Goldilocks and the Three Bears

As Stephen Hawkin’s put it, “Like Goldilocks, the development of intelligent life requires that planetary temperatures be ‘just right'”. Considering the meteoric increase of physical gold bullion that is also true.

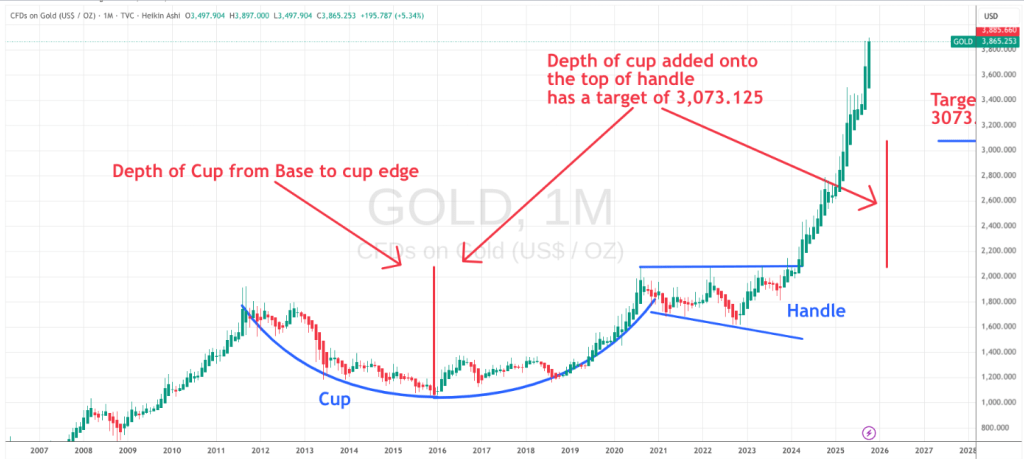

I look at a lot of charts and the one above is called a ‘Cup and Handle’ formation. You can see very clearly the cup and the handle in blue and then the depth of the cup in red added onto the base of the handle.

Nothing unusual here except that the price of gold has overtaken this target. I have data on gold going back to 1833 and although this pattern is very reliable especially on a monthly chart when it overshoots the target it may take years but the price tends to revert o the target.

So what would make this happen. First the largest fallacy out there that gold will protect you if there is a financial crash. It never has. You only have to look at what happened during the last financial crash in 2008.

What gold protects you from is inflation. The bull case for gold is overwhelming but there are two things that could end the party temporarily. A liquidity event where you have forced sale of assets and a significant strengthening of the US dollar. History hints that gold will retreat temporarily to about $3,000 and ounce. This would be the best thing to happen as it would set a solid base for another bull run.

