Hi all, hope your all enjoying your summer. I’m going to do a different investing theme every month and see how it goes. The idea comes from a friend of mine TJ. Many years ago myself and a few friends visited New York. One lazy Sunday we were aimlessly walking around after consuming too much beer on the previous evening. Anyway we happened to come across an ‘Apple’ shop(not the eating kind) and we strolled in. Young old people from every colour under the sun were queuing up to buy their shiny and very expensive products. The line went out the door. Years later TJ mentioned that when he saw this he thought they were returning faulty products and went to investigate. He realised they were queuing up to buy. Well when he got home to Ireland he purchased some Apple shares. That was over 10 years ago in April of 2007. The share price was $13.45. On Friday just gone they closed at $157.48.

So we can analyse profit and loss accounts and balance sheets of companies, we can read every business paper going, look at every tip. But really the most powerful thing you can do is open our eyes and simply look around you for new trends.

So what do I see happening today. Nearly every day I turn on the news or read a paper and their is always something there about electric cars or robotics. I had to buy one of those circular small batteries for a weighing scales at home. I eventually got one in a pharmacy shop. It cost me nearly €7. I was shocked. Anyway I was thinking if a small lithium ion battery like this costs this amount of money then the battery in an electric car must be way more expensive. So I started asking myself, whats so mysterious about making a lithium battery, what are they made up of and who makes these materials?

Below is an estimation of the global growth of Electric Vehicles until 2030.

I still haven’t answered the question what goes into a lithium ion battery?

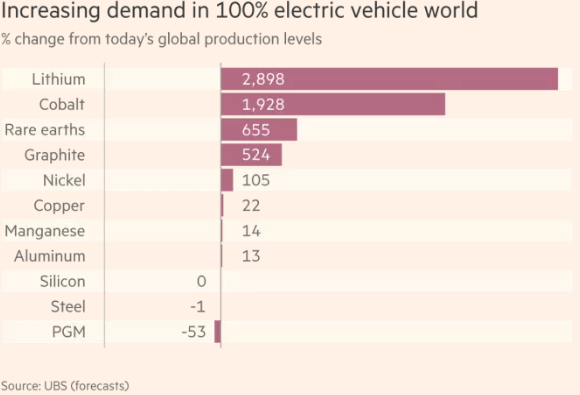

To make these batteries you require obscure minerals like cobalt, lithium, nickle and graphite. Below is a chart with the projected % increases of these types of material. The 2 clear winners are Lithium and Cobalt

Looking at any metal what becomes very obvious is that all you need to do is buy one of the big miners but that will not work here. Aluminium was on fire in 2007, then we had a peak in iron and coal in 2011 and today a plateau in steel production. And with these peaks and plateau’s whether its BHP or Rio Tinto or indeed any other of the big miners they all seem to go up and down in unison.

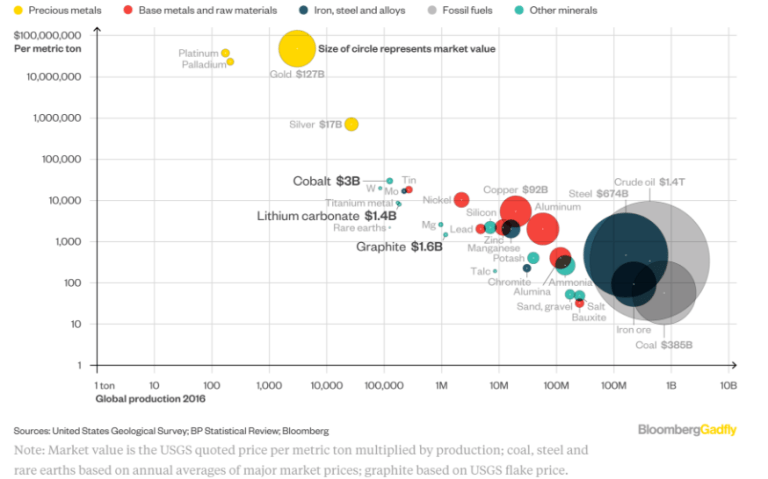

The cost of extraction of Lithium and Cobalt are not as high compared to say gold and silver. Look at the chart below it shows you the size or market value of the extracted commodity. Notice how little Lithium and cobalt are produced each year. So I can confidently say that its a very long way to go. The big circles effectively indicate that big companies are extracting already. Cobalt and Lithium are so small its in the hands of only a few small specialised companies.

