It was an interesting few weeks. My comments on Gold in my last post on 07/10/2025 hit home. Gold and Precious metals still look great and need a correction to go higher. However there is a fine line between a correction and the end of a trend. I will be watching this over the next few weeks.

Over the last three weeks there were some interesting changes on the main asset list. The strangest for me was the growth of Genomics Immunology(IDNA), Biotechnology(IBB) and Medical Breakthrough(SBIO) companies. The last time I saw this was before Covid.

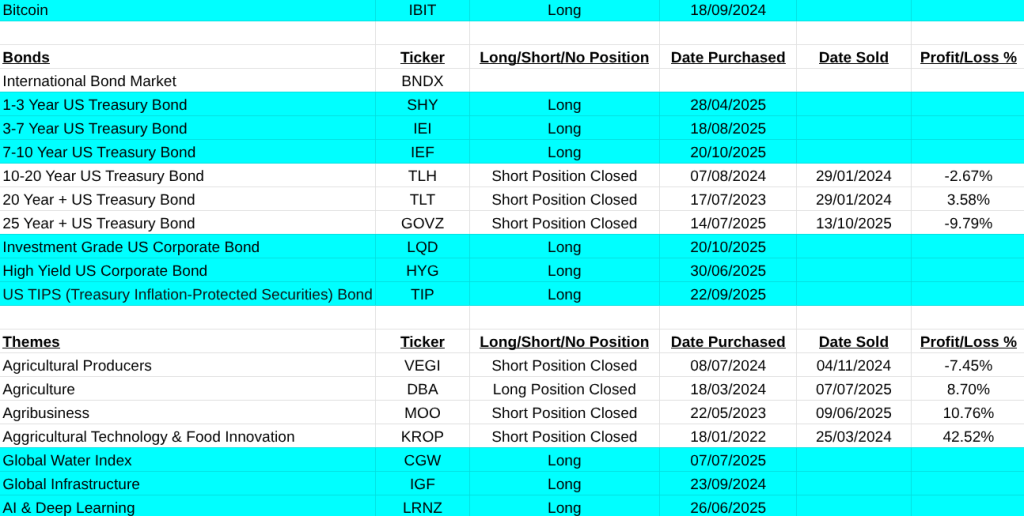

The Utilities Sector(XLU) is now a buy which is hinting at investors looking for safety. This coupled with 7/10 year US Bonds(IEF) and Corporate Bonds(LQD) becoming buys clearly reinforces this thesis.