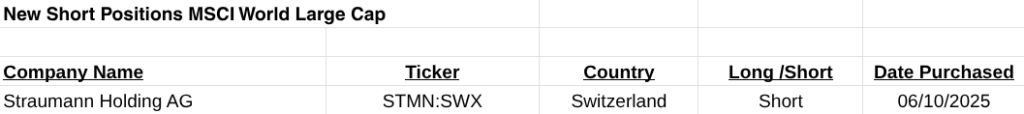

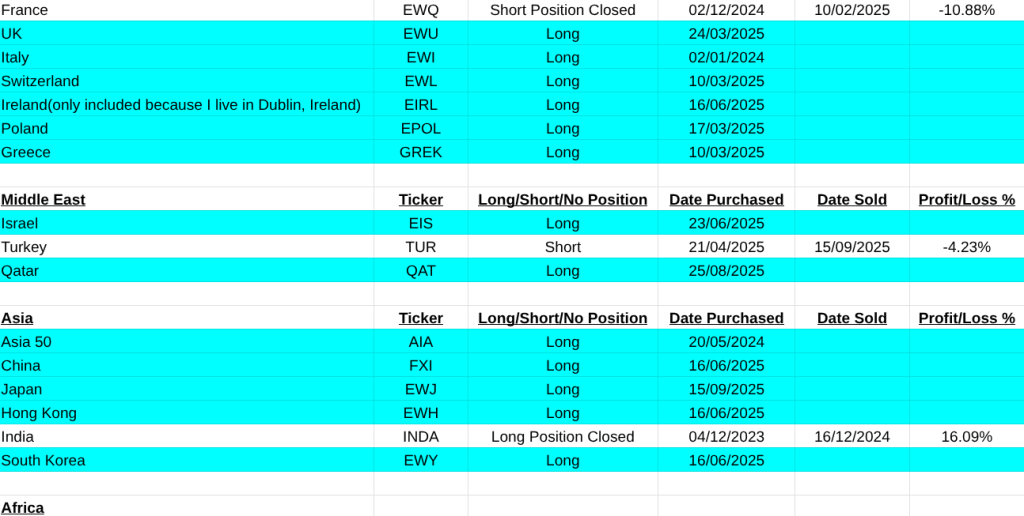

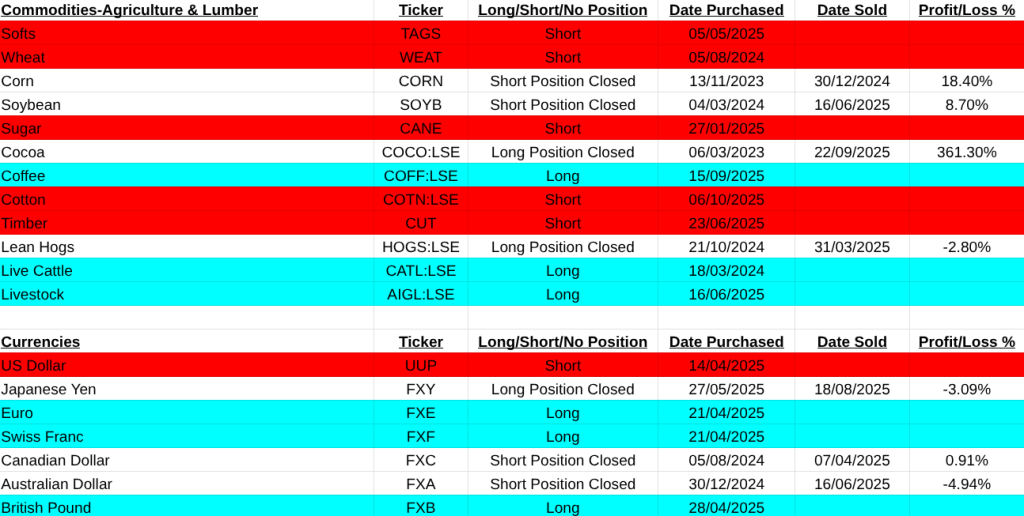

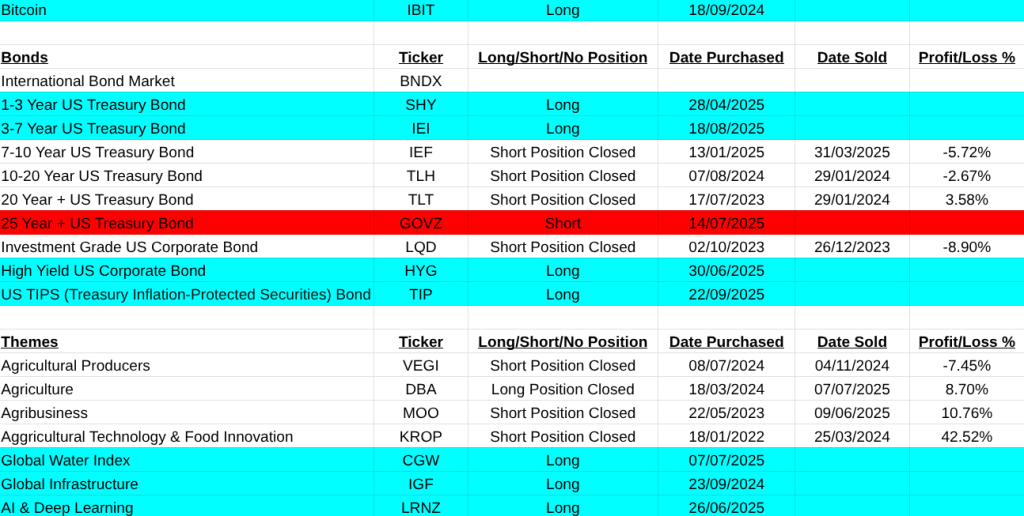

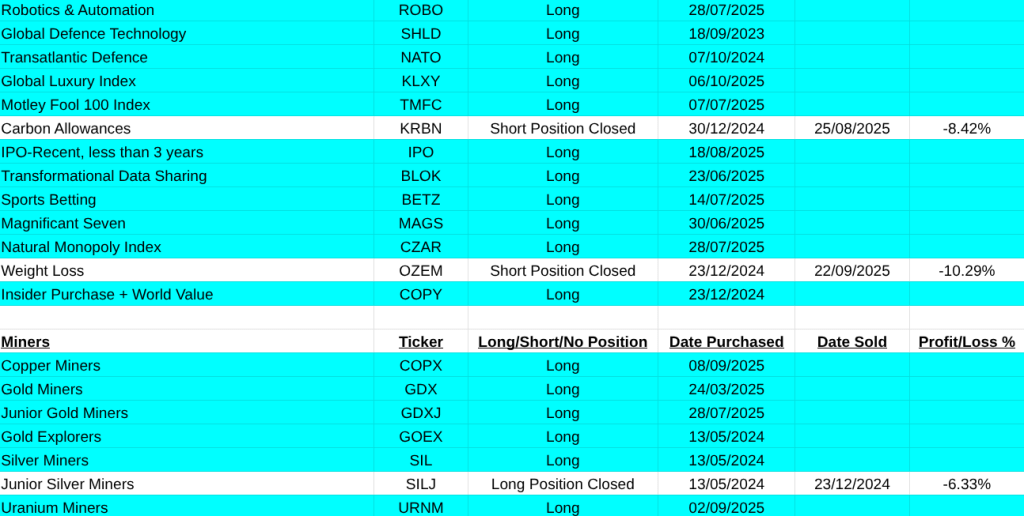

Over the last two weeks progress has been steady. On the World Asset List, Cocoa(COCO:LSE) was closed with an amazing profit of 361.3%. New positions opened in Biotechnology(BIIB), Medical Breakthroughs(SBIO), Luxury Index, Nickel Miners(NIKL), Aluminium(ALUM:LSE) and Cotton(COTN:LSE). Individual trades on the MSCI World Large Cap list of Shares was equally profitable. My best and worst trades were Philip Morris(58%), Progressive Corp(53%), Biogen(39.76%), Anglo American(-23%), Teck Resources(-23%). The full list with details are all listed below. All the best, regards, Pearse.

Note:The above trades do not take into consideration dividends on shares or coupons on bonds. This is important because if you short a stock or bond the dividend will be taken from you. Therefore the safest strategy is never to short any instrument only buy an upwardly trending security and simply close your position when this ends. These trades are my view on the market and not me advising you to take any of these positions. Closed positions have losses and profits listed in percentages. Mainly as a record to myself so I keep honest in evaluating my strategy.

The list of stocks analysed are from the MSCI Large Cap list as of 01/01/2025.