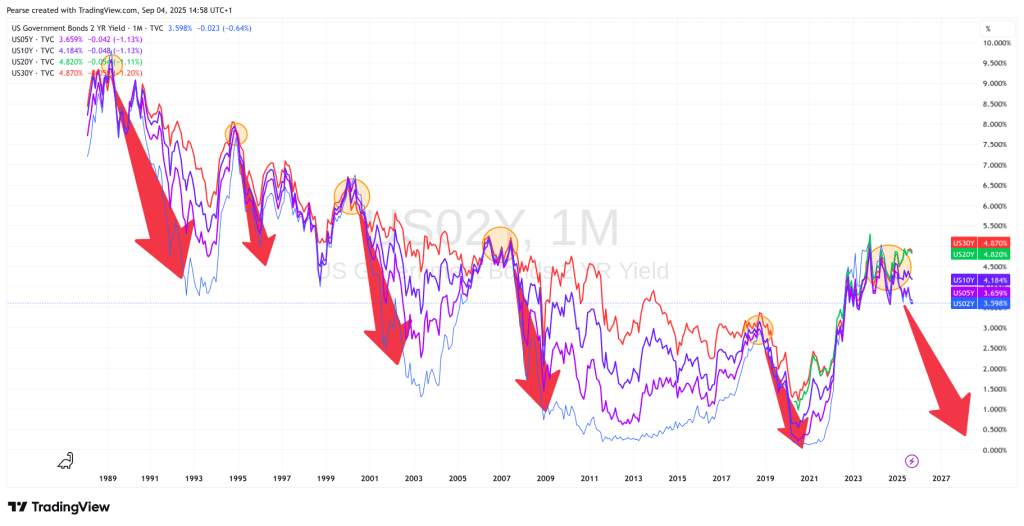

The Bond market is coming to bite!

With all the talk of bonds at the moment, I was looking to see the reality behind how it affects the stock market. One thing I learnt was that when the US Bond market inverts, ie. the 2 year yields more than the ten year. It seems to have very little effect at all.

However when they un-invert this has been a very accurate indication of a serious correction in the next few months. The last time this happened was in June 2007. The S&P500 reached its high then in October 2007 and then all the fun and games started. So lets say its a three to six months warning just like in the past. I only have data back to 1988 and this confirms it. Technically this did not happen before the Covid correction, but I have added it in anyway. The chart above is monthly and what makes it more extreme is that also the five and ten year are un-inverted, ie. Dropping below the 20 and 30 year bond yield.

This for me is a clear indication that something is afoot. The great thing about bonds are that it takes a while to filter into the stock market.

On my trading front its been a great two weeks, best trade Costco(COST +62.72%) and Republic Services(RSG +59.43%), worst trades were Carrier Global(CARR -21.21%) and Koninklijke Ahold Delhaize(AD:AMS -13.69%). Adding individual trades they bank a gain of 123.25%. All trades are below with details of date bought and sold. If you require exact details e-mail me and I will send on.

