Remember this quote from the film ‘Wall Street’? Lou Mannheim (Hal Hollbrook) is giving some advice to Bud Fox (Charlie Sheen). Like so many men(and women) of his generation, they grew up just after the great economic depression, fought in World War 2, Korea, and the start of the cold war struggle. When they turned their attention to making a living they must have thought it was a walk in the park compared to what they had been through.

They understood that fear is a learned response to life. How we act determines what happens to us next. In Aaron Thier’s novel ‘The World is a Narrow Bridge’, the devil gives some advice “The world is a narrow bridge, and the most important thing is not to be afraid. Just repeat it to yourself when things are bad”.

There is great uncertainty at the moment. What’s important now is how we all act. Be scared but don’t be afraid. Fear, worry, and anxiety only makes things worse. We now require solutions, action, training, courage, discipline, commitment, and calm.

There is a difference between being scared and afraid, one prevents you from making things better and the other makes things worse.

After the 1929 financial crash, Hoover was afraid, his response was paralysis, in FDR’s inaugural speech in 1933 he said that the“Only Thing We Have to Fear Is Fear Itself”.

With fear, you freeze up and cannot make any good decision. Let’s not overthink things and be distracted. Just put one foot in front of each other and move forward. Get back to work. Stand up, be a hero. It’s ok to be scared but don’t be afraid. Keep going.

In difficult times the best and the worst surround us. When we need strong capable leaders we have also a frightening memory of the past. The president of the United States Donald Trump is mirroring Heinrich Luitpold Himmler. The appeal of the strong man is nothing new to humanity. But when great catastrophes unfold they come out of the woodwork. Sometimes seemingly well-balanced individuals take on a type of veiled shadow. Himmler’s genius was basically to sell the image of ‘I’m the strong man, just follow me and everything will be ok’. His message was to keep repeating it about Hitler again and again, keeping it simple. Something that a vulgar, ignorant liar like Trump is copying so well. Vocalising stupidy and violently signaling.

I now frequently hear from very well balanced, educated people who say “you know he does speak the truth, and he’s not as bad as other people think he is. There’s the clue, ‘Other People’.

People who are afraid are drawn to Trump as he promises the common man who don’t feel they matter, meaning, and significance. Racists, bigots, and every stew of bile and hatred are rallying to him. They all have one thing in common, they feel that ‘liberal elites’ make them feel worthless and contemptible. Hillary Clinton described them as ‘the deplorables’. Trump has given these forgotten people meaning and importance. They are being politicised not around interests but around being meaningful. Americans stock up on guns, ammunition, and toilet paper. Democracy gets weakened. Trump says he can stand in the middle of 5th Avenue, shoot somebody and he wouldn’t loose his support. His message can be put on a bumper sticker, simple, easy to explain. People who are afraid of the future are drawn to this simple message.

This is where the danger signals present themselves. Trump must give these people meaning by denying reality. This allows them to create a fictional coherent reality that makes their lives meaningful. Trump’s followers are now part of what they believe as a truth movement that will create great things. As we all know what gets in the way is reality. Trump has created a reality-denying movement.

This is where it gets very interesting. Will he take the next step to use force and violence to impose his will? They think they are liberating instead of coercively bullying. Will this step be taken?

In the light of the Coronavirus, it is the gift Trump has waited for. Never let a good crisis go to waste. Like so many before they need a scapegoat to survive and thrive. My guess is it will be the ‘Chinese’ and also ‘Automation’.

Capitalism is about growth. 2 to 3% growth every year doubles an economy in 10 years. As Einstein said, “Compound interest is the eighth wonder of the world”. This is the cornerstone of capitalism. What we have now is a real crisis because we will not be growing at these rates in the future. The spending that governments do is deficit spending or spending money of future generations. So since 2008 we now have a type of zombi capitalism where governments spend money they don’t have and make slaves of future generations. One of the reasons I have so little time for economists is that they believe their models actually work in the real world. At least Mervyn King (governor of the Bank of England from 2003-2013) now openly admits this.

Once you give up on truth, reason, and scientific facts, you open the door to neo-fascism as Trump is doing now. Threatening a collapse of democratic capitalism as we know it. The manipulation of people will be through social media.

If you listen carefully you will hear language like “surplus population” in the business press. ie. a population that cannot contribute to GDP. And with robotics and automation, there will be less and less people who have the ability to work. Cheap labour will become no labour at all. It won’t be just working-class people who suffer this time but the middle class in particular. It will be doctors, accountants, solicitors who will be made redundant in the next 20 years. Todd Dufresne talks about it in his book ‘The Democracy of Suffering’.

