Bubbles have a predictable pattern, from internet stocks in the 1990’s, our very own house price bubble in 2008 and way back to the south Sea Island Company Bubble of 1720. Its share price roller-coaster ride is below along with a picture of a stockbroker during the time. Remember, human nature never changes but may-be the fashion accessories of stockbrokers?

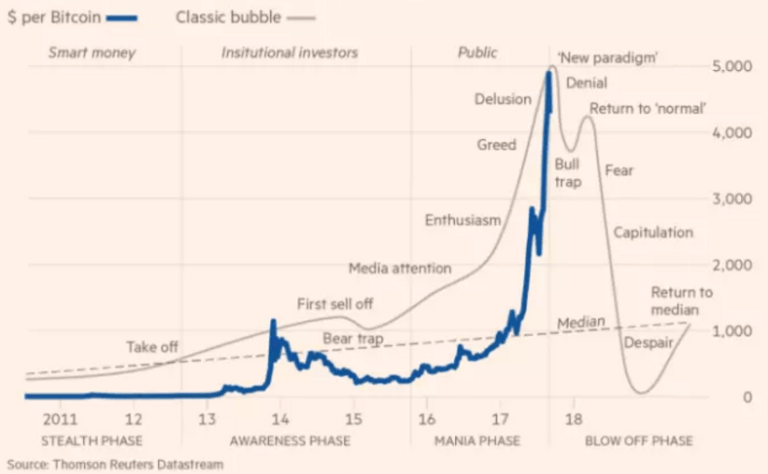

Now, look at the classical bubble chart overlaid on the price of bitcoin. Yep think we have one here. That’s the beautiful thing about charts is they are a subtle communication tool using price action that tells you exactly what the participants are doing and once you learn that simple language the truth hits you.

We are now at the ‘bull trap’ phase that is just before the eventual bust. Don’t get me wrong I think it has a great future but like all growing pains a bubble is usually part of it. As soon as it’s out of the way we can all get back to normal. Unfortunately, it must happen.

The US economic upturn is now exactly 100 months old. Artificially sustained by the Federal Reserve and to a smaller extent European central banks. Key indicators like the growth in car sales and retail have peaked since last December and January and yet stock prices continue to go up. Corporate earnings are beginning to drift sideways and seem to have peaked. We are already in a recession but we just don’t know it!

As in the classical bubble phase results from certain large-cap companies are driving the irrational exuberance. As I mentioned before a company like Google has had three key week reversals in the last 5 months! I have looked at charts for many years and have never seen that before. Notice that these handful of companies are all in the technology sector.

Remember that in the ‘dotcom bubble’ peak in March 2000 to its low in October 2002 the Nasdaq Composite lost 78%.

We now have two clear facts, firstly the market (S&P500) is fully valued. It bottomed in March 2009 at 666 and today it’s 2,547. So basically nearly 4 times what it was. This has happened as mentioned above because of governments interfering and artificially pumping up these assets.

Secondly as mentioned in my previous blog the very act of passive investing has artificially inflated certain core asset prices especially in the area of technology.

In purchasing a ‘Passive ETF’ to just follow the market investors are forcing concentrated investments into the above companies. Its become such a problem that the ETF suppliers are now openly warning their clients that by blindly pouring money into concentrated stock indices they are at risk of outsized losses if markets tumble. (Martin Flanagan, President, and CEO of Invesco). Remember the last big correction for high tech was 78% mentioned above.

In purchasing a ‘Passive ETF’ to just follow the market investors are forcing concentrated investments into the above companies. Its become such a problem that the ETF suppliers are now openly warning their clients that by blindly pouring money into concentrated stock indices they are at risk of outsized losses if markets tumble. (Martin Flanagan, President, and CEO of Invesco). Remember the last big correction for high tech was 78% mentioned above.

The top 10 suppliers of ETF’s in the US have taken in nearly $65 Billion in cash since January and invested mainly into the S&P500. But nearly 12% of this indice is in only five companies, Apple, Google, Microsoft, Amazon and Facebook.