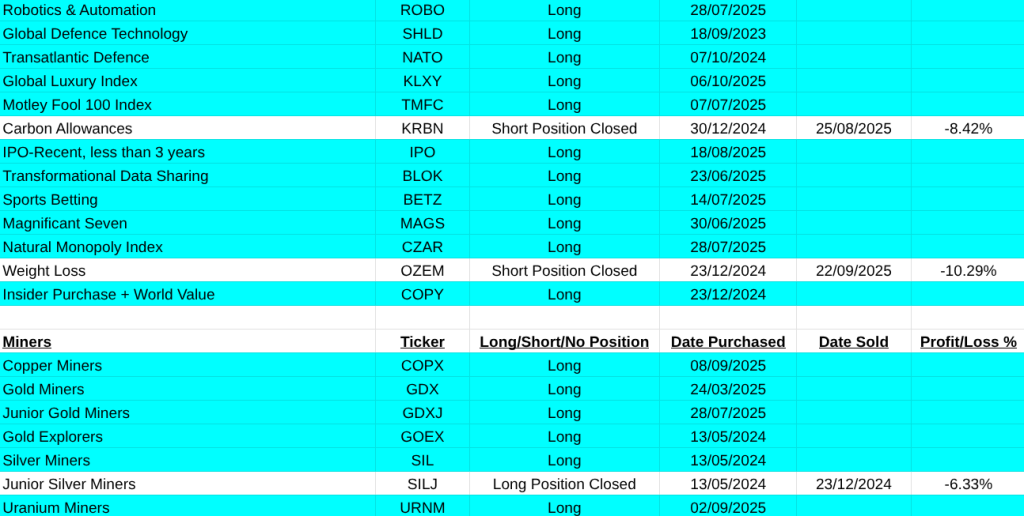

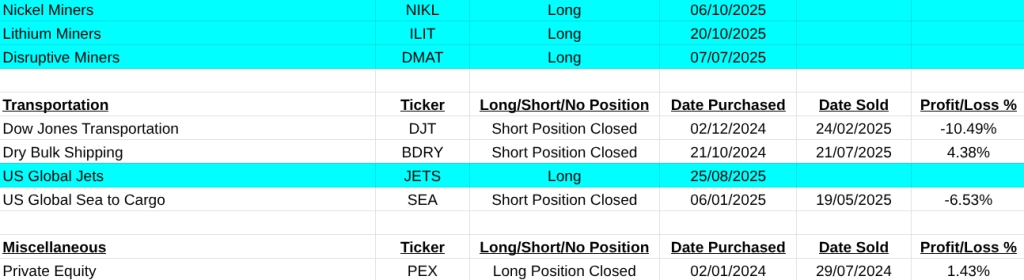

Lithium(ILIT) and Nickel Miners(NIKL) are now buys. This is interesting as the Lithium miners were a really bad investment over the last two years. Previously I had shouted them from October 2023 to July 2025 for a profit of 56%. So, it just goes to show that reading the papers during this period would have convinced you that lithium is booming. Well it was not but now its beginning to warm up.

Finally Global Luxury(KLXY) is coming back. THis index is mainly made up by French and Italian luxury houses.

On the MSCI World Cap trading the results were excellent with an overall gain of 135% over the last three weeks. The first week was slow with a loss of 17.25% then the following week jumped with a profit of 109.73% and last week with a profit of 43.28%. The largest profit was made up with a trade on a German company called ‘Munchener Ruckversicher Gesellschaft AG’,(MUV2:XETR) what a mouth full. Anyway it accounted for 99.81%. I enclose a full list of the trades below.

This week’s FOMC meeting on Wednesday should be interesting, all the best, regards, Pearse.

