Hi all. Half a year has gone by. I think of something and by the time I put it down on paper its already old news that most people have read about in much better English than I can ever write. So let’s kick off this year on a positive note.

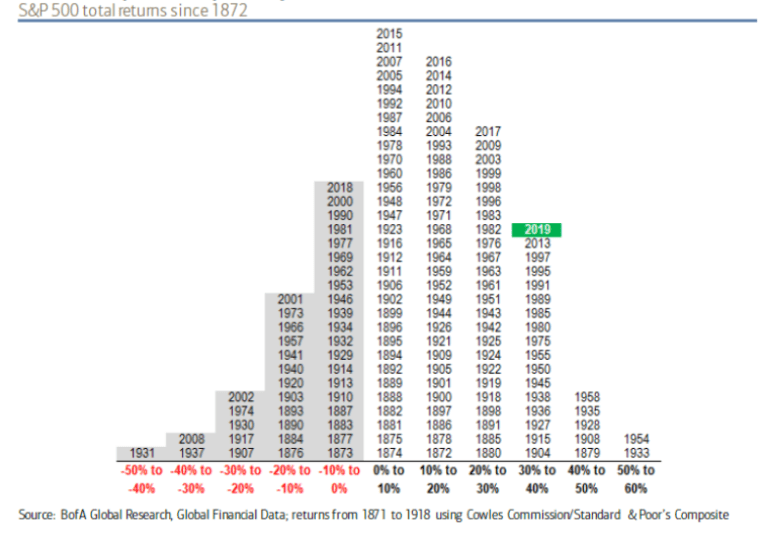

Below is an interesting chart of S&P returns since 1872. 2019 was good, very good!

We’ve had a great year. Nearly every single asset class has gone up. The most successful investor we all think of is Warren Buffet. However, his year was not good. He underperformed the S&P500 by nearly 20%. It seldom happens that he makes a loss.

1999 and 2009 were the last times. We are nearly at the greatest bull run the market world has ever seen. Yipee.

With interest rates in negative territory, it just makes sense for investors to take on more risk. Looking at currencies the least dirtiest shirt is the US dollar. A strong dollar keeps emerging markets weak. So global growth will be stagnant. In an environment like this, the only growth you will find is in technology. Remember the top five (FANG companies) comprise nearly 20% of the S&P500.

Below is a chart of the S&P500 with overlays based on different price to earnings ratios.

You can clearly see that when the S&P500 expands above a P/E of 20 that we have a contraction just as we had in 2008. Where we are now is simply unsustainable.

So, what will happen? After March the FED has said it’s going back to normalisation. In an election year, they will come under increasing pressure to keep the party going.

So my call is that nothing big should happen until the end of the year. Yes, there could be a slip between the cup and the lip but its party time, so splash out on a magnum of some Krug or Veuve Clicquet champagne.

Two warnings, I don’t really understand astrology but there is a Jupiter/Saturn conjunction that kicks in at the end of the year (December). The last time this happened was in May 2000 that saw the market decline post dot com boom until the low of 2003.

Also, an interesting market cycle called Benner predicts a large market correction that will have bottomed in 2021 (the lower right-hand corner in red). Check out the other dates that it predicts as bottoms, 1913, 1933, 1949, 1987, 2003. The only one not predicted was the 2009 low after the property crash in 2008.

Comment and Idea

With the assassination of that thug Soleimani in Baghdad. Too easy a departure for such a nasty creature. Everything has its place. Unfortunately, I think restraint would have been better here. Remember what allowed the US to prevail in the cold war was patience, restraint and willingness to avoid quick solutions which are usually violent. A long-forgotten US diplomat George F. Kennan recommended the cold war strategy of “long term, patient but firm and vigilant containment of Russian expansive tendencies”. This I think would have been a better approach. But Trump is a man with a hammer and to him, everything looks like a nail.

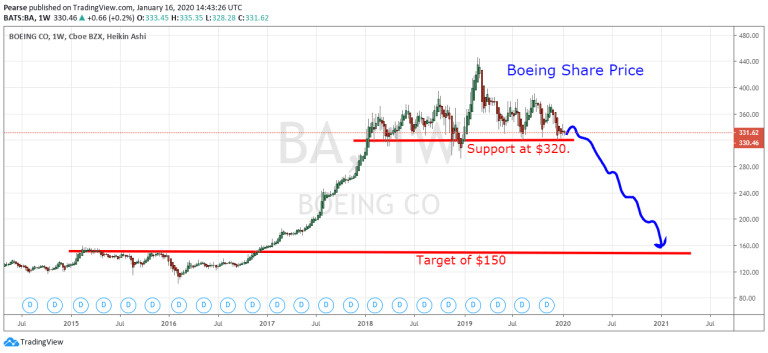

After the attack the share prices of most of the US defense companies rallied except one. It’s the company that designed the 737 max “made by clowns who in turn are supervised by monkeys”. It’s responsible for two crashes where 346 people died.

