FOMC week.

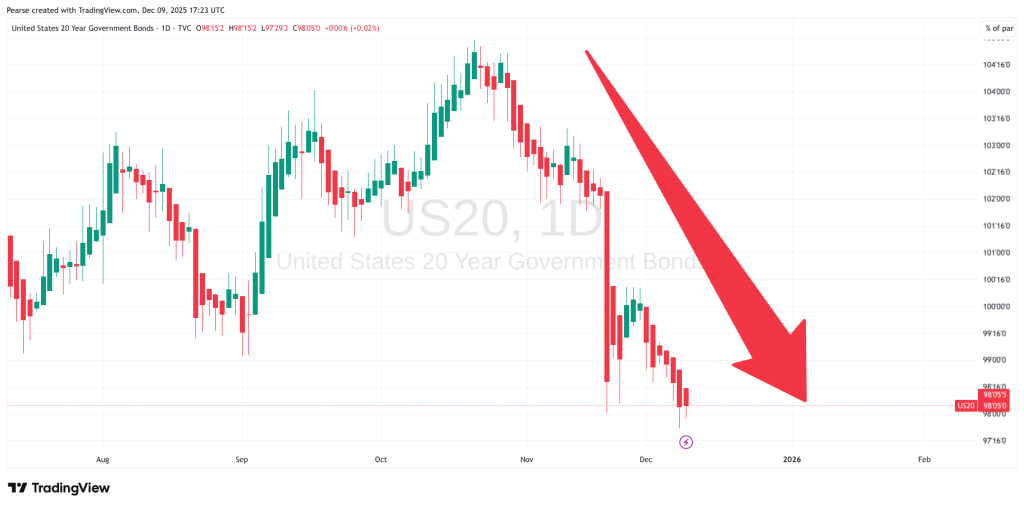

It’s FOMC week again. The markets are stagnant and all we hear the economists pratter on about are dot plots and the different personalities in the FED. Here’s a rule of thumb that works very well. If the US 20 year government bond drops for a month before the meeting its pretty certain that there will be a drop in interest rates.

So you can be pretty sure tomorrow there will be a positive announcement to spur the markets onto new high’s.

So what else is happening on the main asset list. Argentina looks like it’s off to the races again. It’s last run produced a whopping 105% gain.

The energy sector(XLE) was quiet for a long time and is now coming back to life.

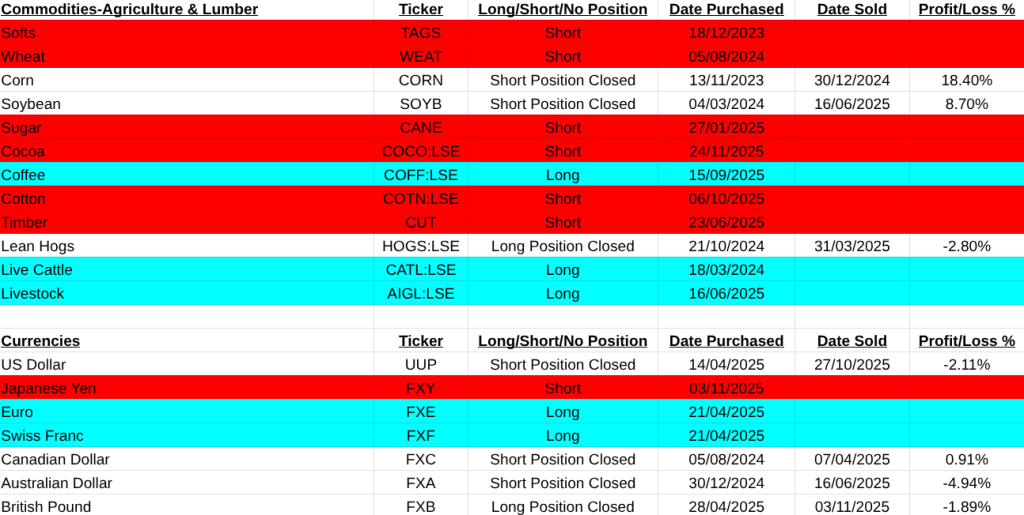

No other noticeable changes other than the Japanese Yen continuing to slide and short term Japanese bonds effectively at zero for the last fifteen years, climbing now. I will take a proper look at this next week.

