Two good weeks. I was a little nervous at the start but the gains well over took my losses. The mental stress in taking eight losses in a row to make a very large gain with two can have a very serious mental effect on your resolve.

After the decline in the S&P500 in March/April I saw a bullish ‘Inverse Head and Shoulders Pattern’ on the daily time frame chart. I usually use weekly charts as the patterns are much more clearer and slower to form. Depending on where you take the neckline this hints at a measured move up to 6,652.5 to 6,827.

I was never good at art, the pattern’s looks like a bulls head.

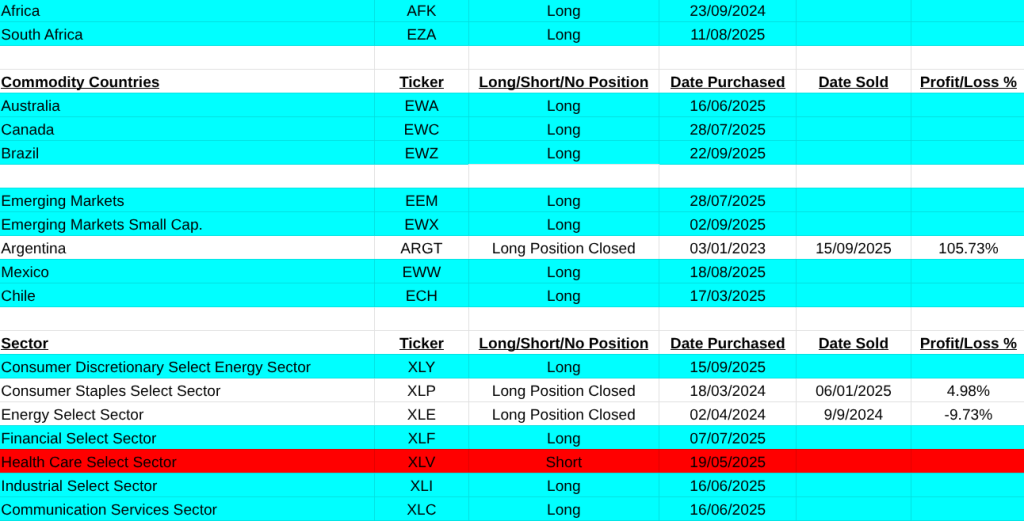

I was reading about Argentina and how president Javier Milei said he would boost pensions, education and healthcare which he previously blocked. His sister and chief of of staff are also caught in a corruption scandal. It was all too good to be true. At least there is a positive. Going through my list the Argentine ETF(ARGT) gave a close signal. The profit was 105.73%. Every cloud has a silver lining. The other closed country was Turkey(TUR) for a small loss of 4.23%.