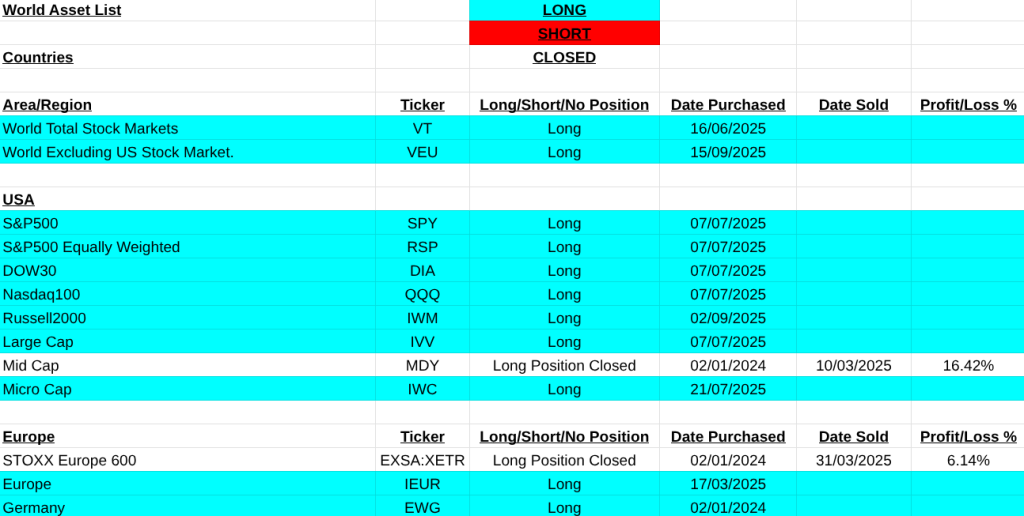

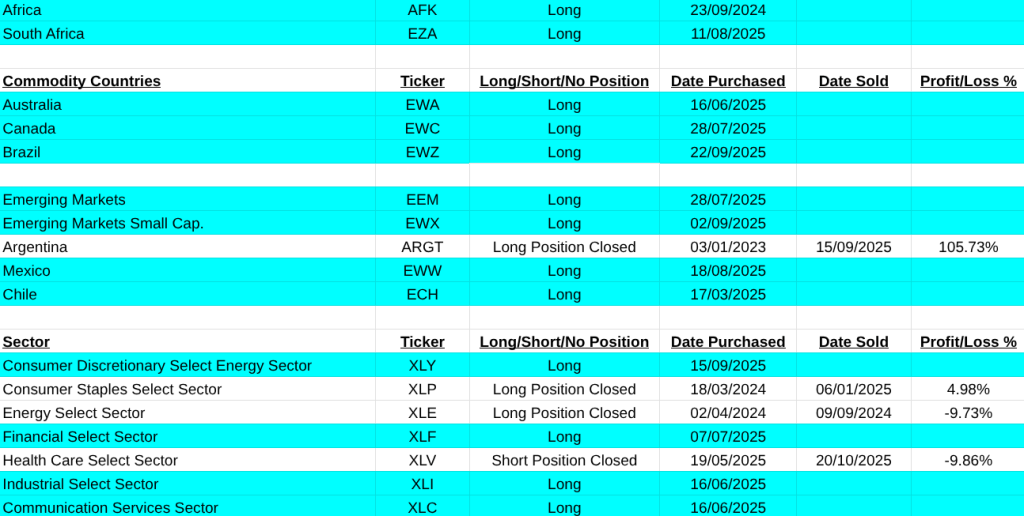

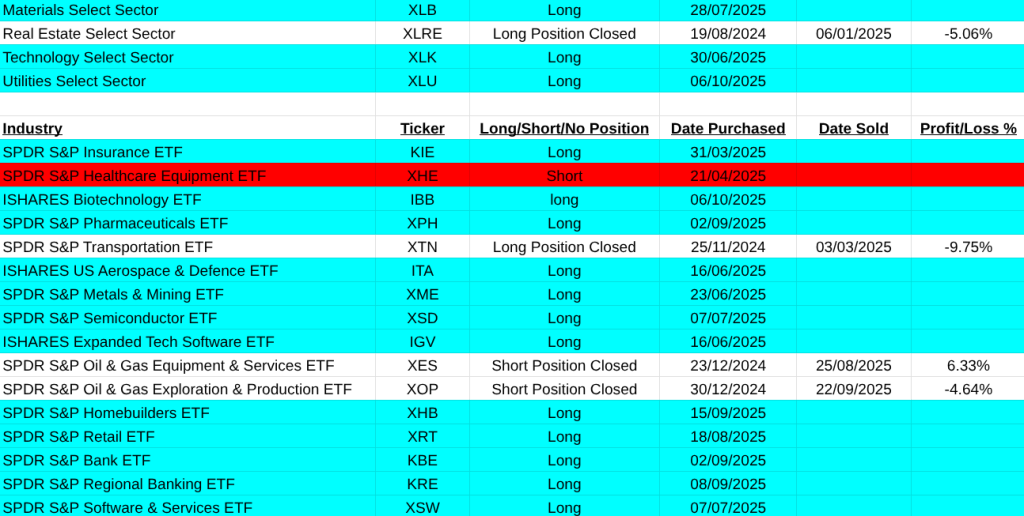

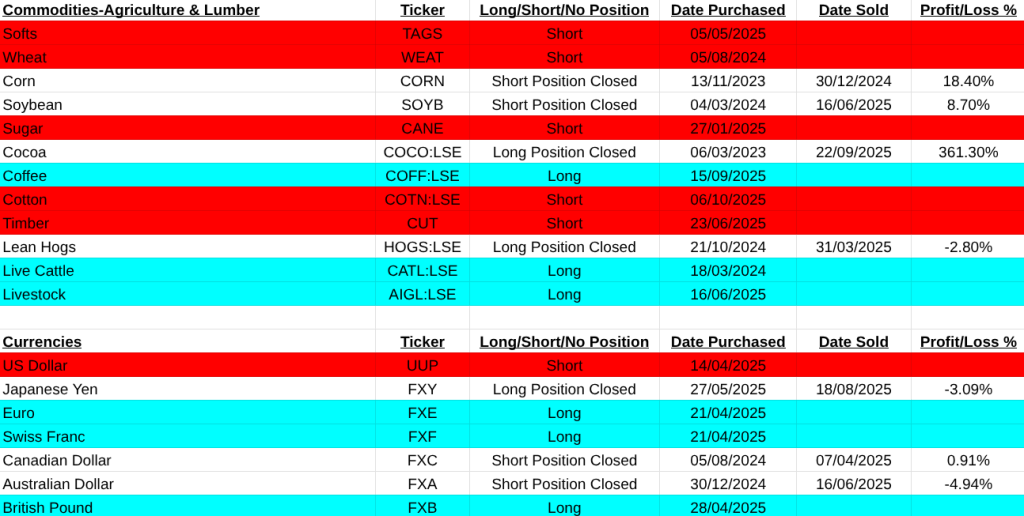

Note:The above trades do not take into consideration dividends on shares or coupons on bonds. This is important because if you short a stock or bond the dividend will be taken from you. Therefore the safest strategy is never to short any instrument only buy an upwardly trending security and simply close your position when this ends. These trades are my view on the market and not me advising you to take any of these positions. Closed positions have losses and profits listed in percentages. Mainly as a record to myself so I keep honest in evaluating my strategy.

The list of stocks analysed are from the MSCI Large Cap list as of 01/01/2025.

Good report – as much as I understand – and observations appear to have been verified 👍 – all the best.

LikeLiked by 1 person