The Second Most Overvalued Market in History.

The highest one was in 2007, where we are now and then thirdly during the Dotcom Crash in 2000.

So, the market is overvalued. Overvalued means that based on traditional valuation measures, people are paying too much for stocks. This can go on for years and is not an immediate worry but when you hear the advice to ‘buy the dip’ you begin to notice that it works but increasingly the market roars back less and less until a top is reached. I think we are getting pretty near that if not there already. Overvaluation can exacerbate declines as there is no intrinsic value left to incentivise potential buyers. Overvaluation doesn’t matter until it does!

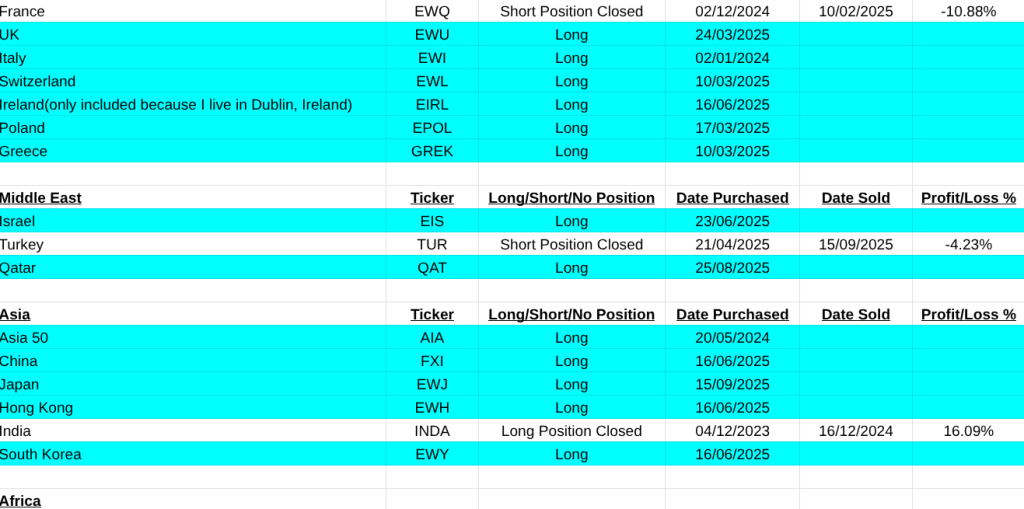

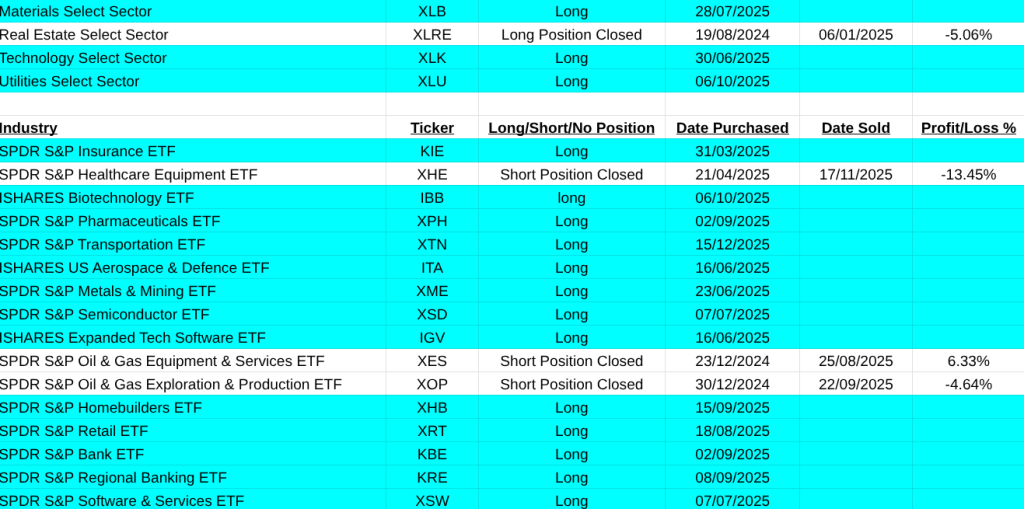

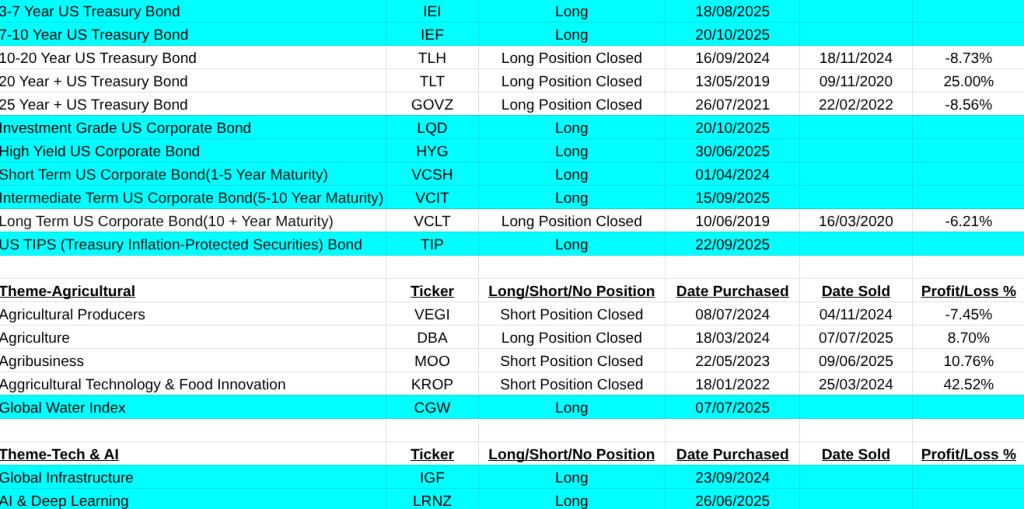

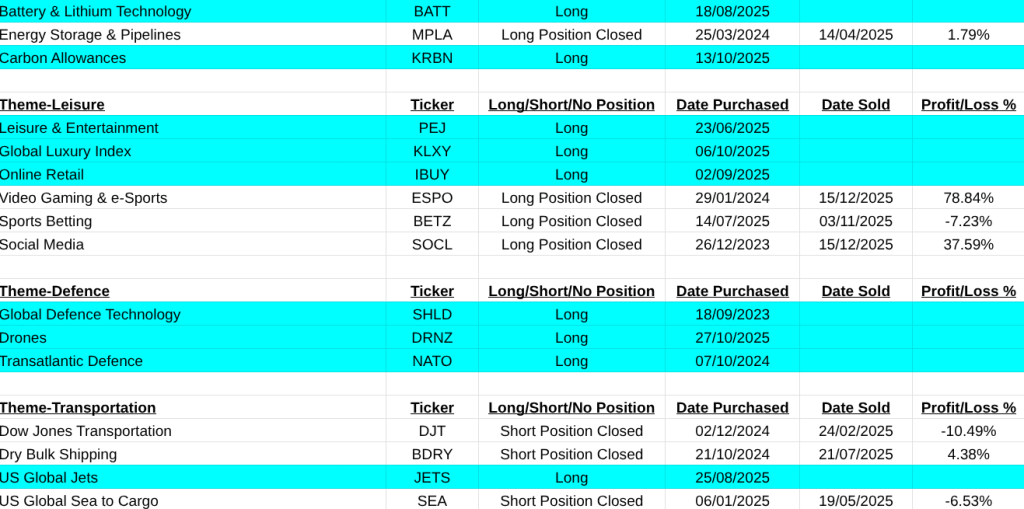

Now let’s get down to business. On the ‘World Asset List’, there were some interesting changes. Transportation(XTN) and Copper(CPER) are now new buys. Two sales were in Video Gaming(ESPO, +78.84%) and Social Media(SOCL, +37.59%).

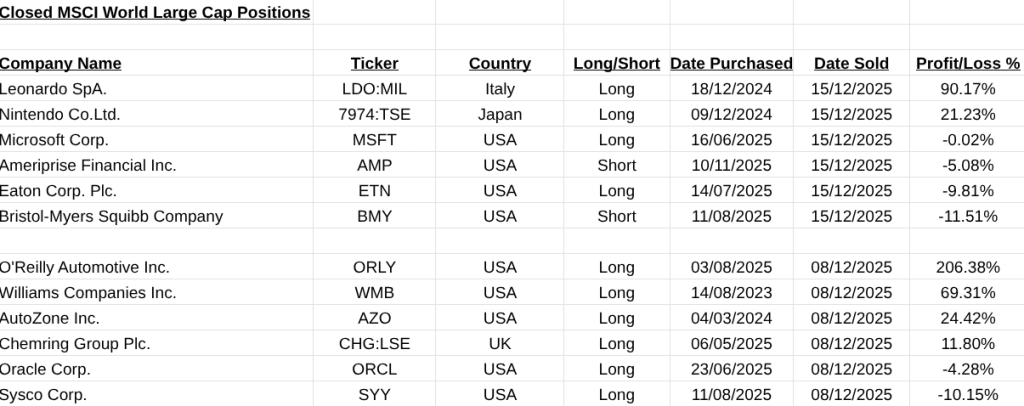

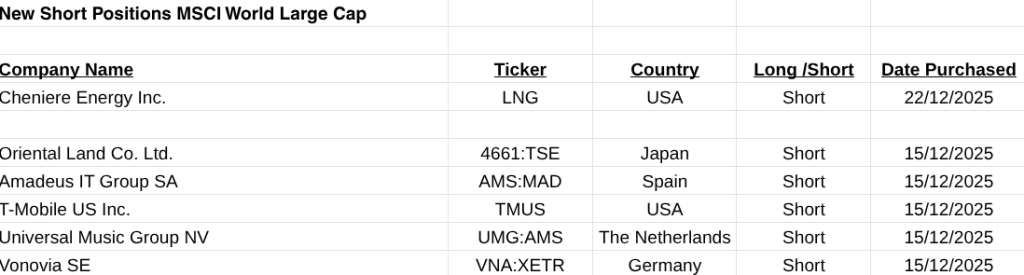

On the MSCI World Large Cap Closed Positions the profits just kept coming. The largest gains were in O’Reilly Automotive(ORLY, +206.38%), Williams Companies Inc.(WMB, +69.31%), Leonardo SpA.(LDO:MIL, 90.17%). Full details of all trades are below, along with new long and short positions. Either I’m a genius or trend following is a goose that lays golden eggs. This will be my last mail for 2025 so I wish you all the best over the Xmas holiday season. Hope Santa Claus brings you all something nice! Pearse.

Note:The above trades do not take into consideration dividends on shares or coupons on bonds. This is important because if you short a stock or bond the dividend will be taken from you. Therefore the safest strategy is never to short any instrument only buy an upwardly trending security and simply close your position when this ends. These trades are my view on the market and not me advising you to take any of these positions. Closed positions have losses and profits listed in percentages. Mainly as a record to myself so I keep honest in evaluating my strategy.

The list of stocks analysed are from the MSCI Large Cap list as of 01/01/2025.