Lithium

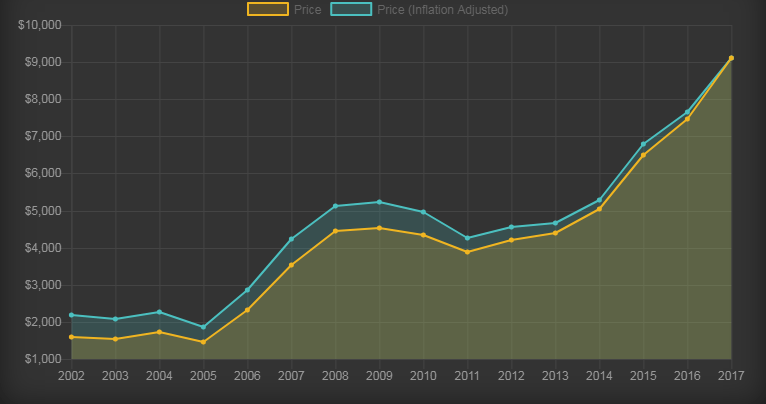

So lets take Lithium, its price is up 18% so far this year at $9,100 per metric ton.

There are only 2 real sources of Lithium, Australia and Chile. In Australia Lithium is in rock deposits and more expensive to extract. And those bright people in BHP will only start production in 2019. So let them go back to sleep.

The only real play is the world’s biggest lithium company Sociedad Quimica y Minera de Chile SA, symbol on the NYSE is SQM. Its up 67% so far this year at $41. You could also look at Albemarle Corp(ALB:NYQ) or FMC Corp(FMC:NYQ).

Cobalt

Now to Cobalt which is even more interesting. Below is its price per ton this year.

Demand is expected to rise significantly according to Goldman Sachs.

Most cobalt is produced as a byproduct of copper or nickel mining. There are cobalt-rich mineral resources around the world, including significant deposits in Australia and Canada.

So what companies to buy? First off stay away from the big boys as they are too diversified and dare I say slow and have some incompetent managers. For example BHP referred to its Lithium and Cobalt mining as non core assets and were looking to sell them up to November of 2014. The name of the unit was called Nickel West. Now the penny has dropped and they now see that these two will be potentially the new oil. I would equally say something about Rio Tinto.

My 2 favourite plays on this are based in Australia, Ardea Resources(ARL:ASX) and Cobalt Blue(COB:ASX)

My belief is to go for pure plays, keep it simple and simply ride the trend for the next 10 years.

Ardea Resources, a small mining company based in Perth, is aiming to develop Australia’s largest cobalt deposit near Kalgoorlie — a resource formally owned by Brazilian group Vale. Another Australian company Cobalt Blue is targeting a project near Broken Hill in New South Wales.

Cobalt in Africa

The Democratic Republic of Congo has more than 60% of the world’s existing cobalt production. Glencore’s Katanga mine being one of them which opens next year with a capacity of 22,000 tonnes a year and Eurasian Resources Metalkol project producing 14,000 tonnes a year. You might think that the people there would welcome such large investment but if history is anything to go on they will gain very little. If they’re lucky maybe a poorly paid dangerous job and some militia violence thrown in free of charge. Global witness found that 30% of revenue paid by mining companies($750m) to the government from 2013-2015 simply disappeared.

https://www.globalwitness.org/en/campaigns/democratic-republic-congo/regime-cash-machine/

Of course we don’t have to look too hard to see where the money has gone to? But we don’t really care as long as we think were ethical in a very narrow sense. Its one of the poorest countries in the world with on average of $800 a year per person. Industrial miners like Glencore facilitated this institutionalised looting. No need to watch comedy on TV when you can look at Glencore’s web site where they tell us how they support the local community. http://www.glencore.com/public-positions/supporting-development-in-the-drc/

They are from a long line of colonial European abusers and thieves from King Leopold II of Belgium to the British and French. (Their still there, they never really went away)

Anyway enough moralising, we know that price is not, however, the most significant barrier, but availability and the DRC, Congo is where it is in abundance.

There is only really 1 play on it and that’s a Canadian mining company called Lindin Mining Corporation(symbol LUN:TOR). It holds an indirect equity interest in three pure cobalt mines, Tenke Fungurume mine located in the DRC, the Freeport Cobalt Oybusiness (Freeport Cobalt) and a cobalt refinery located in Kokkola, Finland.

Recap of Stock Name’s

Below you will see the stocks mentioned above in a pretend portfolio. Only one share in each stock and the purchase date was Friday 11 August 2017. I will send it on in 12 months and lets see what will the % increases are

Business as usual

So back to basics. I get a little nervous when I hear any leader of any country like Donald J. Chump, I mean Trump make a statement on the stock market.

Stock Market hit another all-time high yesterday.

Well most of you know I’m a sell side type of person and now I am convinced that before 2017 is out we will see a very large correction. ‘Make America Great Again’, that’s a real backwards looking vision. Basically lets go back to the past.

So what do I see happening now.

The main world indices don’t worry me yet. There are no clear sell signals but there are some unusual things happening. My attention is drawn to the chart of the South Korean Composite Stock Price Index or KOSPI. You can see that it has clearly broken down below significant support.