What I find amazing is that the man who oversaw this Dennis Muillenberg is heading off with a payment of $80 million and vested stock options of $18.5 million. When you see a CEO get fired and head into the sunset with such an exorbitant payoff you know the rot is deep.

Take a look below at the chart of this wonderful company called Boeing. The old Wall Street saying goes “Bulls make money, bears make money and pigs get slaughtered.” Well, this porker is heading to the knacker’s yard.

This company is ready to drop from $330 to $150. Now that’s a big call.

So I’m looking forward to some nicely braised tofu vegan steak in the next few months. I think it’s better to go for the steak than the sizzle.

Two Interesting Charts

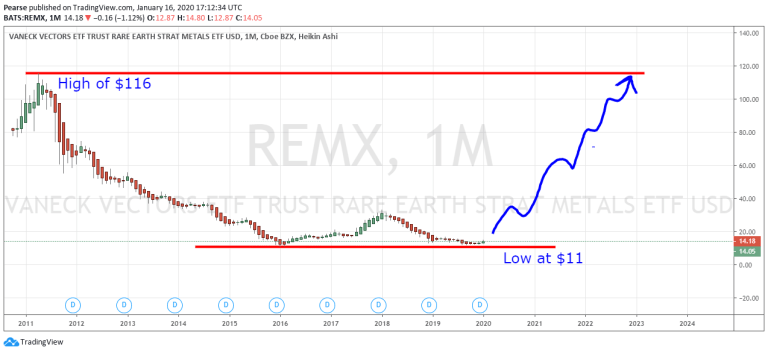

1) Rare Earth’s-REMX

On the opposite side of this, I have been looking at Rare Earths for a long time. My brother Daragh interested me in them as they are an essential component in everything electronic from like phones to tablets and such like. Most of the companies that produce these are Chinese and are small-cap. The chart below is a monthly chart of an ETF called REMX that only holds these shares. I see great potential for rare earth’s as I believe the Chinese will use them going forward to inflict pain on US tech companies. REMX has fallen since April 2011 as the Chinese allowed easy access to these. It looks like the supply of these valuable commodities is being slowly restricted.

2) Copper

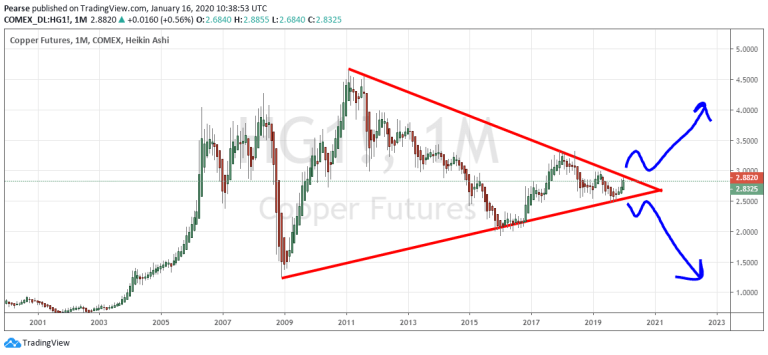

Traders call it “Dr. Copper” as the price of copper forecasts recessions and recoveries, far more accurately than practitioners of the “dismal science”. So it pays to pay attention to it.

Below is the monthly price chart for copper. You can see clearly how it bottomed in late 2008/early 2009. The red lines I have drawn in show a symmetrical triangle pattern. What makes this so important is that it has been forming for over 10 years. It’s now coiling up and getting ready to make a big breakout, up or down who knows? But it will be powerful and signifies a very large market move between now and the end of 2021.

Last Years Sectors Performance and Trends Emerging

Going through sectors and areas there were a few interesting movements, so let’s start;

Consumer Discretionary: LVMH up over 60%. Wines & Spirits, Fashion & Leather Goods, Perfumes & Cosmetics, Watches & Jewelry

Consumer Staples: Poorest major performer Imperial Brands. No future in smoking!

