Hi all, hope you all had a good month and profited from the turbulence. Just a quick word to anyone who was on my old e-mail list. Before July of last year I was positive and since then have been decidedly negative on the outlook based on the charts of the main world indices. My blog is a stream of consciousness of mixed up ideas focused on the markets and the hints they give us about the future. The bear above looks cuddly but get out of the car and wait to see how long it will be before papa bear comes along to eat you.

Hopefully next month we will see a Bull but until the charts change and tell us something different we owe it to ourselves to be honest. I say what I see and not what I feel. So in advance if anyone is squeamish look away now. See you all and stay safe out there.

Before I dive in there are 2 main themes that hit me last month, Millennials and Australian Property. I put this at the end of the blog.

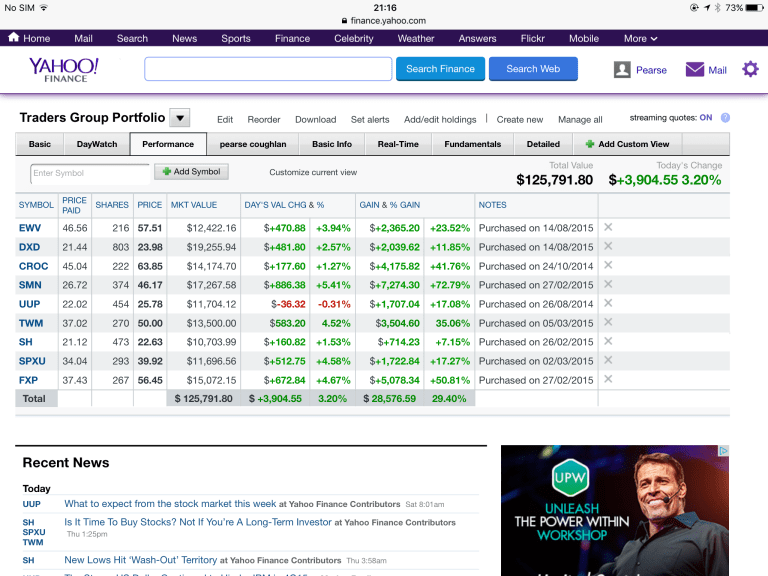

Portfolio

I have kept this running for over a year to show that simple trends once identified can easily be followed used to build wealth slowly. All the items were agreed by a group of us who meet up every few months. The reason I am highlighting this is that most people seem to want something quick and exciting. It has been proved to me that listening to the likes of CNBC, Bloomberg or reading anything like Investors Chronicle or Shares magazine are a total waste of time. When you get something for free you have no appreciation for it.

Anyway I’m going to wind this up as most people seem to think there are better ways to get rich. Important to note that Warren Buffet only made about 15% every year but he steadily did this and compounded the results.

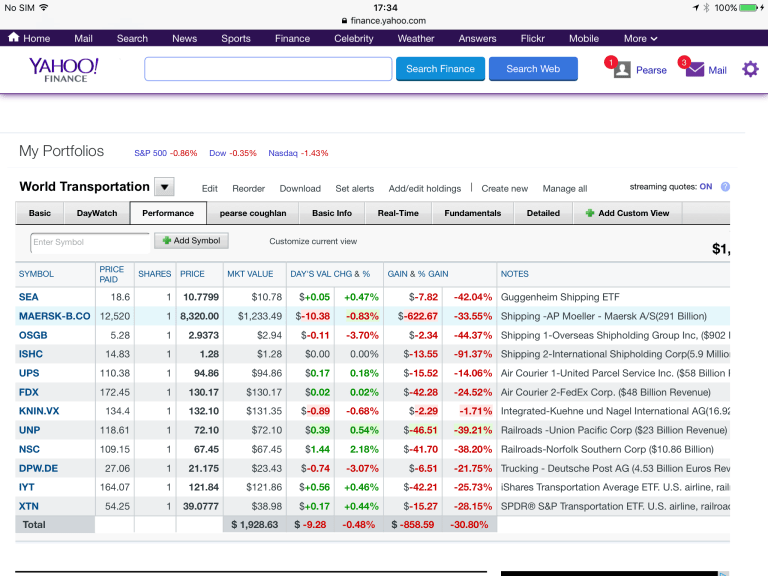

World Transportation

Below is a summation of world transport by land, sea and air. All the dates of these securities are based on purchase on 02/01/2015. You can very easily see that all forms of transportation are dropping significantly. If this isn’t a leading indicator then I don’t know what is. I have listened to hours of rubbish on TV about so called experts saying that even though the Baltic Dry is at all time lows since records began that in the modern world its not really important and we should focus on other forms of transport like air courier as Intel does in delivering its chips. Well its this simple can anyone see any green on the table below in the far right hand column. No more required. Whats really scary here is that in 2008 very few of these were negative at all. Buckel up boys cause were going fore a ride.

