We all hear about a bubble in tech and AI stocks, but what does it really mean? If you look at the earnings of a company and break it down to an individual share level it really hits you.

For example, the earnings of one share of Apple would take nearly 33 years before it could make up the price of one share! Amazon, Alphabet, Microsoft 28 years, Nvidia 27 years!

If this isn’t financial madness I don’t know what is. This is why fundamental analysis does not work as its based on past averages and potential projections based on this flawed concept.

In the US I don’t think that inflation is now a worry, it’s the job market and employment figures that will be the Feds main worry. That inclines me to think the next FOMC meeting on December 10th could be a nice gift to the market with a 0.25% ish reduction and the markets should rev up again. Anyway, who knows? Judging from the chart of the S&P500 it really looks great. The upward trend is still in place.

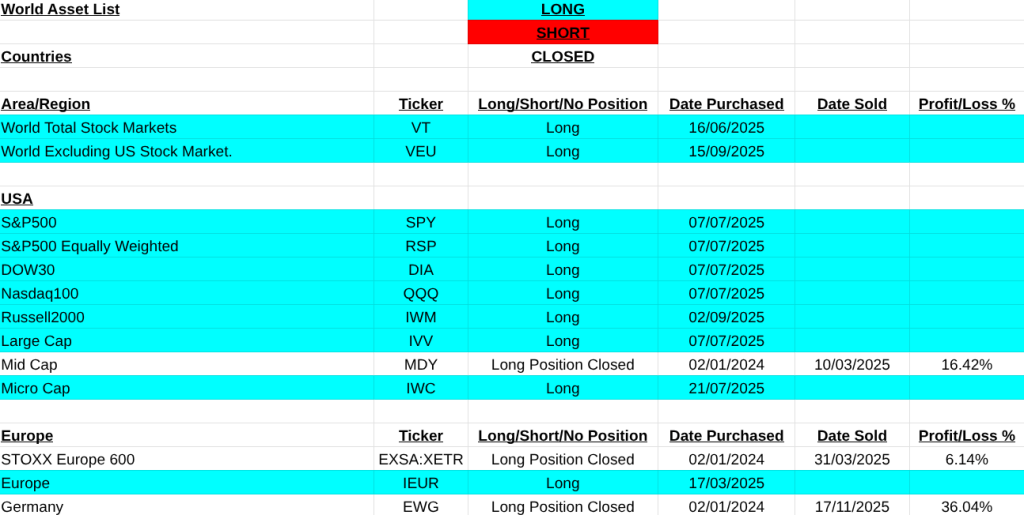

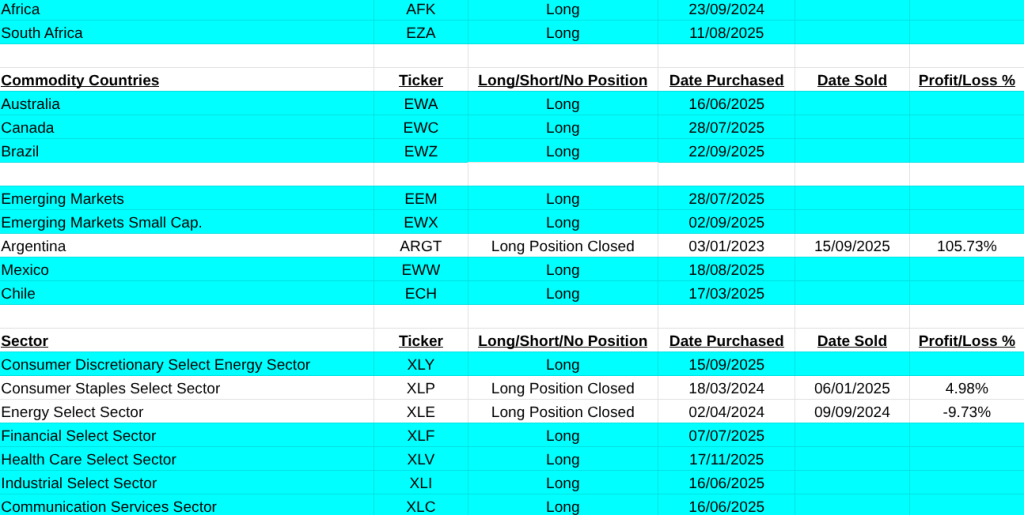

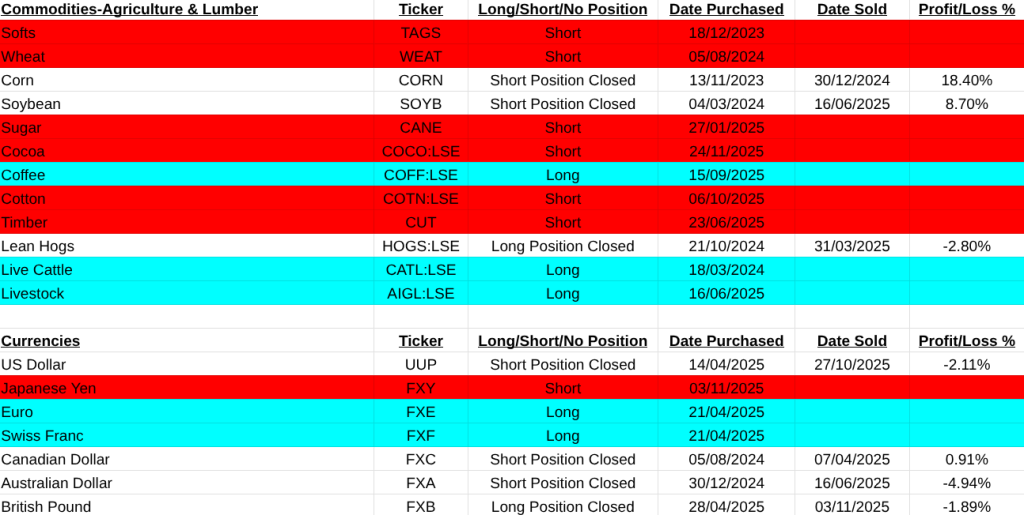

So what were the big changes I saw in the last two weeks on the main asset list.