I hope that cheered you up, now let’s get down to business.

Markets

I have had my best 2 months ever. An increase of over 40%. If you look back at what I said in my last piece I took a short on Boeing and Ryanair and they worked out very well.

The bounce-back has been nothing short of amazing. At least that is positive. The following is a warning and not a severe weather one but a severe financial one:

- The Spanish Flu which started in 2018 had three waves. This mimics in some way where we are now. It was the second wave that was the big killer and also the one that did most of the economic damage. So hopefully they can formulate a vaccine before October. We live in a world that is better prepared so I do see the universal stimulus as well received by the markets.

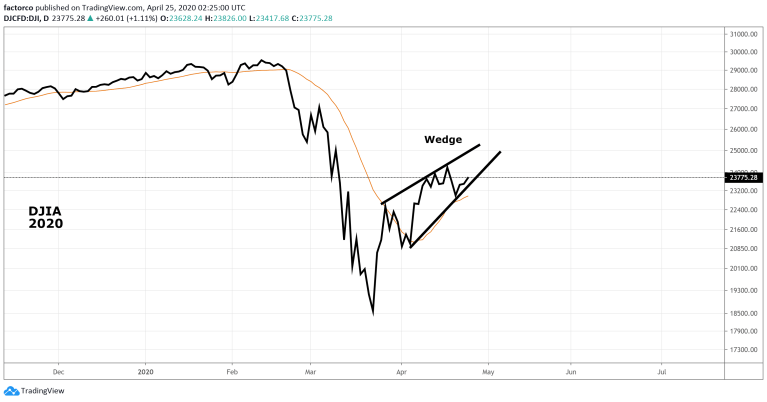

2) TradingView.com allows you to look up the DOW(30) way back to 1915. Its the only reliable indice to look at as you have access to real data. The S&P500 or Nasdaq did not exist then. Anyway, in 1929 there was a pattern called a bearish wedge or pennant. You can see how the great sell off started below. The chart below this is where we are now. You can see the same pattern forming. I’m getting ready to short all the major indices in the next 4 weeks.

2) TradingView.com allows you to look up the DOW(30) way back to 1915. Its the only reliable indice to look at as you have access to real data. The S&P500 or Nasdaq did not exist then. Anyway, in 1929 there was a pattern called a bearish wedge or pennant. You can see how the great sell off started below. The chart below this is where we are now. You can see the same pattern forming. I’m getting ready to short all the major indices in the next 4 weeks.

3) To me this looks like a ‘bear market rally’ or ‘dead cat bounce’. So where or when will it turn negative. A clue can be to use Fibonacci. I usually find them very confusing as different people take different highs and lows to base these ratios on. In this case it is very easy. The high is our recent all of all time (@ 29,568 on 12th of February) and the recent low (18,213 on March 23rd). I have used figures from the FT as diffeent brokers have slightly different figures.

You can see the results clearly above. And before you ask why is there not a 50% fibonacci level? thats a discussion for another day. But trust me 50% is not important as it only appears once in the progression and is considered irrelevant by most traders. Notice how the price performance hugged these fib levels.

You can see clearly that the level of 25,231 is the one to really watch. I’ll be long all the way up to this and then see what happens. My gut feeling is that it will not break it convincingly. But who knows.

There is a clear divergence between a dying economy and a soaring stock market. The IMF forcast a recession greater than 1929 and yet stocks climb. The only answer I can come to is co-ordinated stimulus by central banks in an unprecidented way. So much for the free market and capitalism.

In 2008, Central Banks supported other governments by purchasing their bonds. Now the Fed have announced that they are purchasing corporate debt that is rated ‘junk’ by the main credit ratings agencies such as Moodys and Standard & Poors. The Japanese central bank is now directly purchasing assets such as shares in companies. Let me be blunt about this, travel and leisure shares are up nearly 25%. Whatever madness is going on it will end and soon!

“Facts are stubborn but statistics are pliable”(Mark Twain). The truth always has a future. So my advice is to listen to your portfolio as it is whispering to you now. If you do you won’t have to hear it scream.

Sailors have in interesting saying which you can apply to investments. They are talking about degrees latitude but you can use percentages just as easily to relate the panic felt. Below 40 degrees of latitude there is no law, below 50, there is no God. So keep track of your performance and cut your loosers quickly. We can’t choose what happens, we choose how we respond and most of all remember ,

“The world is a narrow bridge and the important thing is to not be afraid”.

Good luck over the summer, best wishes, Pearse.

Thanks Pearse,

We are living in interesting times, if nothing else.

All the best,

Leonard

LikeLiked by 1 person