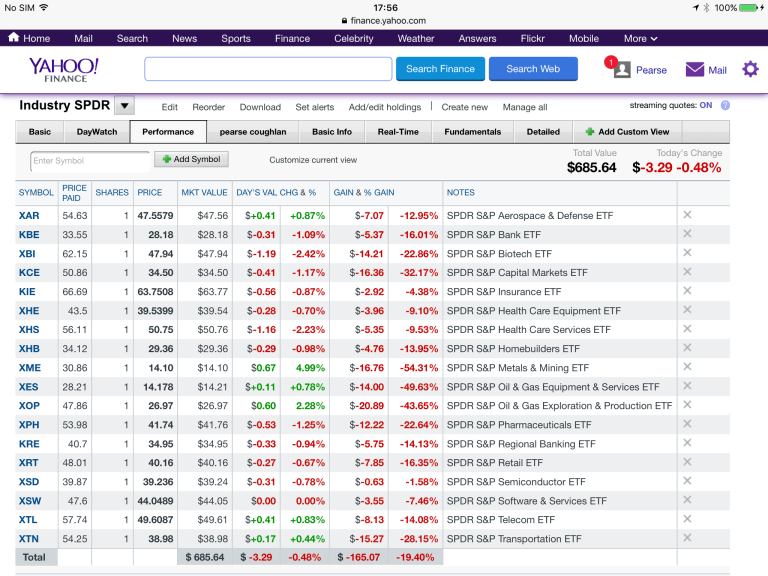

Sectors

There are only two sectors that are positive(based on 02/01/2015 to today) and just barely. These are all based on the S&P500. A lot of whom are foreign as well. It just happens to be the big daddy of them all. I have looked at the global international sectors and you get the same idea only 2 of 10 are hanging in there. You can use whatever metric you like. Use SPDR’s use iShares ETF’s, use Bloomberg online, use the FT and the picture is just the same. If you think buying potatoes or cans of Coke in Tesco or Wallmart(Consumer Staples) or 20 silk cut blue cigarettes and tins of lager(Consumer Discretionary) will save us then I’ll have a very large Pale Ale and a Monte Cristo cigar please.

Industries

Now I can talk and talk but no matter what I cant make sow’s ear into a silk purse. The scary thing is the momentum of change that none of this shows. You have to look into the individual securities. I can use colour full language like finding support and whatever warm language makes you feel good. The simple truth is we have been a bull market since July/August of 2015. Nothing goes up forever.

Usually before you get a change of a trend you get a major formation in a shape like a double top, a head and shoulders and so on. When you look at a lot of the Sectors, Industries, Stock Market Indices ie. the S&P500, the DOW, the Nikkei225, DAX, they all show a type of double top. I can go on and on but the upward trend has broken and is now downward. Every news monger picks up on the slightest positive and exagerates it. After BP’s worst results in history yesterday don’t expect Cinderella to arrive at the door in a pumpkin.

In short GET OUT OF EVERYTHING!!!

Countries Above Water

In Europe there is Ireland, Belgium and Denmark.

In all of North and South America: Nothing

In all the Middle East: Nothing

In all of Asia: Only Japan. And we know why that is.(Desperation)

Correlations:

Interesting that Japan has no correlation to the price of oil. ie. there are no oil companies that I know of. For some reason the Nikkei 225 seems more closely related to the West and not China or Asia. 1/3’rd of Japanese companies balance sheets are in cash. Good dividend plays here in the future. You know in the start of January you look back and you see the best and worst performers and say to yourself, that looks great think I’ll pick up some battered fish finger stocks. Over 20 years this doesn’t work really well. but if you change your timing and look every 3 years it seems to work much better. It seems that momentum plays a large part here. For me cyclicals like steel companies, shipping and banks in Japan will in the future look very attractive but not yet.

Based on the Big Mac Index a hamburger in Tokyo is now cheaper that New York. Time to get on a plane and see this beautiful country.

An interesting correlation I found is that there is nearly an exact correspondence between the price of Copper and the Peruvian Stock Market(EPU).

Oil going down usually strengthens the US $.

Metals coupled to Emerging markets not just Australia and Canada.