What I find unusual about this is that the North Korean’s have been launching missiles to beat the band and nothing happened to the KOSPI before. When I looked at it I said to myself what does this crazy guy have to do to get any reaction from investors. Well whatever happened last Thursday it really spooked the market. Yes it was Grump, I mean Trump and his comment that North Korea will be met with ‘fire and fury’ if it threatens the US.

Separate from this the real concern is the Middle East. In the last week the Tel Aviv Stock Exchange or TASE lost nearly 9% of its value. The largest stock on the exchange is Teva which lost over 45% of its value. Teva is the worlds largest pharmaceutical generic drugs manufacturer. Hopefully this is the reason and nothing else.

I notice that Greece and Portugal have finally bottomed out. Think a toe in the water with the ETF for Greece called GREK looks interesting.

Colombia(COL), Mexico(EWW) and Nigeria(NGE) are really picking up. Europe is spluttering. Think the strength of the Euro will hold it back.

In a previous blog from over a year ago I said I was shorting Paddy Power/Betfair. It finally came in for me. Sometimes you need patience. I also have 2 big shorts on CRH(CRG.IE) and Greencore(GNC.LON) that are also coming along nicely.

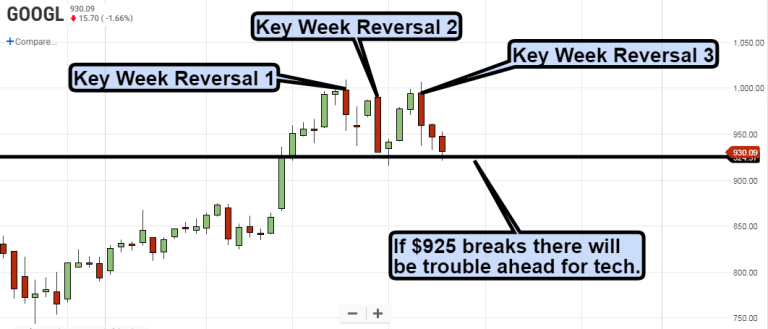

I noticed that Google has been doing some really strange things lately. Its made 3 ‘key week’ reversals in 2 months. I’ve never seen that before and as said last month the chart is signalling a top on all the major technology companies.

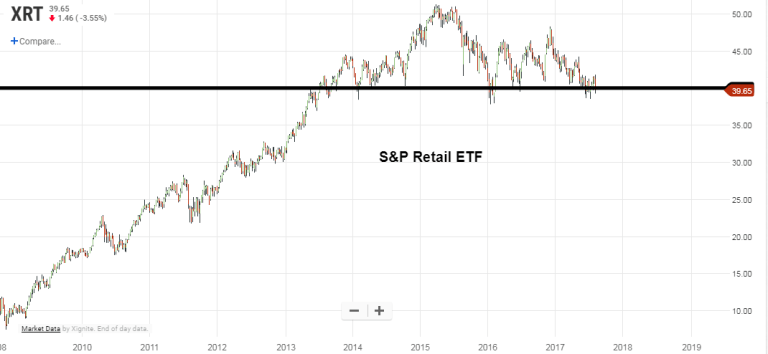

Also below is a chart of the Retail stocks in the S&P500. $40 is strong support and its just bronke down below. Not convincingly but interesting to watch. I guess the likes of Amazon are really disrupting the existing supply chain. Remember what happens in the US eventually comes over here.

Very interesting Pearse….

You’ve gone for the mining companies rather than the car manufacturers.

Ten years ago when Apple started making iphones which companies did best? Was it the mining companies or Apple? I suspect it was the latter.

In which case I’m wondering why you didn’t mention Tesla. I know Tesla stocks have shot up not far off doubled in a year, but do you not see that trend continuing considering they’ve only just released their new “affordable” model and haven’t even really started in Europe yet?

LikeLike

Your correct Darian with Apple and maybe with Tesla. What worries me about Tesla is for 2 reasons, 1) Its price to earnings ratio is 82.43 today. Compared with other car companies its nearly 10 times higher in valuation. For example GM is 5.54, Nissan is 6.48, BMW is 6.89, Volkswagen is 7.84, Ford is 11.33. 2) Its the most largest stock in the US that is being shorted at the moment. Its market cap is $59.4 billion and at this moment over $10 billion worth of shares have been lent to speculators to short. Check out the article in todays FT and Elon Musks comments on short sellers, regards, Pearse.

https://www.ft.com/content/55a0b316-7edd-11e7-9108-edda0bcbc928

Tesla founder Elon Musk has occasionally taunted short sellers: in April he tweeted “stormy weather in Shortville”, and this summer he said “these guys want us to die so bad they can taste it . . . Just wish they would stop sticking pins in voodoo dolls of me.”

LikeLike

Thanks for these updates Pearse. Excellent information. Hope you’re keeping well…

If I had a few grand spare I’d be investing in your Lithium and Cobalt related listing!

Kind Regards,

Brian

LikeLike