Wow, what a week. Looks like US interest rates will drop by at least 0.25% at the FOMC’s next meeting on September 16. Seems like they are more worried about unemployment than inflation.

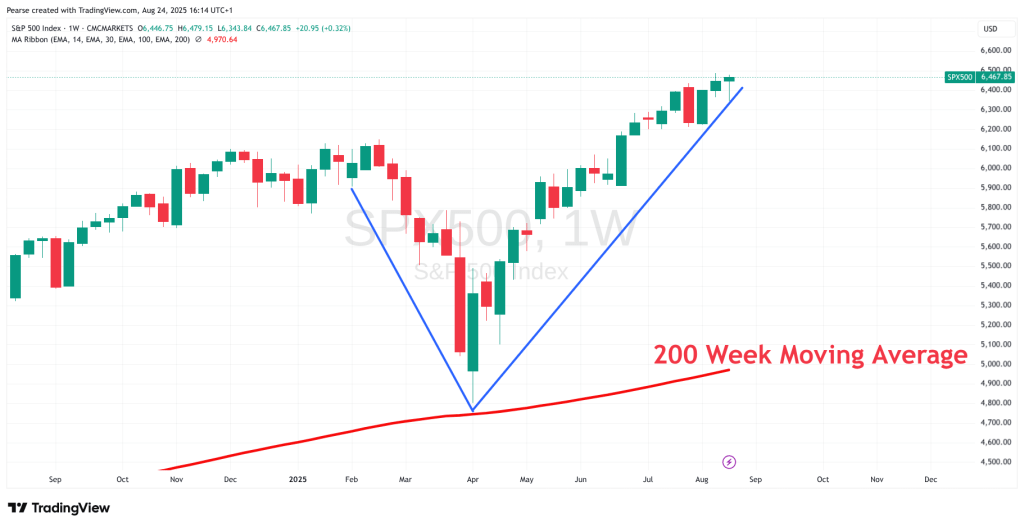

Taking a weekly time frame you can see a classical V correction since the start of April. Nearly touching the 200 weekly moving average and then rallying strongly. No need to watch the news, the price tells you all you need to know. Proper corrections usually start with a large drop, a half-hearted recovery and then a slow ebbing away of confidence.

Dow theory still works today. In 1922, over a hundred years ago William Hamilton talked about this in his book, “The Stock Market Barometer”. No need to watch Bloomberg, CBC Business or even pick up a paper.

It increasingly feels like the AI boom is like the railroad boom in the USA that started in 1827, until the ‘Panic of 1873’. Amazingly these companies never made profits but after the ‘Panic’ these companies were purchased for cents on the dollar, amalgamated and became cash machines.

To give you an idea of their change on society. The US in 1803 concluded the ‘Louisiana Purchase’ from France. This area now includes 15 US states and was nearly one third of present day mainland US. The government projected that it would take 300 years to settle this huge land area. Using railways it took 30 years. The railways were subsidised by the government and private debt

Sound familiar? AI today does not make money but it will in the future. Amazon and Google are funding approximately half the $3 Trillion required for AI infrastructure over the next three years. And never get a penny in returns, just like the railways of old. You will constantly hear of some new AI upgrade like say Chat GBT which is now in its fifth release. Or Sam Altman, believing that there is ‘huge potential’. But none of this makes a dime! Tech doesn’t run on dream’s but cold hard cash. They are laying the tracks at the moment but will they be around to profit from their trains?