Overlay Australia and Canada stock markets and you can hardly see a difference. Which came first the chicken or the egg?

Currencies

Since the 70’s the Yen has appreciated against the $ but in the last 3 years the mighty US $ has become the global currency of choice. Everywhere I looked I was getting a tip on the Yen. Over December and January I believe that large positions have been built up by speculators. They will be squeezed badly. But what is the Bank of Japan or indeed any government now saying. Quantitive Easing(QE) doesn’t work anymore so we will reduce interest rates below zero. You pay us to keep your money in the bank. Ever wonder why you would want to deposit money in a Swiss or Japanese bank account to Loose money? Something doesn’t add up for me. I see the Yen marching on after the speculators are squeezed badly.

The mighty US $ will continue to strengthen. Lets face it its the only show in town! Historically in the past when the Fed hiked rates the US $ dropped away but not this time. The Chinese are liquidating large amounts of US$ to support its own currency and this is the only external stabilizing force keeping it down.

Sterling is under real pressure. This is the year that the EU referendum is up for grabs by the British public. I just can’t see this going through. No matter what deal he gets from Europe he still won’t get this through a referendum. Not even the Iron Lady could convince the British public on this and now they have a vote. Wow fun and games ahead. Get the smoke and mirrors ready.

I was thinking about Mark Carney, the Governor of the Bank of England. Incidentally he has Canadian and Irish Citizenship but not British. That must be a first? Lots of rumours swirling around that his guiding hands are not appreciated by some blue blood types working for the old lady of Threadneedle Street. If Canada goes into recession which I think it has already, there will be more appreciation of his services on the other side of the pond.

To me the US $ and the Euro are no brainers. If there is one person I definitely follow its George Soros and that’s where he has most of his cash stashed. I laughed when I heard how I believe he’s playing it. (His largest equity positions I believe at the moment are in Amazon and Paypal).

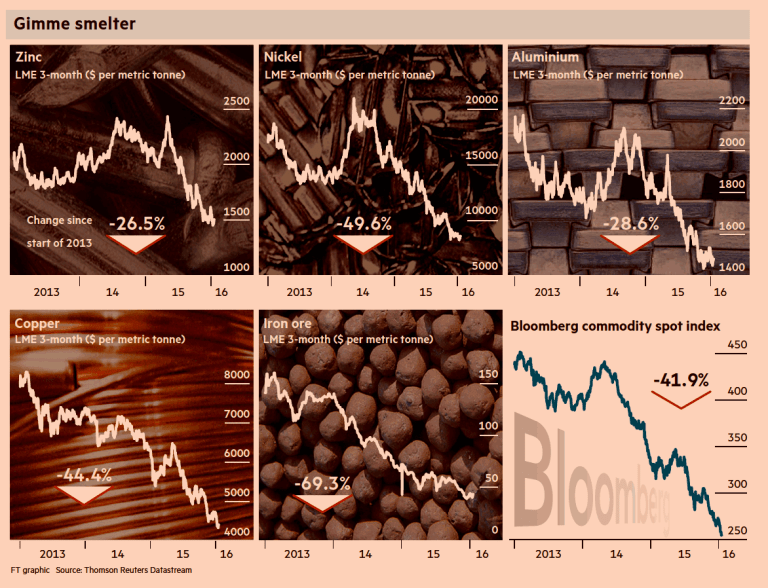

Commodities

The only thing to talk about here is Doctor Copper and Oil. At the start of February last year I sent gave a presentation in Trinity on the markets and said the price of oil could hit $26 a barrel. I was laughed at. I put this in writing. Tomorrow I’ll be meeting the group again, hope they’re still laughing.

Copper dropped below 2$ a pound(lb) to $1.94 on the 19/01/2016. Its now today above $2 at $2.09. The $2.00 is really important as the next support level is $1.38 . If this does not hold then if you think you have seen pain in the likes of Glencore, BHP, Standard Chartered or indeed any mining company then you’ve seen nothing yet. As far as I am concerned this is more important than the price of oil. Its a leading indicator for over 120 years. Copper is such a widely used good in multiple industries that it is an excellent gauge of global economic activity, especially production. You will read that its no longer reliable. Trust me if $2.00 is not held then a good laxative coupled with a few boxes of Panadol tablets, tinned food, a shotgun and lots of ammo will come in handy.