Many people have said to me well not worry if we get another big correction then central banks will just print some more money and make the problem go away. This is exactly what a communist regime would do. Yes, you can do it but the consequences are that debt increases and sooner or later someone is going to buckle and it won’t be a bank or a company the next time it will be countries and regions. So big in fact that there is no-one big enough to bail them out.

Yesterday(08/10/17) Wolfgang Schäuble, the outgoing finance minister warned that spiralling levels of global debt and liquidity present a big risk to the world economy. He said there is a serious danger of “new bubbles” forming due to the trillions of dollars that central banks have pumped into markets.

Christine Lagarde(07/10/17), head of the International Monetary Fund warned, however, of “threats on the horizon” from “high levels of debt in many countries, to rapid credit expansion in China, to excessive risk-taking in financial markets”.

Interesting Comparison

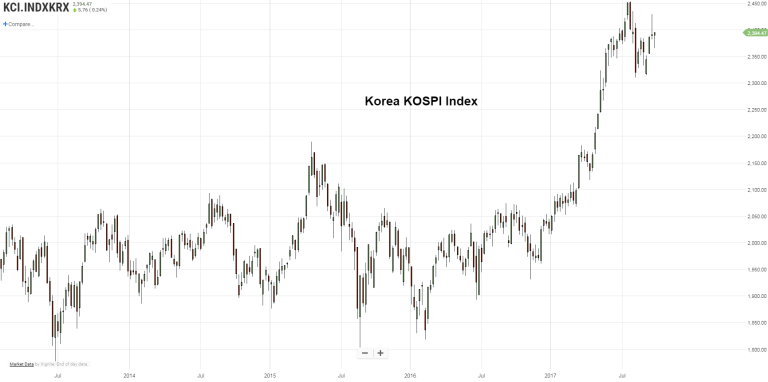

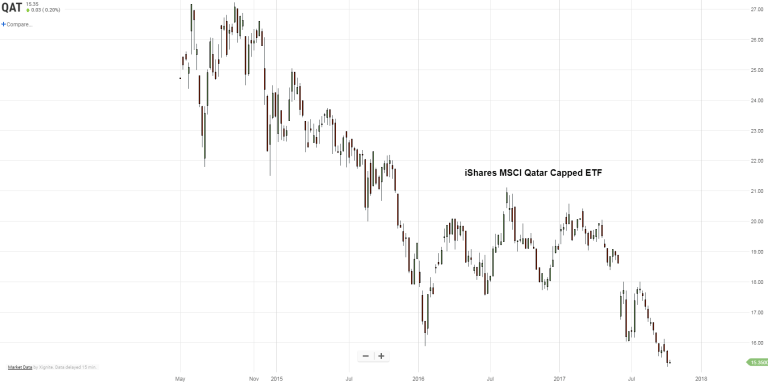

With all the rhetoric about North Korea you would imagine it would have an effect on its neighbour South Korea(35miles,56Km from border to Seoul). Yes, talk of nuclear weapons and crazy headlines in the newspapers. So you would imagine this would have an effect on the KOSPI stock market index. Eh, no its just taking a little breather! Whereas a country like Qatar with the largest sovereign wealth fund in the world is dropping like a hot brick.

My Plays

My real interest at the moment is with Lithium and Cobalt, shorting retail and consumer staples(Reckit Benckhiser). I have now added a short position on telecommunications and cigarette companies, especially BAT, IMB and Altria(MO) .

I think the emerging markets have peaked a little but I’m very positive about Chile(ECH), Columbia(ICOL), Malaysia(EWM), Vietnam(VNM), Nigeria(NGE).

In particular, I like Alternative Clean Energy companies, check out the ETF’s TAN, KWT and FSLR. Also Healthcare(CURE) and Biotech(LABU).

Roundup

I hope my dire predictions do not come true but I am not taking any chances. Enjoy your Autumn wherever you are, all the best regards, Pearse.

Thanks Pearse; although I must say that Irish stockbrokers never looked like the Dutch one in the picture; at least not in my time!

Regards,

Leonard

LikeLiked by 1 person