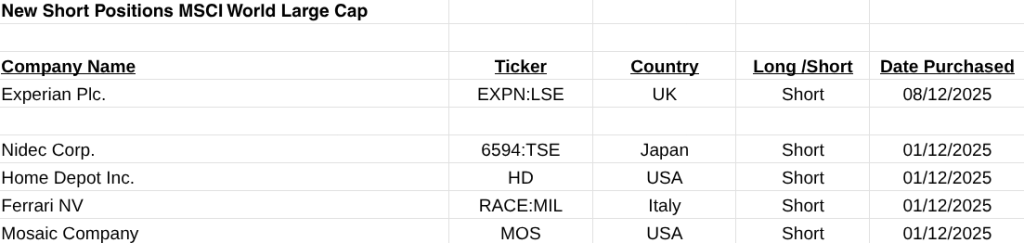

On the MSCI World Cap list of stocks, it was another solid two weeks. The largest gain was in Avio(AVIO:MIL +195%), Hensold(HAG:XETR 55%), Stellantis(STLAM:MIL 34%). I won’t go through them all but I am noticing some profit taking in European Defence companies.

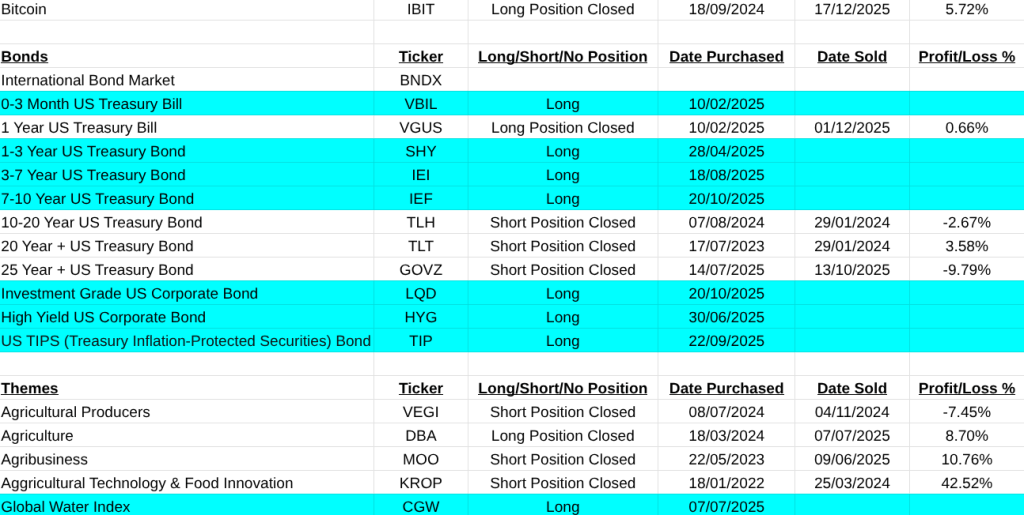

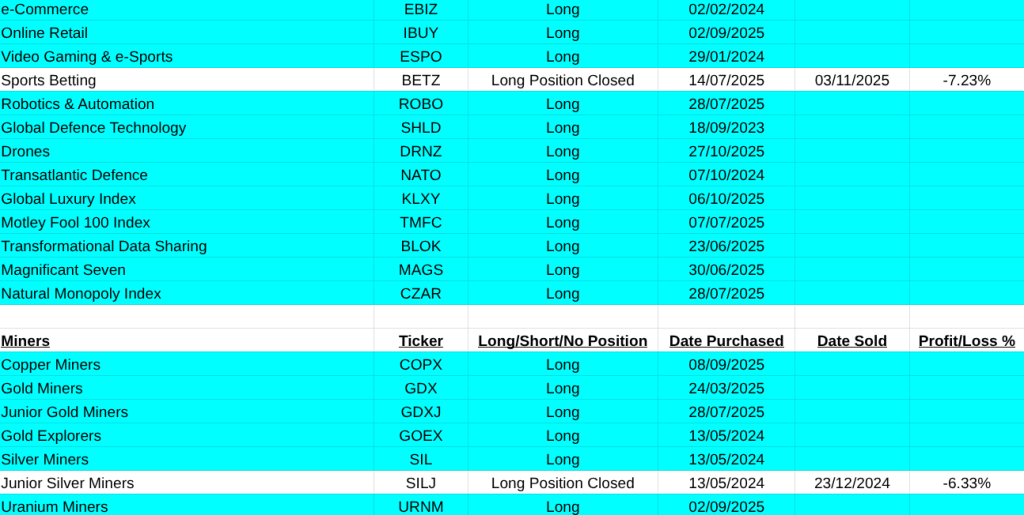

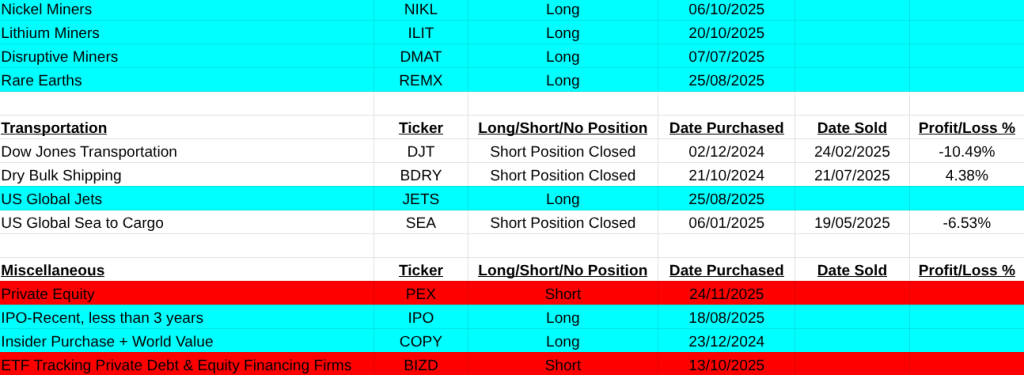

My full list of closed trades, new longs and shorts are below.

Two interesting effects that take place most years in December are what are called Wall Streets only “Free Lunch” and the “Santa Claus Rally”. I think it’s a good idea to clearly define what exactly they are.

The free lunch effect is when Investors tend to get rid of their losers near year end for tax purposes which hammers them down to bargain levels by 15 December. These stocks tend to outperform the following year, so look out for some bargains.

The “Santa Claus Rally” is a short, sweet, respectable rally within the last five trading days of the year and the first two of January. Santa’s failure to show tends to proceed bear markets. This effect is so pronounced it even has a saying on Wall Street. “If Santa Claus should fail to call, Bears may come to Broad and Wall”.

This year while everyone is finishing early and drinking beer I will be watching the markets closely on Thursday, the 18th of December and the next day which is the Options Expiry called ‘Triple Witching’.

Enjoy the rest of the year and hope Santy brings you something nice, regards, Pearse.

Note:The above trades do not take into consideration dividends on shares or coupons on bonds. This is important because if you short a stock or bond the dividend will be taken from you. Therefore the safest strategy is never to short any instrument only buy an upwardly trending security and simply close your position when this ends. These trades are my view on the market and not me advising you to take any of these positions. Closed positions have losses and profits listed in percentages. Mainly as a record to myself so I keep honest in evaluating my strategy.

The list of stocks analysed are from the MSCI Large Cap list as of 01/01/2025.