Guns Not Butter

Check out the rally in non US Defence stocks since the abduction of Nicholas Madura. Europe certainly has got the message since Trump was elected. Trump has unleashed his secret weapon, namely fear, uncertainty, loss and confusion. If it wasn’t clear before it certainly is now with Greenland. Were all on our own now and the US has no-one’s back not even Nato.

Last week the unemployment figures came out in the US. They fell but the interesting thing is that they dropped at their lowest rate since Covid. The labor market is weakening.

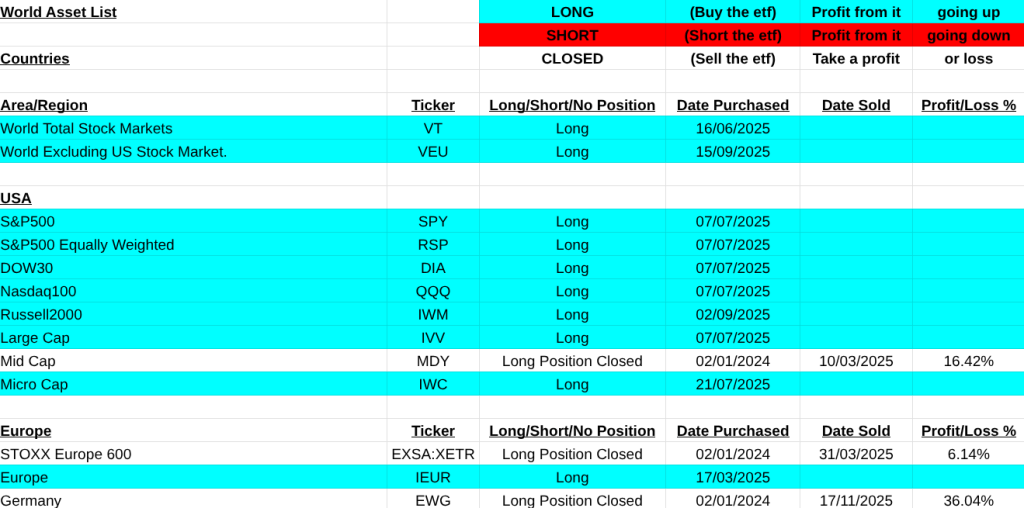

Now lets get down to business. On the ‘World Asset List’, the main changes were ‘Oil & Gas Equipment & Services'(XES). It’s now a buy. Interesting timing with the US oil majors bullied by Trump to invest in Venezuelan oil infrastructure.

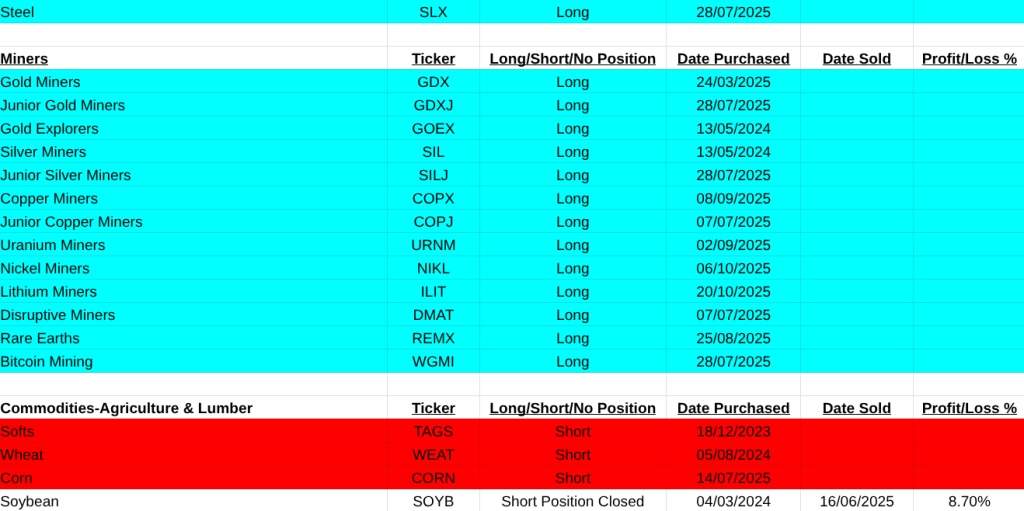

Nickel Miners(NICK:LSE) are up over 25% in the last three weeks. Short Position Closed. I think its in play now due to demand in electric vehicles(EV’s) and stainless steel. The worlds largest supplier by far is Russia.

Two themes were closed for a nice profit, E-Commerce(EBIZ, +56.69%) and Transformational Data Sharing(BLOK, +14.60%).