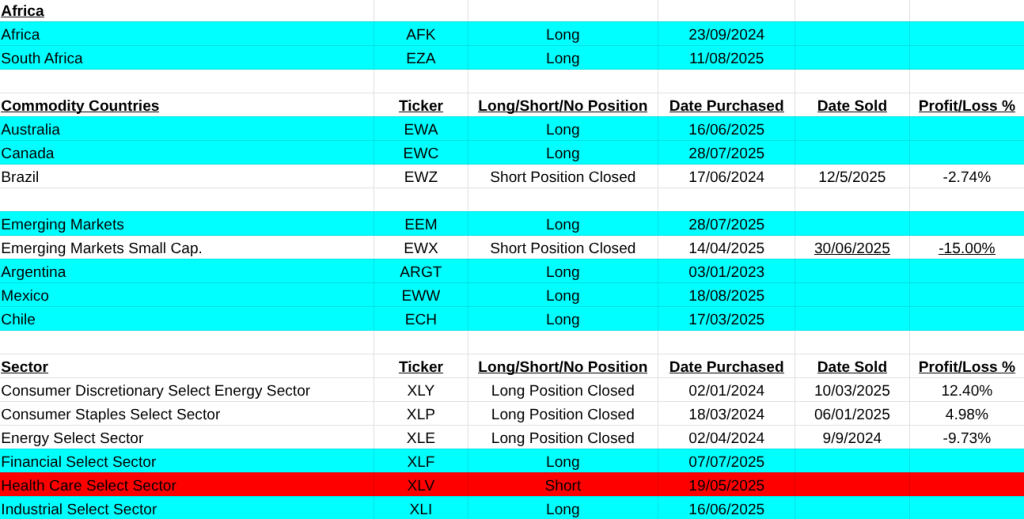

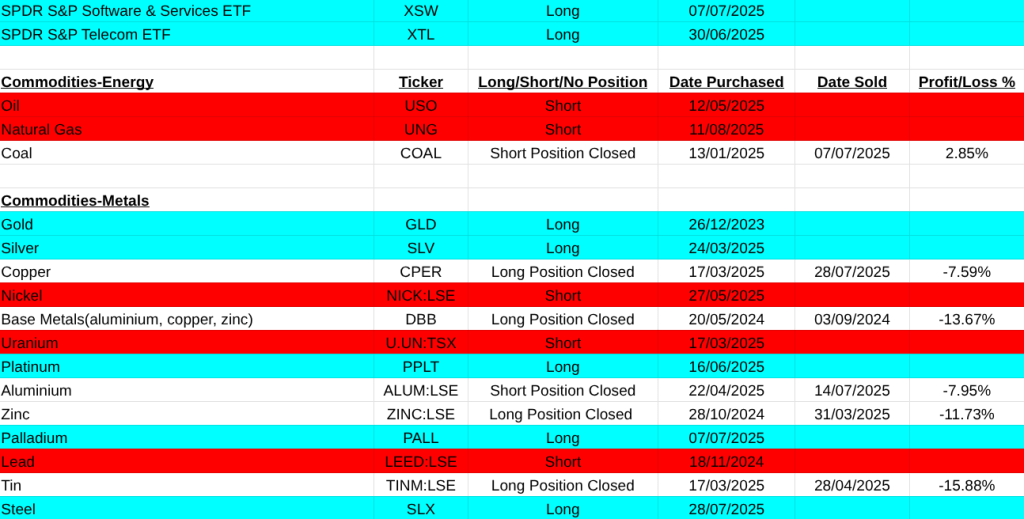

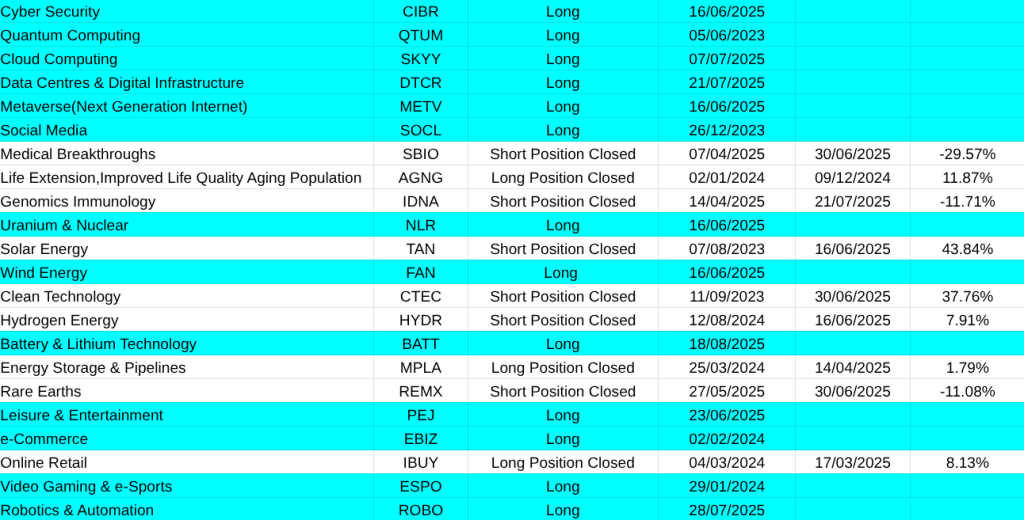

Changes on the main asset list are as you would expect, buys. Mainly, Mexico(EWW), Retail(XRT), Batteries(BATT), Rare Earths(REMX) and US Global Jets(JETS). On the currency front the haven currencies will continue to decline, namely the US dollar and the Japanese Yen.