Healthcare(XLV) is coming alive and is a new buy. New shorts are Cocoa(COCO:LSE) and Private Equity(PEX).

Closed positions were on Germany(EWG, +36.04%), Bitcoin(IBIT, +5.72%) and Health Care Equipment(XHE, -13.45%).

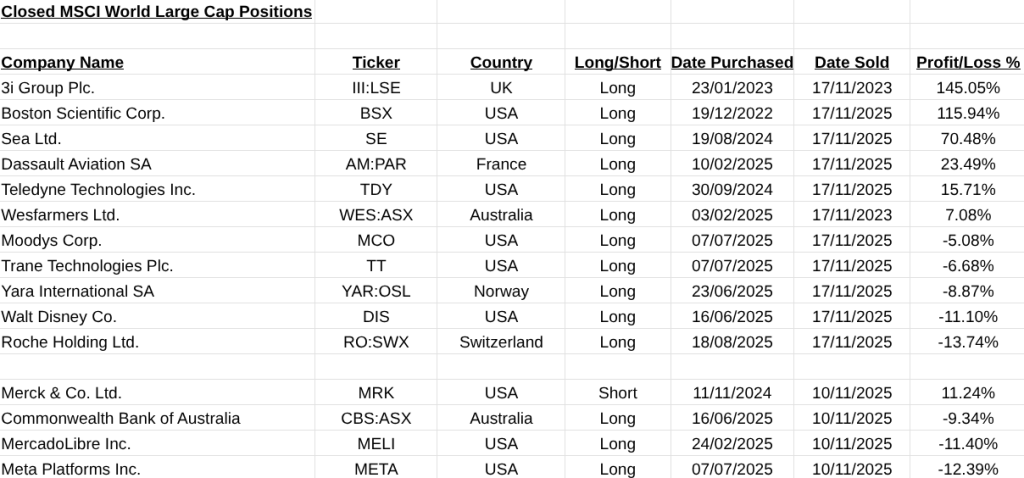

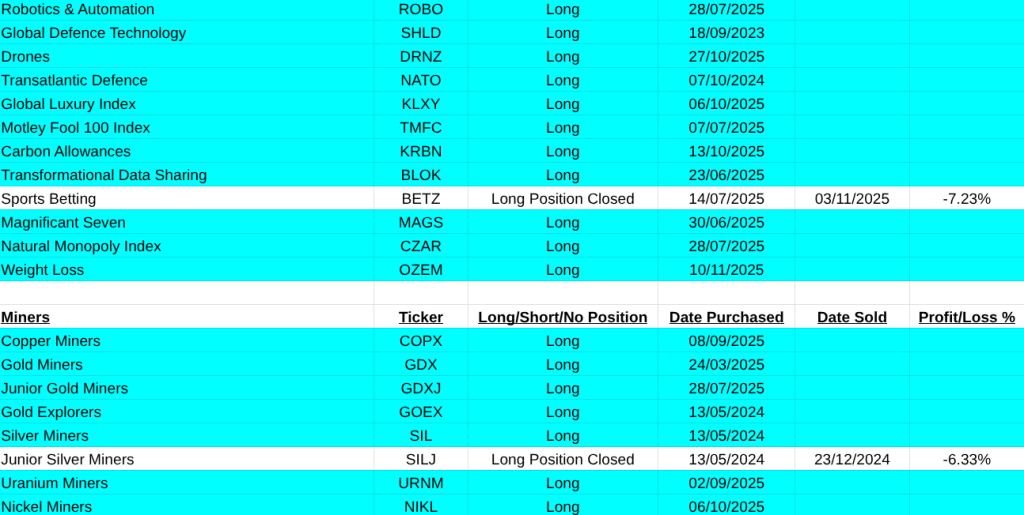

On the MSCI World Large Cap the gains were again quite staggering. Either trend following is a licence to print money or my trading abilities are exceptional. I somehow don’t think that’s the case. Anyway take a look at the trades below. All the best for the next two weeks, regards, Pearse.

Note:The above trades do not take into consideration dividends on shares or coupons on bonds. This is important because if you short a stock or bond the dividend will be taken from you. Therefore the safest strategy is never to short any instrument only buy an upwardly trending security and simply close your position when this ends. These trades are my view on the market and not me advising you to take any of these positions. Closed positions have losses and profits listed in percentages. Mainly as a record to myself so I keep honest in evaluating my strategy.

The list of stocks analysed are from the MSCI Large Cap list as of 01/01/2025.