Energy: Had a really bad year. Some great bargains out there like Chevron Texaco. Oil will not go away.

Finance: Citigroup +53%, HSBC -8.5%. Wait till Brexit kicks into the UK economy.

Healthcare: Allergan +42%. A lot of stents bein sold. Teva -35%. Generic drugs got hammered. Seem to have leveled off. Bargains here.

Industrials: Airbus +55%, Boeing +0.7%. We all know what’s happening here.

Materials: Rio +22%, Glencore -19%. No future in coal.

Technology: ASML +92%, Apple +85%, Canon -1%. Semiconductors+innovation. Products without brains = zilch.

Utilities: Enel +40%, PCG -53%. The future is clean energy, no fossil fuel.

Telecoms: Good year nothing special.

Bonds: ZROZ(25 Year) +18%, SHY(1-3 Year). Bull run still on for long-dated bonds. Bonds go up plus the stock market, something’s gotta give?

Middle East: Israel +25%, Qatar -3%, UAE -1.4%. One country with no energy resources uses innovation the others are one-trick ponies with oil. Welcome to the new world.

Americas: Small-Cap Brazil +35%, Chile -19%. Worlds largest producer of Lithium for electric cars SQM had a bad year. Electric cars are still hype. Sizzle but no steak.

Europe: Greece +46%, Russia +32%, Poland -8%. European periphery recovering. Bad governance in eastern Europe.

Africa: Nigeria -17%, South Africa -3%. Oil dependence rots a society and bad governance destroys hope.

Asia: Taiwan +32%, New Zealand +25%, India -17%. Small and dynamic beats slow and old.

Surprises: Gazprom +85%. When the rest of the worlds oil majors get hammered it outperforms, 6% yield on a p/e of less than 5. What a bargain!

Batteries: Johnson Matthey +3%, Umicore +24%. All the talk of battery technology but nothing happening. These companies were nearly as profitable 10 years ago.

Cobalt + Lithium: A Disaster. Some of the major producers losing over 75%. The electric car revolution is just talk for the wealthy west.

Marijuana: Tilray -74%, Aurora -58%, Cronos 30%. Disaster. Just talk. These stocks got really smoked. Interesting that Miracle Grow the largest US producer of nutrients is up over 75%. Like the Yukon gold rush. Invest in shovels and picks forget about mining.

Solar Energy + Alternative Energy: All positive, no losers across the board.

Cyber Security: All positive, Big winner Israeli tech firms.

Internet of Things: All positive across the board.

e-Payments: Biggest winners Visa and Mastercard, forget about Bitcoin. Again all talk.

Global Infrastructure: All Positive

Interesting trends that have emerged: Tatoo removal, Rare Earths, Robotics, Water, Food, Alternative Clean Energy, Obesity, Diabetes, Health Care for Older People. Financial Technology, Biotech LifeSciences, Small Cap Healthcare.

I will look at some of these later in the year. I remember many years ago visiting New York with friends. We passed by the Apple store near Central Park. While I was looking at the products I noticed my friend TJ wondering why there was a queue nearly out the door, were they returning products that were faulty. No, they were queuing to hand over money. When he came home he purchased some shares in Apple. Think it was about 2005 when their shares were about 4$, today they are about $310. Wonder if he still has them?

So every time I see so many people especially women with tattoo’s, I know its only a matter of time that they become unfashionable.

Trends emerging for 2020 New:

New regulations worldwide for shipping to stop high sulfur levels in fuel.

Critics of climate change are slowly changing due to the weight of data being made available, ie. Nasa information release.

Public companies are becoming more accountable. This year we will see more directors fired.

Private equity coming under increasing scrutiny. Mr.Buffet will not like that.

Final Comment:

I will try to write more regularly even if its for me to keep a record for myself.

As Shakespeare said in his poem Troilus and Cressida that

“Time hath, my lord, a wallet at his back”

As I get older the more I realise that time is the ultimate currency.

So get out there and enjoy yourself!

Best wishes from Dublin, Pearse.

Brilliant work Pearse! Look forward to reading more of your thoughts and insight. (And look forward to discussing them over a pint in Kehoes!) 😉

LikeLiked by 1 person

Thanks Pearse,

I suppose I’ll have to start working on my bet for 2020…

Leonard

LikeLiked by 1 person

Great blog Pearse – keep up the good work!

Peadar

LikeLike

Very good post

Dan aka Heikin-Ashi guy @ http://www.educofin.con

LikeLike