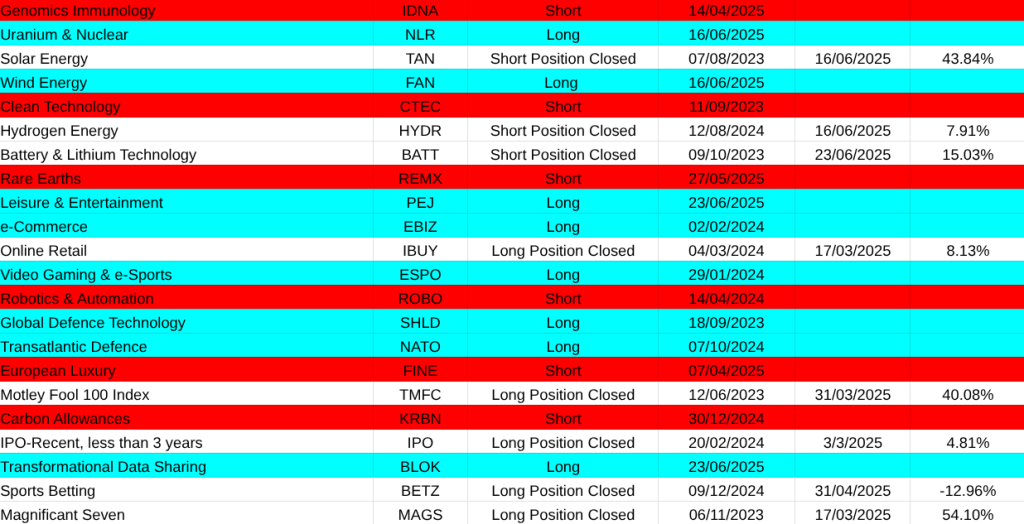

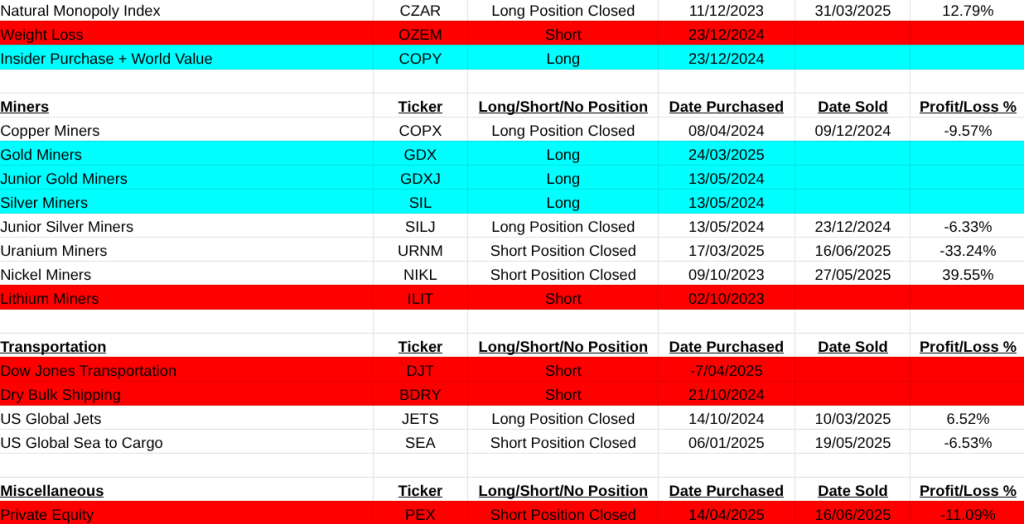

The main asset list didn’t suffer at all. Mainly because most of the products are etf’s and this waters down their movement. My worst loss here was a short on Uranium miners(URNM -33.24%). It was easily covered by a gain in Solar(TAN +43.84%). Others that closed were Cotton(COTN:LSE +16.10%, Battery Tech(BATT +15.03%), Soybeans (SOYB +8.70%), Hydrogen(HYDR +7.91%), Australian Dollar(FXA -4.94%).