On a positive note, the Dow Jones Transportation Average Index(DJT is now a buy)

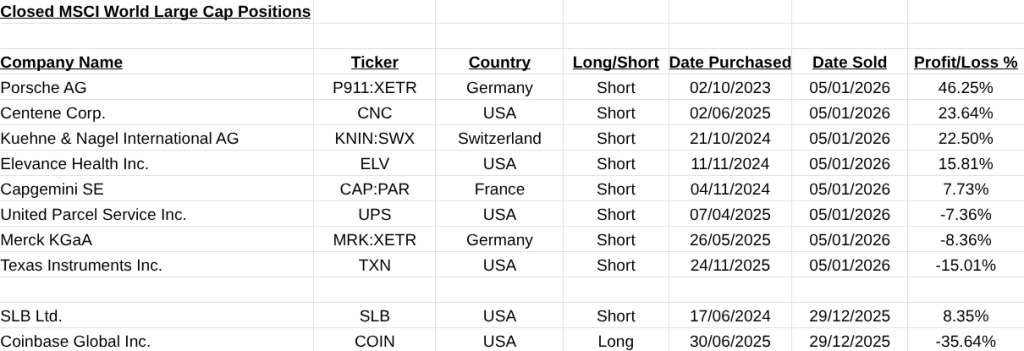

On the MSCI World Large Cap Shares front it was a very positive two weeks with substantial gains in Porsche(P911:XETR, +46.25%), Centene(CNC, 23.64%) and Kuehne & Nagle(KNIN:SWX, +22.50%).

The main loss was in Coinbase Global(COIN, -35.64%)

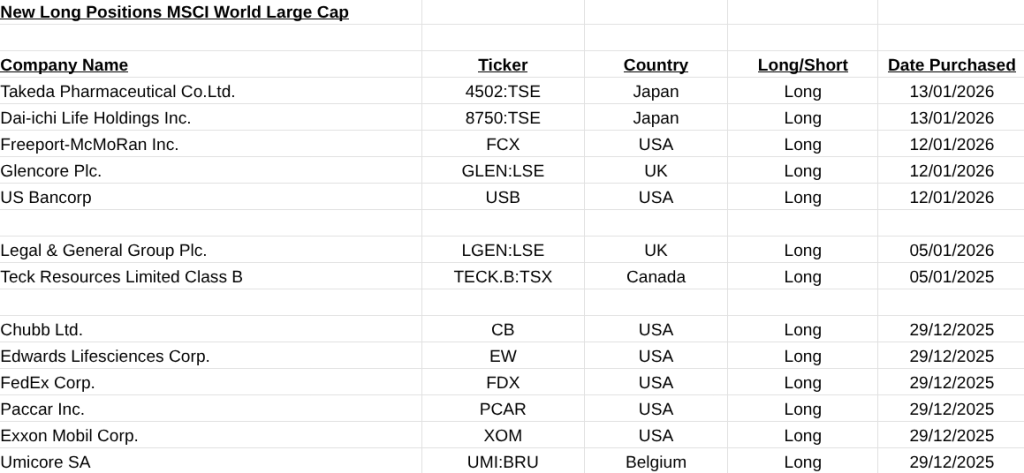

Finally on a positive note I note that there buy signals on three miners, Freeport-McMoRan(FCX), Glencore(GLEN:LSE) and Teck Resources(TECK.B:TSX). The one thing these all have in common is Copper.

