I was looking at how Trump has affected the markets since his election. I knew that European Defense was a big winner but I hadn’t appreciated how well other markets had performed.

South Korea’s Kospi was a surprise for me even though I follow it weekly using the iShares ETF, EWY. After Argentina’s magnificent performance I looked for some other outliers.

Ghana, since November 2024 the Ghanaian stock market is up nearly 180%. Africa’s largest producer of Gold and the worlds sixth largest. A quick google lets you know that Ghana has spent nearly the last 40 years under the IMF. So no matter how wealthy the country gets it can’t perform even basic services for its citizens. I had lunch with someone from Ethiopia during the week and they explained to me that most African countries are not countries at all in the way we view it in the west but tribal oligarchies with no loyalty to each other other than what’s in it for me!

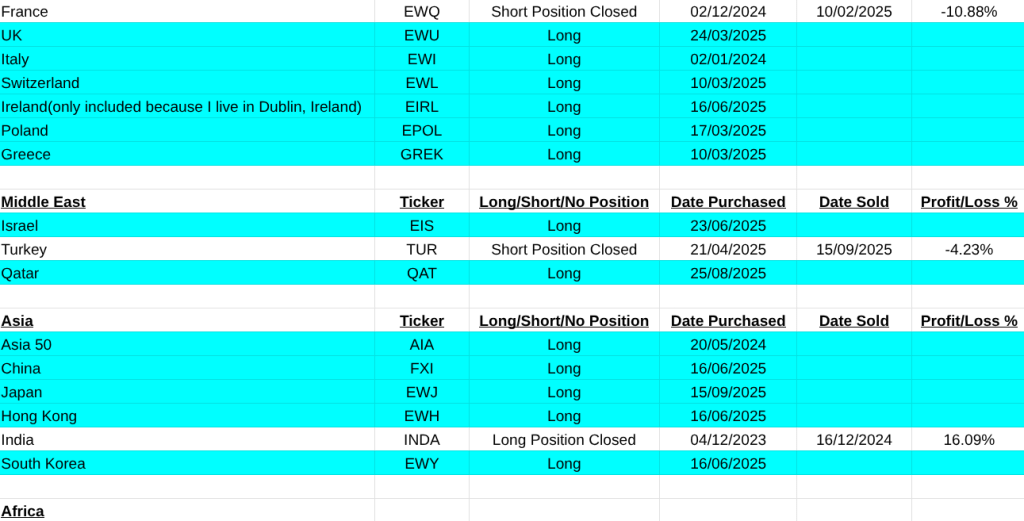

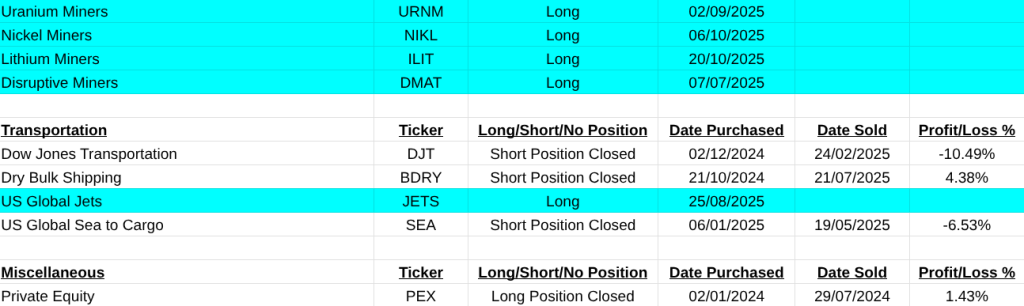

So what are the changes in my main asset red list over the last two weeks? Base Metals(DBB) and Zinc(ZINC:LSE) are now buys a long with the Weight Loss ETF (OZEM). On the currency front the Japanese Yen(FXY) is now a short. My long positions on Sterling(FXB) for a small loss of 1.89% and my short Position on the US dollar(UUP) is closed for a small loss also of 2.11%. So with the UK budget coming it doesn’t look well for Sterling.

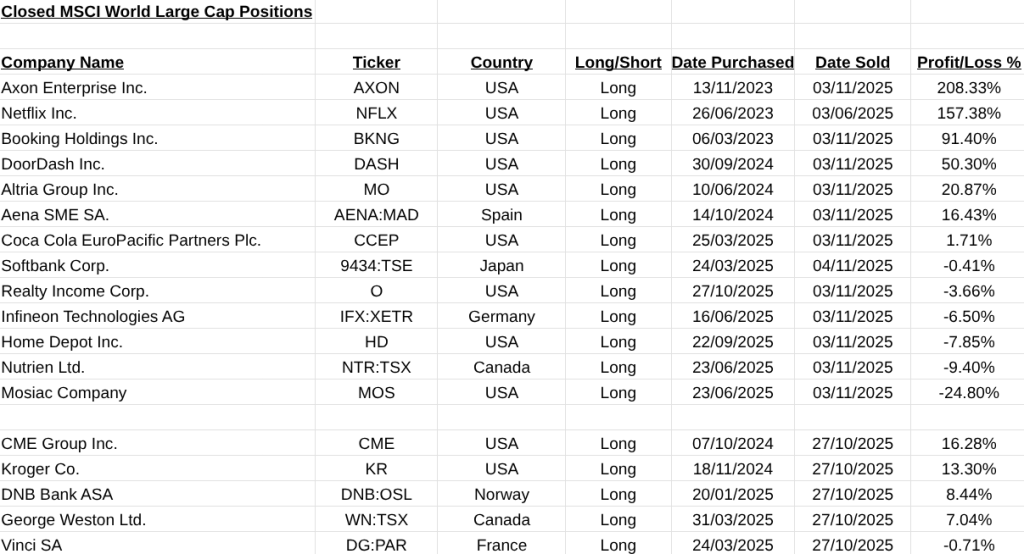

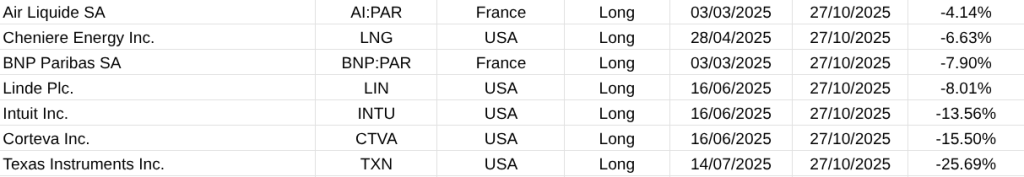

On the MSCI World Large Cap trading list the last two weeks were my most profitable ever. I won’t go through the details as it will sound like I’m boasting. I still cannot believe my performance so far. The two best trades were Axon(AXON:NYSE, +208%) and Netflix(NFLX:NYSE, +157%). The two worst trades were Texas Instruments(TXN:NYSE, -25%) and Mosiac(MOS:NYSE, -24%). The gross gain is 456.72% in the last three weeks. I include the trade details below.

All the best over the next few weeks, regards, Pearse

Note:The above trades do not take into consideration dividends on shares or coupons on bonds. This is important because if you short a stock or bond the dividend will be taken from you. Therefore the safest strategy is never to short any instrument only buy an upwardly trending security and simply close your position when this ends. These trades are my view on the market and not me advising you to take any of these positions. Closed positions have losses and profits listed in percentages. Mainly as a record to myself so I keep honest in evaluating my strategy.

The list of stocks analysed are from the MSCI Large Cap list as of 01/01/2025.