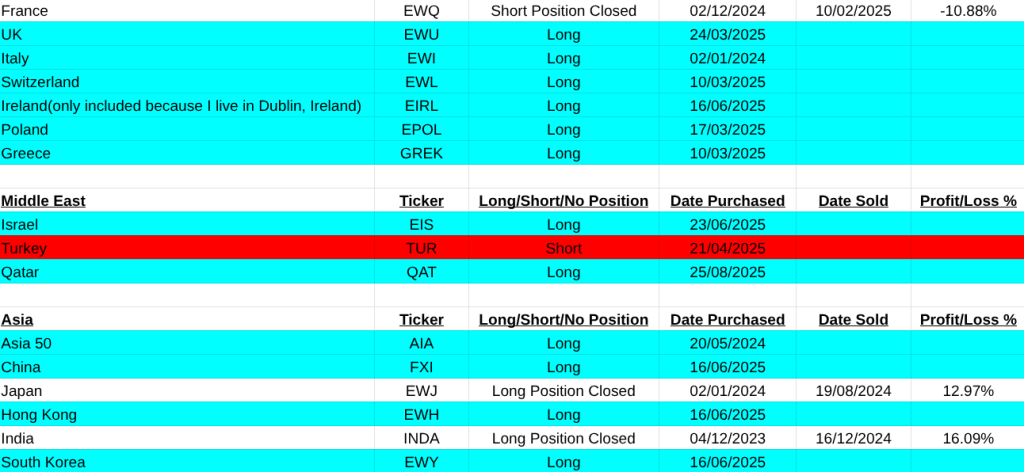

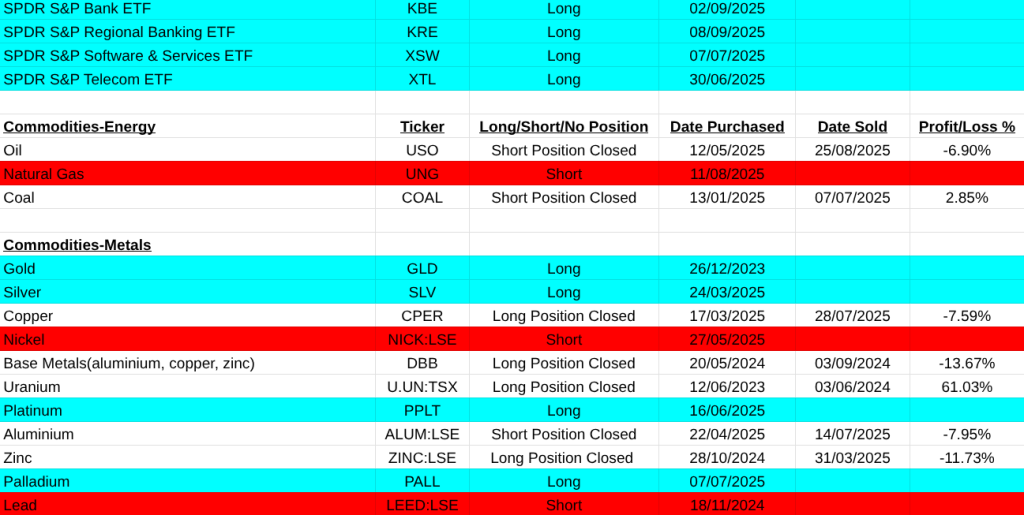

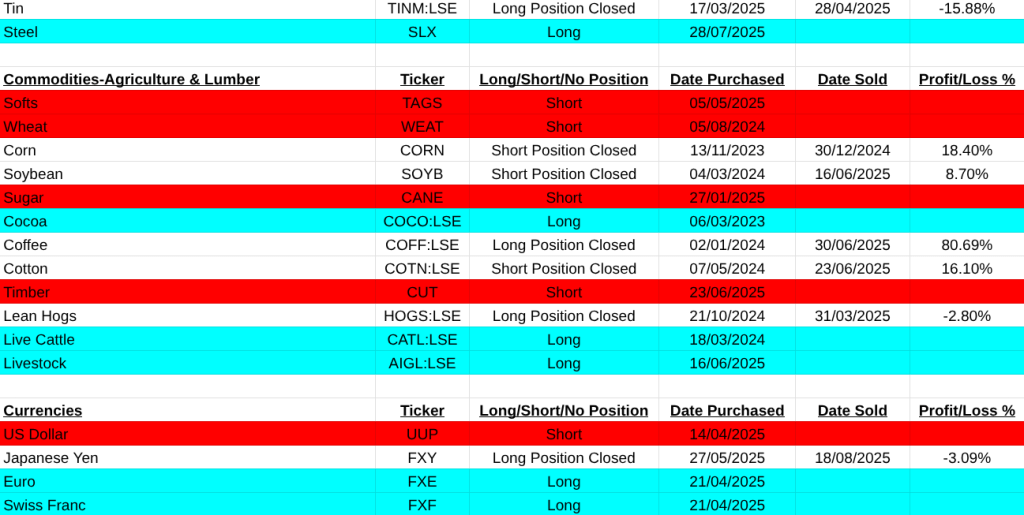

On the main asset list there were mainly buys, Emerging Markets Small Cap, Online Retail and the Russell 2000. Lithium, Nickel, Uranium and Copper Miners. Two sales in Global Carbon and Oil & Gas Equipment & Services.

All the best for the next few weeks, time to get the steel helmet and flak jacket out of storage, regards, Pearse.

Note:The above trades do not take into consideration dividends on shares or coupons on bonds. This is important because if you short a stock or bond the dividend will be taken from you. Therefore the safest strategy is never to short any instrument only buy an upwardly trending security and simply close your position when this ends. These trades are my view on the market and not me advising you to take any of these positions. Closed positions have losses and profits listed in percentages. Mainly as a record to myself so I keep honest in evaluating my strategy.

The list of stocks analysed are from the MSCI Large Cap list as of 01/01/2025.