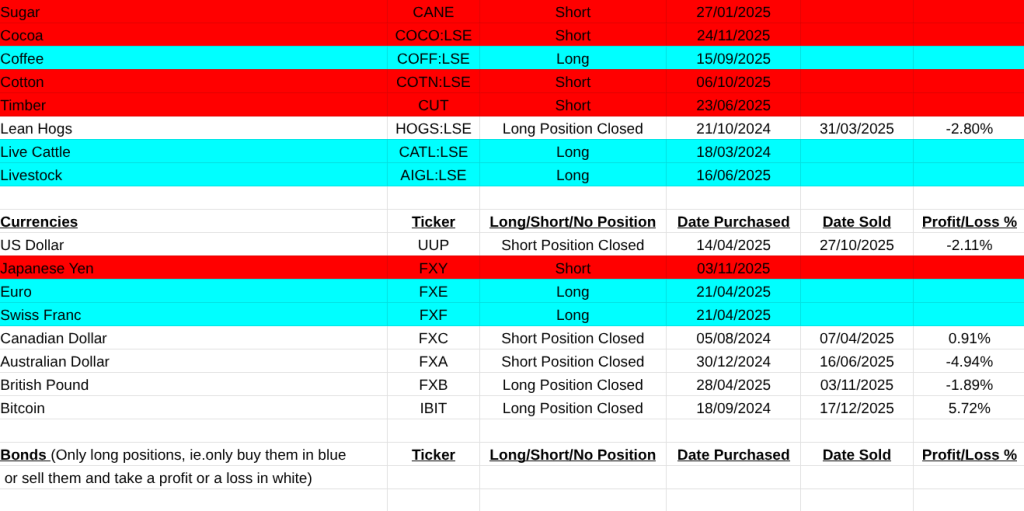

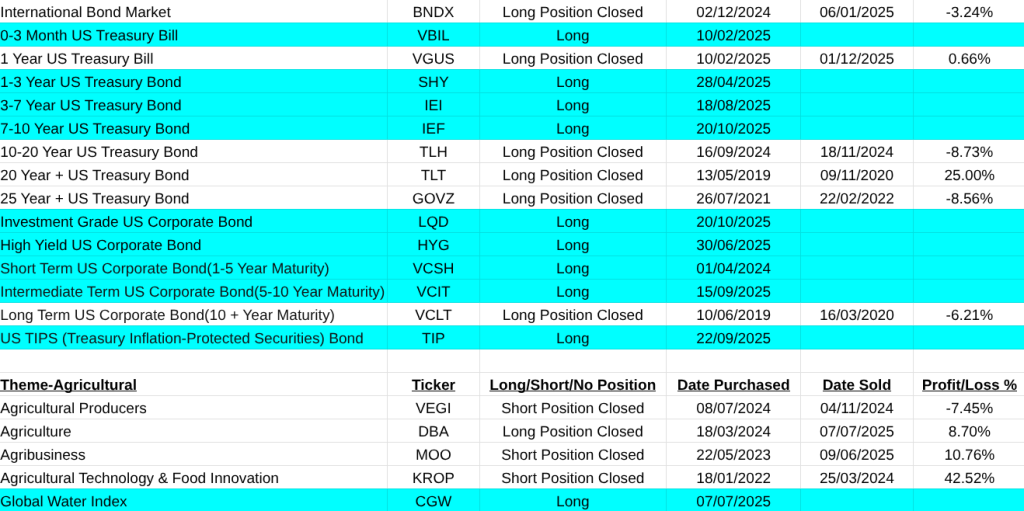

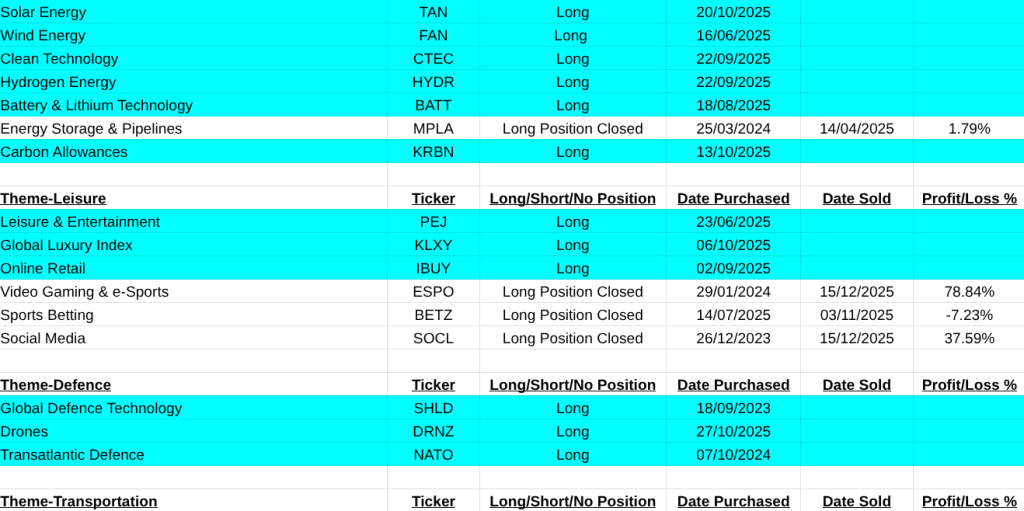

My list of closed trades, new buys and shorts are below. I wish everyone a rewarding and great 2026, Pearse.

Note:The above trades do not take into consideration dividends on shares or coupons on bonds. This is important because if you short a stock or bond the dividend will be taken from you. Therefore the safest strategy is never to short any instrument only buy an upwardly trending security and simply close your position when this ends. These trades are my view on the market and not me advising you to take any of these positions. Closed positions have losses and profits listed in percentages. Mainly as a record to myself so I keep honest in evaluating my strategy.

The list of stocks analysed are from the MSCI Large Cap list as of 01/01/2025.

Thanks Pearse

LikeLike

Ref to Trump, oil, and unemployment in the US, Iran in crisis – Higgins should be made answerable for his letter to Iran last year.👍

LikeLiked by 1 person