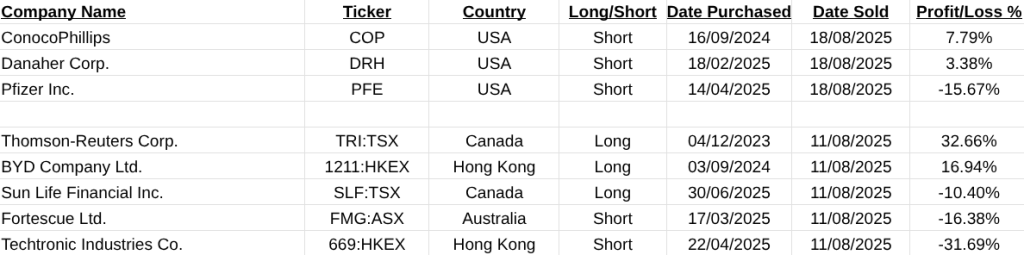

On the MSCI World Large Cap trading, it went well except for one trade. No matter how I analysed it to see where I went wrong I couldn’t find anything. I would still do the same thing again. No system is perfect. Anyway the trade was in Techtronic Industries(669:HKEX -31.69%) headquartered in Hong Kong.

My best trade was in Thompson Reuters(TRI:TSX 32.66%) a Canadian Company. My full list of closed trades are below with profits and losses and also my new positions, long and short.

The markets climb a wall of worry anyway, so turn off your pc and phone. Enjoy a good novel. You will probably learn more about the markets than listening to the drivel supplied free online,

enjoy the last of the summer, Pearse.

ps. You might wonder who the person’s picture on the blog is. It’s the fictitious character called Flashman from George MacDonald Fraser’s books by the same name. He had a saying which was “Lick up the honey stranger and ask no questions”.Reading the news and then acting on it puts you at a serious disadvantage. By the time you hear about a stock its already taken off months ago. Do yourself a favour and the next time you get a tip or recommendation on anything, check out the chart. No-one likes those that arrive late to a party, especially the market!

MSCI Large World Cap. Closed Trades

MSCI Large Cap Long Signals

MSCI Large Cap Short Signals

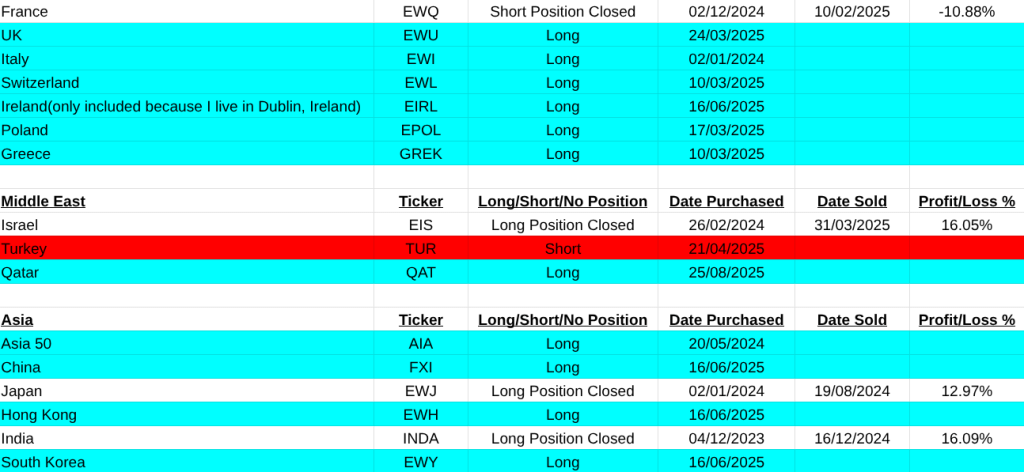

Main Asset List, Short positions are marked in red, long in blue, neutral in white.

Note:The above trades do not take into consideration dividends on shares or coupons on bonds. This is important because if you short a stock or bond the dividend will be taken from you. Therefore the safest strategy is never to short any instrument only buy an upwardly trending security and simply close your position when this ends. These trades are my view on the market and not me advising you to take any of these positions. Closed positions have losses and profits listed in percentages. Mainly as a record to myself so I keep honest in evaluating my strategy.

The list of stocks analysed are from the MSCI Large Cap list as of 01/01/2025.