Hi all, hope you’re having a good summer wherever you are.

Hi all, hope you’re having a good summer wherever you are.

Musings

The reason I put a picture of Winnie the Pooh is as you are probably aware there have been mocking comparisons between the way president Xi Jiping of China walks with large strides and Winnie. I was in town about a week ago and met a nice Chinese couple from eastern China. I had never met or socially talked with anyone from mainland China over drinks in an Irish bar.

One of them had excellent English and translated for the other. The topic of their president came up and they said the usual ‘He’s a great man’. Anyway, at the end of the night and after a few beers they very quietly explained to me that they wouldn’t dare tell anyone what they think especially about any member of the communist party. They said at home that you can only talk with friends you know for a long time and only within the confines of your home where you are assured of privacy. They said that censorship is everywhere along with informers and party apparatchiks that make sure everyone toes the party line.

On the platforms that allow you to search in China like Weibo, put in Winnie or Pooh and nothing will come up. Let alone Falun Gong or anything that you would consider threatening to the powers that be, such as ‘The Tiananmen Square Massacre’ in 1989 even the word ‘protest’. Not only is their internet, film, and book censorship but companies such as Google, Apple and Twitter fully comply with the Chinese government censorship and are hypocritical in the extreme. Never was there a better reason to break up these companies as now, before they ‘take the shilling’ from the Chinese. What fragile little egos these great Chinese leaders must have.

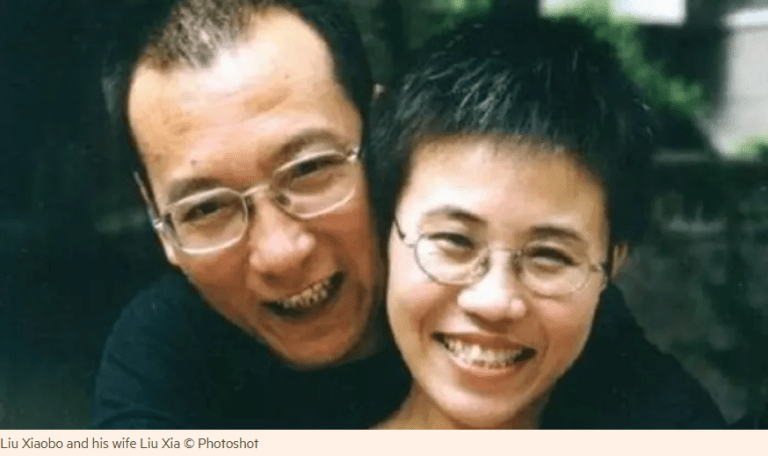

In hushed tones and whispers, the couple mentioned to me the story of a man called Liu Xiaobo, I had to note it down as I would usually forget. They said he was a Chinese dissident and Nobel Prize Winner who died in prison serving an 11-year sentence for subversion of state power. He was one of the last to hold out as the tanks rolled into Tienamin square.

He is only the second Nobel Peace Laureate to have died in jail. The other great man was Carl von Ossietzky a German pacifist who died in a Nazi concentration camp.

In a letter to his wife before he was sent to jail, never to see her again, he told her.“Even if I were crushed into powder, I would still use my ashes to embrace you.”

After his death from cancer in jail, he was anonymously buried at sea.

As nations rise the natural cycle of an empire or nation is usually hallmarked by trade and advancement and at the latter stages abuse of government, greed and delusional arrogance. It is assumed that China is a government that grows based on benevolence as it helps millions of its citizens out of poverty. It convinces itself that it is only doing the right thing for its people and the world. Then finally an empire typically in its final state of madness no longer believes what it does is for the people but the people merely serve the state.

We all know that economic power is moving from the west to the east. But in history, I see China as an unusual aberration as it tries to blend idealogical communism with free-market economics and total loyalty to a system that shows no tolerance of any kind. This is what Karl Marx was all about–Control. An economic distortion like this only ever ends badly. Like a human being, we are born in innocence, mature in self-interest and finally realise at the end that nothing can really be controlled forever and that life is not simple but full of grey areas that we must explore.

What I Think.

Now let’s get down to business. I’m the first to say that my timing is usually appalling. That’s the main reason why I like charts so much. No matter what you read in the papers you always see the truth in the chart as its reality.

Below is a weekly chart of the DOW 30 indice. I have drawn in a simple symmetrical triangle in red. Usually, with symmetrical triangle breakouts, you get an explosive one way or the other. As you can see it has broken out upwards of the red line. If this formation works out it suggests a move to the upside towards 30,000 from 25,600 today or roughly a 17% move upwards. It could well retest the top of the triangle but this looks pretty positive to me. Your probably all gasping as usually I see the negative in different markets and prefer to short. Like a line in the jungle, I look for weakness. Well, no matter how bad the news gets I can see it going a lot higher from here. Up, up and away.