I had heard that gold was recovering a little. I think its not real. I looked up the charts of Goldcorp, Inc., Barrick, Newcrest Mining Ltd, Anglogold Ashanti Ltd. I even looked up the smaller ones like OceanaGold Corp, Northern Star Resources Ltd, Evolution Mining and couldn’t see any bounce, so if the guys taking this stuff out of the ground aint pickin up now then in 6 months time I don’t think Gold will either. Remember gold is used as a hedge against inflation and its Deflation that everyone is worried about now.

Whereas with Silver I noticed the opposite. They are not going up but are putting in strong bases Fresnillo(FRES.LSE) or Silver Wheaton Corp.(SLW:TOR), Tahoe Resources Inc(TAHO:NYQ)

Australian Property:

After looking at the Australian Stock Market Indice the ASX200 for the last 25 years I am now convinced that that its ready to take a big drop. At 4876 it has only dropped 18% from its recent high of 6000 in March of last year. Funny how the market likes nice round numbers. Its next support levels are 4000, 3120 and 2000.

Yes there is a surge of capital to Australia particularly from China but with China now clamping down on off shore accounts this will suffer. Same complaint everywhere in London and New York. The locals are being priced out of the market. That may be so but no one ever says no to cash, even if its drug money. Isn’t that right HSBC, Barclays, Bank of America, JP Morgan, Western Union. Anyway to anyone that has ever read any of George MacDonald’s Flashman novels. His advice would be ‘Lick up the honey stranger and ask no questions’.

So now down to the nitty gritty. The easiest way to short here is to use CFD’s and short the big property plays like Mirvac Group(MGR.ASX), GPT Group(GPT.ASX), Good Group(GMG.ASX), Scentre Group(SCG.ASX), Vicinity Centres(VCX.ASX), Stockland Corp.(SGP.ASX), Westland Corp.(WFD.ASX), Dexus Property(DXS.ASX), BWP Trust(BWP.ASX) and Investa Office Fund(IOF.ASX). Make sure your provider is backed up by a proper financial watchdog. Yesterday the UK financial watchdog put the UK providers on notice that they had to improve their controls. Wait till you get this. There are about 130 providers of Contracts for Difference (CFD’s) in the UK. 100 of these are regulated directly by the FCA UK Authority. 30 are regulated off shore typically in Cyprus and one or 2 in Romania. Just checked one or two that interest me and boy I got a surprise. One very big one sticks out!

Regarding the currency, its going to get cheaper to go to Aus. The AUD/EUR looks leaded for 0.5 and the AUD/USD looks headed for 0.6 to 0.5. The problem for anyone expecting a recovery is that China has a threefold influence on Australia. Firstly, their miners are struggling with China’s slowing consumption of commodities, particularly its metals. This is set to continue. Secondly flows of capital from China are slowing as capital controls are being introduced and as Australia is tightening its rules. Thirdly, the Aussie Dollar is being used as a proxy for bad news from China because of its liquidity.

If your coming from the US its got a lot cheaper(25%) in the last year. For the last year I have used an interesting instrument to short the Aussie. Its called ProShares UltraShort Australian Dollar, its symbol is CROC. The last four weeks look like a dead Kuala bounce and I think it will resume its steady drop.

Millennials:

I keep hearing this word and hadn’t got a clue what it meant. I now know that its a general term for people born between the 1980’s to the early 2000’s. I’m at the age when I hear the usual criticisms of the younger generation. They are lazy wasters with too much. Give them an iPhone and their happy. Young people have never had it so good. This coupled with so many friends of mine moaning about work and taking for granted their gold plated pensions. I sat back and thought I think we might have it all wrong.

Millennials are the best educated of any generation that has ever existed on our planet. They will also live longer due to advances worldwide like flushing toilets, clean water and medical advances such as antibiotics.

I think they are being oppressed and ultimately abused by our society in the long term. Yes, we love and nurture them, females have freedoms as never before but their talents are being squandered. Youth unemployment in the west is on average 15% and 25% in developing countries. But take a closer look at some of the countries and you get a shock. My brother lives in Portugal and he estimates it at nearly 30-50% that are not in employment or education.

Education is too expensive, the young get saddled with hugh debts. President Obama only last year fully paid back his student loans. No wonder he’s going grey. Can they look forward to a steady job, a home, a future?

The job market is too competitive. The dream of working for Google or Facebook is just a dream. In fact these types of companies target the young with their products but don’t really want to employ too many of them. For example Google has revenue of $75 Billion with only 59,980 employees. That means each employee represents $1.25 Million of revenue! Comparing it to MacDonalds you get each employee responsible for $60,500.

I nearly choked reading about Ruth Porat, Google CFO expounding the need for paying taxes and social responsibility.