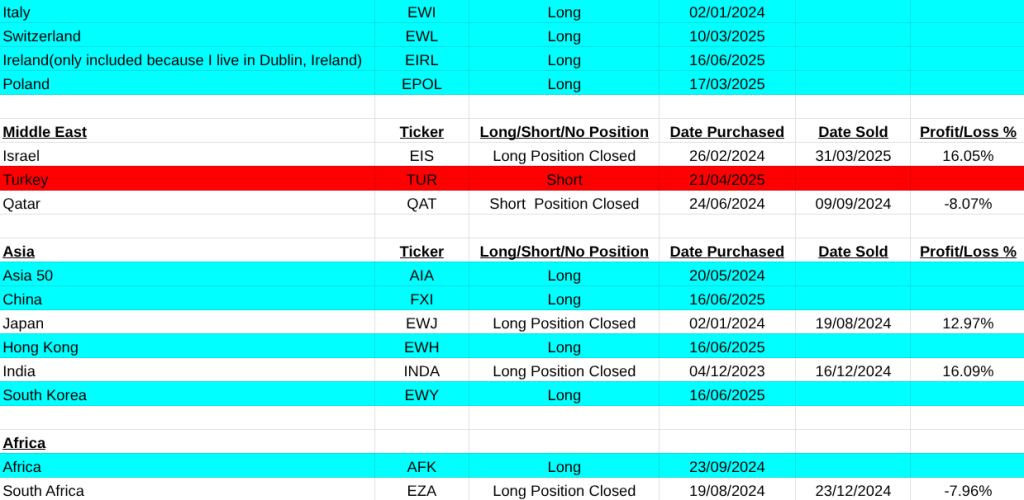

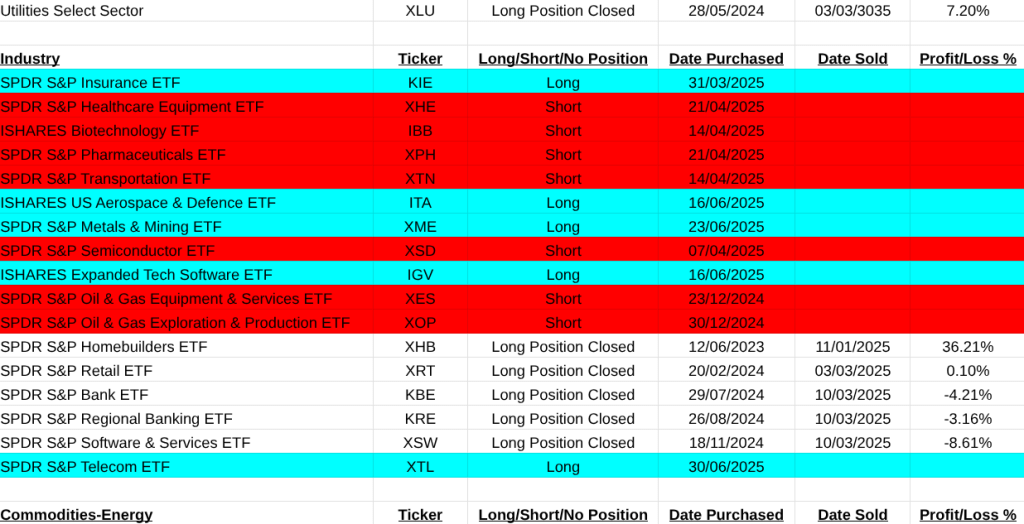

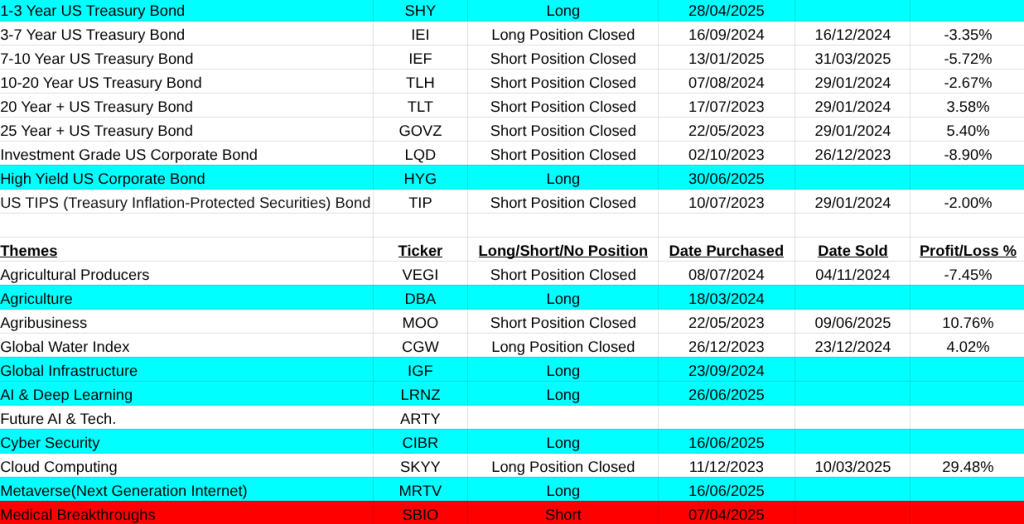

There were nineteen buys to the list. They are all below and too many to list briefly.

Overall this worked out very positively.

Regarding shares on the MSCI World Large Cap list this was a different story. My best trade was in Vestas Wind Systems +27.63% but my worst was in Lam Research Corp. -58.82%.

I have made a few changes by including Chinese car companies like Xpeng(9868:HKG) and BYD(1211:HKG) to better reflect the car industry.

There is a clear trend over the last two weeks from the buy list with Agricultural Chemicals and Banks.

Enjoy your summer wherever you are, regards, Pearse.

MSCI Large World Cap. Closed Trades

MSCI World Large Cap Long Signals

MSCI Large Cap Short Signals

Main Asset ETF List. Short positions are marked in red, long in blue, neutral in white.

Note:The above trades do not take into consideration dividends on shares or coupons on bonds. This is important because if you short a stock or bond the dividend will be taken from you. Therefore the safest strategy is never to short any instrument only buy an upwardly trending security and simply close your position when this ends. These trades are my view on the market and not me advising you to take any of these positions. Closed positions have losses and profits listed in percentages. Mainly as a record to myself so I keep honest in evaluating my strategy.

The list of stocks analysed are from the MSCI Large Cap list as of 01/01/2025.

Thank you Pearse DR Sent from my iPhone

LikeLike