Remember before we have a meaningful correction or crash it has to go really hyperbolic. I have long looked for a nice 10-20% correction and this convinces me now that when the correction does come it will be a really bad one but until then I will stay long. Remember, 30,000 on the Dow!

So Where do I see Weakness

Sterling

The British Pound is showing serious signs of weakness. You could almost compare it to an emerging market currency as some of the British politicians do their best to destroy their economy. They have this kind of mental block that they project thinking they still have an empire. You know when you’re goosed when the left and right come together to put you in the pot. One to pluck you and one to slowly cook you till the meat falls off the bone.

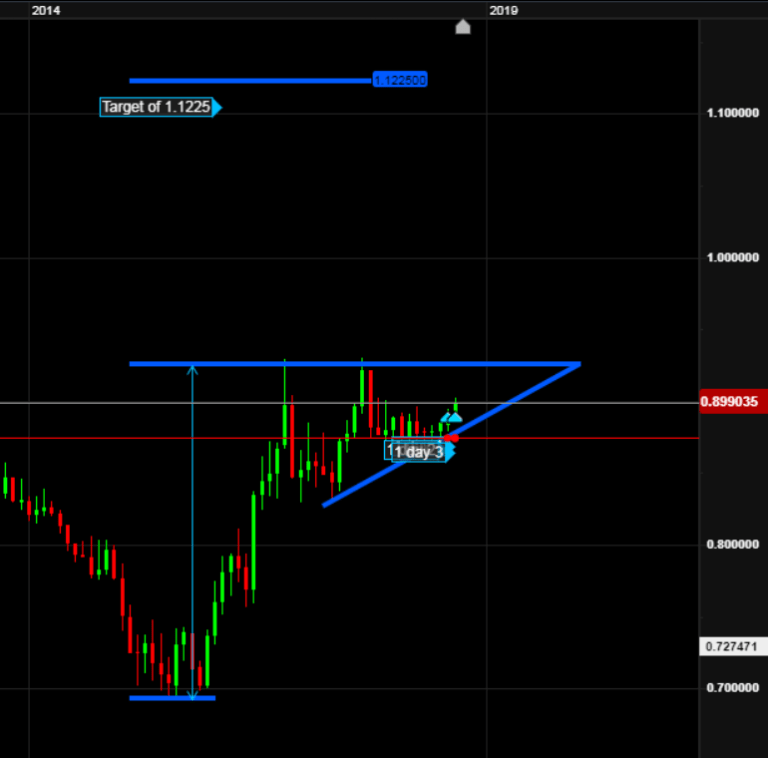

Take a deep breath now, at the moment 1€ will get you £0.89. My target is 1€=£1.1225. George Soros, hope your backing this horse, or should I say pony.

US Dollar

Contrary to what I read looking at the chart of the Dollar Index it tells me that it has founded serious support at 95.00. I see it getting higher. The easiest way to play this is to buy UUP an ETF that as a leveraged play on the US Dollar Index.

The most important thing is the knock-on effect that this has. I won’t bore you talking about deflation or commodities but commodities like gold and oil will get cheaper, a lot cheaper as they are denominated in US dollars. So hold off on buying any protection, just yet.

What will not do well?

Emerging Markets

Below is an ETF that is inversely related to emerging markets by 2. The last time it gave a buy signal was March 2015. Just so you know I use a very simple system using a cut up or down of 13 and 34 week moving averages to give me a buy or sell signal. You probably use something else but worth a look. Upside potential looks good, in January 2016 it was $158, today it’s only $43.

China

This year the Hang Seng has been the worst performing major indice losing over 2 Trillion US $ wiped off its value alone.

The China-US trade war is just beginning. 37 Billion US $ worth of imports are affected so far in an escalating trade war. Note an effect of this is that investors will pull away from this market.

Its economy is under pressure as companies no longer look cheap, especially the banks and property developers.

There is a huge debt pile up, which will lead to defaults on some Chinese bonds. This is only a matter of time. The government is trying to regulate the leverage banks use to let Chinese companies refinance their debt.

An easy way to play this is with iShares ETF called FXP. What I like about these two plays are that if I’m wrong then get out quickly, don’t hang around

I will try to do something more regularly and a little shorter. Maybe more charts and less talking. In other words, let the charts do the talking. Anyway, wherever you are have a good summer, all the best from Dublin, Ireland, regards, Pearse.

Thanks Pearse; thought provoking ideas as always.

Regards,

Leonard

LikeLike

Well done Pearse.

Cheers,

Jader

LikeLike

Pearse, I like the cartoon! Regards, Deborah 🙂

LikeLike

Thank you very much Pearse.

I have put 5,000 GBP on the ProShares China 50 – wish me luck.

LikeLike