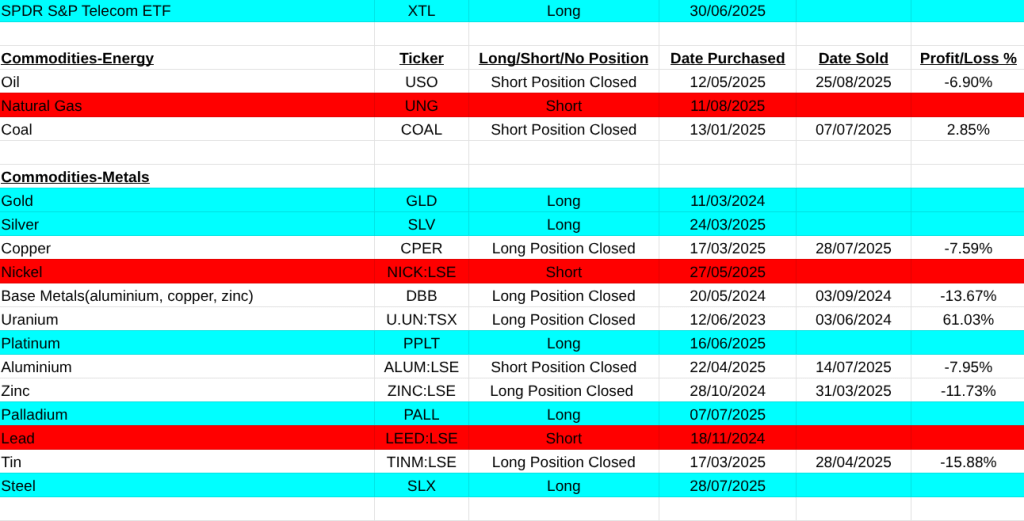

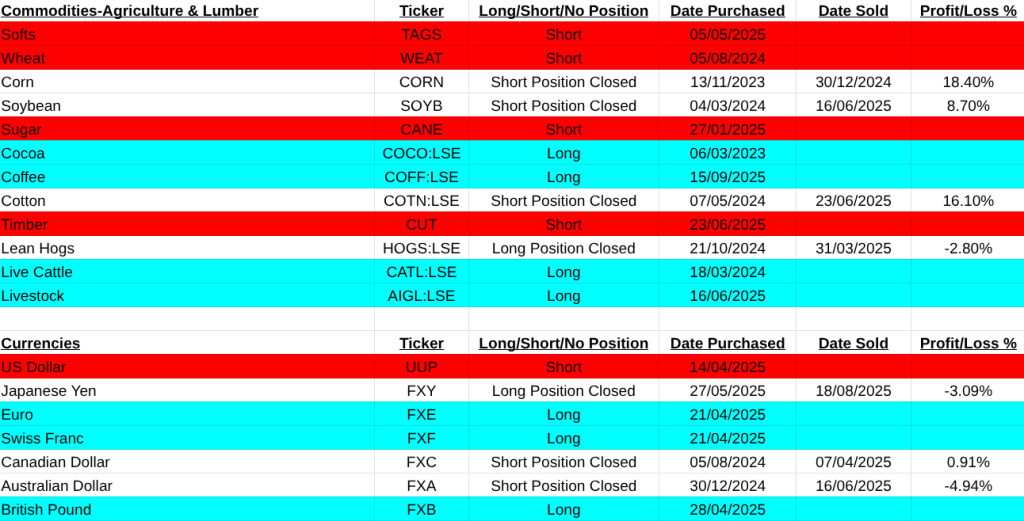

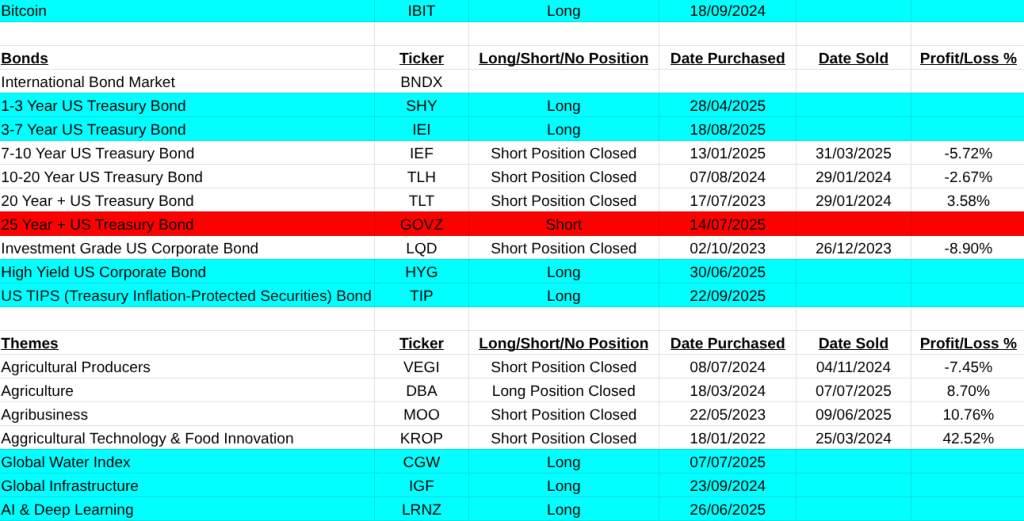

On the buy side new buys were Coffee(COFF), Life Extension/Aging ETF(AGNG), US Homebuilders(XHB), US Consumer Discretionary ETF(XLY), Clean Tech ETF(CTEC), Brazil ETF(EWZ), Japan ETF (EWJ), Hydrogen ETF(HYDR), US Treasury Inflation Protected Securities otherwise known as TIPS and All World Excluding USA ETF(VEU).

On the MSCI World Large Cap Shares my performance was positive but two weeks ago it was a little rocky. Best trade was Constellation Software of Canada(CSU:TSX +83.77%) and my worst trade was Kering of France(KER:PAR -39.06%).

I market (S&P500) looks great, too good in fact. Markets always look the best at the top. Its obvious. But in the back of my head I believe if it’s that obvious then it’s obviously wrong.

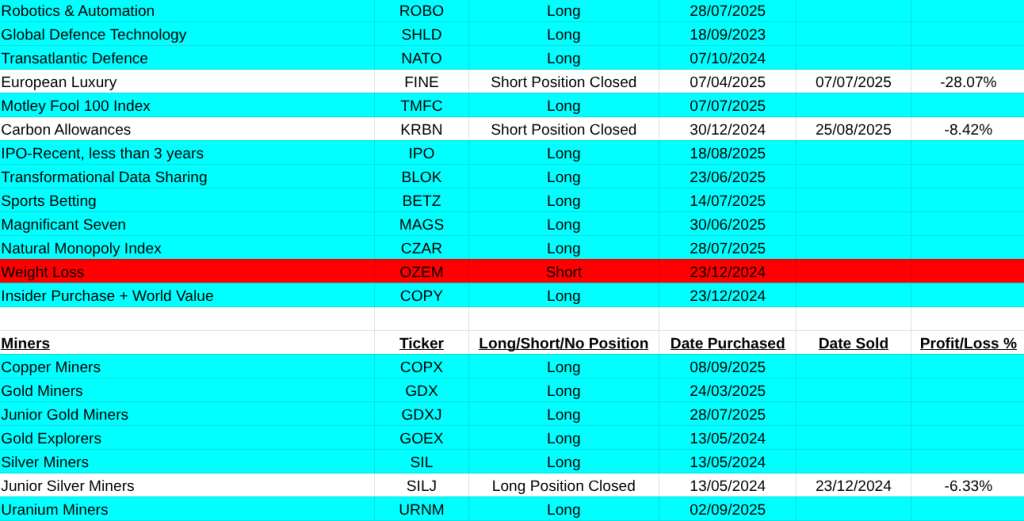

All my trades are listed below, all the best, Pearse.

Note:The above trades do not take into consideration dividends on shares or coupons on bonds. This is important because if you short a stock or bond the dividend will be taken from you. Therefore the safest strategy is never to short any instrument only buy an upwardly trending security and simply close your position when this ends. These trades are my view on the market and not me advising you to take any of these positions. Closed positions have losses and profits listed in percentages. Mainly as a record to myself so I keep honest in evaluating my strategy.

The list of stocks analysed are from the MSCI Large Cap list as of 01/01/2025.