With lack of employment and hope the young turn to living at home longer which is the only option for so many now. In general the young are in education until their late 20’s, take longer to get established into a job. Have children in their late 30’s and as some of my friends did, they waited till their 40’s. After spending years trying to avoid pregnancy they now understand how hard it can be in their 40’s. What a waste!

In the past the old subsidised the young, now its the young that are doing it. As we get older we will borrow more for our increased healthcare and pensions that the young will have to repay on behalf of us. So not only will they have education and housing debt but now the debt for our pensions and healthcare.

There is a flow of resources flowing into the future from the young to the older. As far as I know this has never happened in human history.

As we all know younger people are disaffected and don’t vote so why should the politicians bother to worry about them. Ronald Lee of the University of California estimated that only 23% of 18-34’s voted in the 2014 mid term elections whereas 59% of over 65’s voted. In the UK that increased to 78% in the last election. Yes you guessed it older voters won. Today in Dublin an election was called after wrangling from the two existing government parties, Fine Gael(Centre/right wing) and Labour (Centre/Left). Labour wanted a vote on Friday so that there was a possibility that students could vote. Anyway they got their way. Angry young people with no ownership in society are highly dangerous as we learnt in the Arab Spring.

Rumours

About 2 months ago someone mentioned to me that a very large integrated oil company was in serious trouble. I thought nothing of it until BP’s results yesterday. The other thing mentioned to me was that there was a US oil major looking at the possibility of a reverse takeover of an Irish oil company for tax purposes. I usually put tips and rumours in the bin but would be nice if Chevron Texaco or Exxon Mobil became an Irish company. After Pfizer no-one is laughing anymore. Anyway this is only pub talk ?

Discrepancies in China

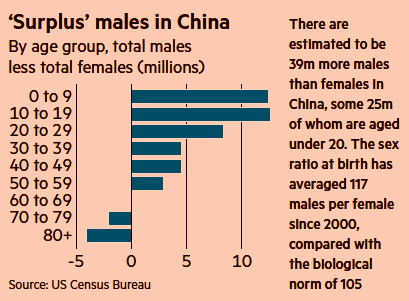

Look at the % of males to females in China. Nature uses 2 ways to balance this major discrepancy, war or disease.

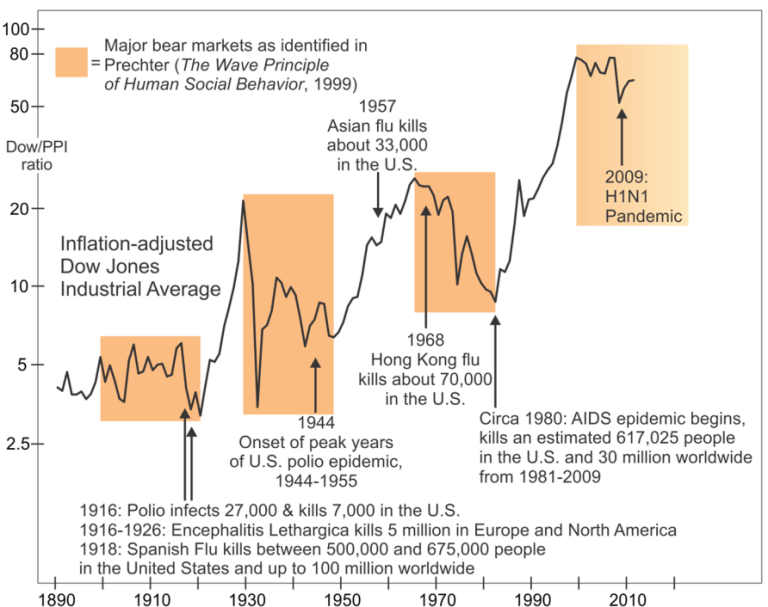

Interesting chart showing major disease outbreaks versus the DOW

Well Worth a Listen

Martin Wolf of the FT in Ireland. An excellent insight from a man with great vision

https://woodfordfunds.com/insight/martin-wolf-global-challenges/

Once again, a great piece Pearse – always worth a read!

LikeLike

Reblogged this on FXTraderPauls Trading Adventures and commented:

Once again an interesting read from my friend Pearse – he always gives a very interesting big picture view of the world and provides plenty of food for thought. It always makes for an interesting chat between Pearse and I (which is normally in a nice Dublin pub over a Guinness or two….trust me it helps the creative process!)

LikeLike

Thanks Pearse, I think! Something tells me you are not feeling altogether bullish…

Leonard

LikeLike