“From Russia with Love” as James bond said. Lets see how much lovin there is this Friday in Alaska.

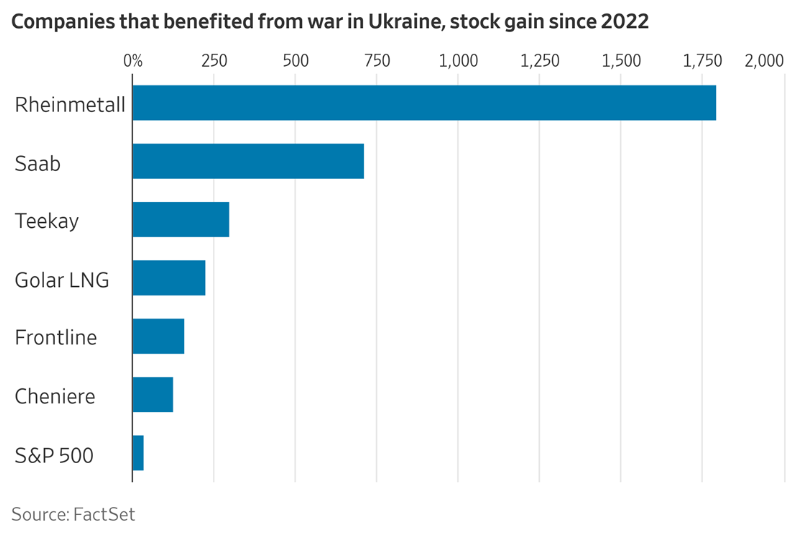

Trump said before his election that he would end the Ukraine war within 48 hours. The last time he dressed down Zelenskiy in the White House, the US dollar took a drumming. The war grinded on. Since then privately in Europe every government now knows that the Trump administration cannot be relied on. Germany relaxed borrowing limits and along with most European countries this caused an increase in defense spending. What I noticed was that US defence suppliers have gone nowhere. But in Europe the gains have been mouth watering. The increases below are in %.

Just as Europe is shifting away from buying US defense products I would be almost definite this would be the same for US debt. The US does not understand diplomacy but it certainly will notice its bond yields rising.

So who’s going to be the next Chairman of the FED, Bessant, Walker, Warsh or Hassett? It will be like a game show with king Trump as the compare. The contestants are lined up ready to suplicate and bow with answers reminiscent of Groucho Marx who said, “These are my principles and if you don’t like them I have others.”

The relaxation of crypto guidelines by US banks under Bessant’s influence will be great for Wall Street. Now they can sell an unlimited supply of nothing. If you find your bank is dabbling in crypto, close your account!

Enough of my opinions, lets get down to business.

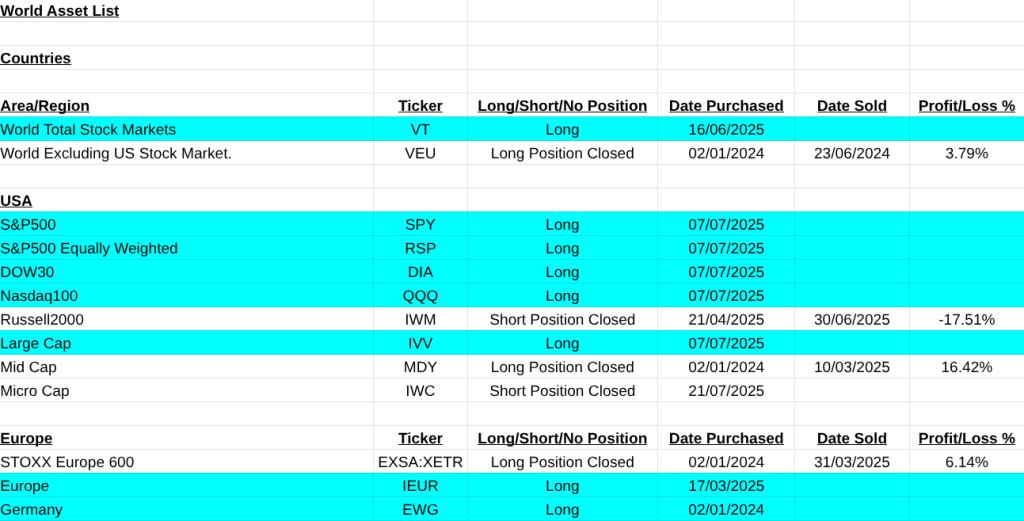

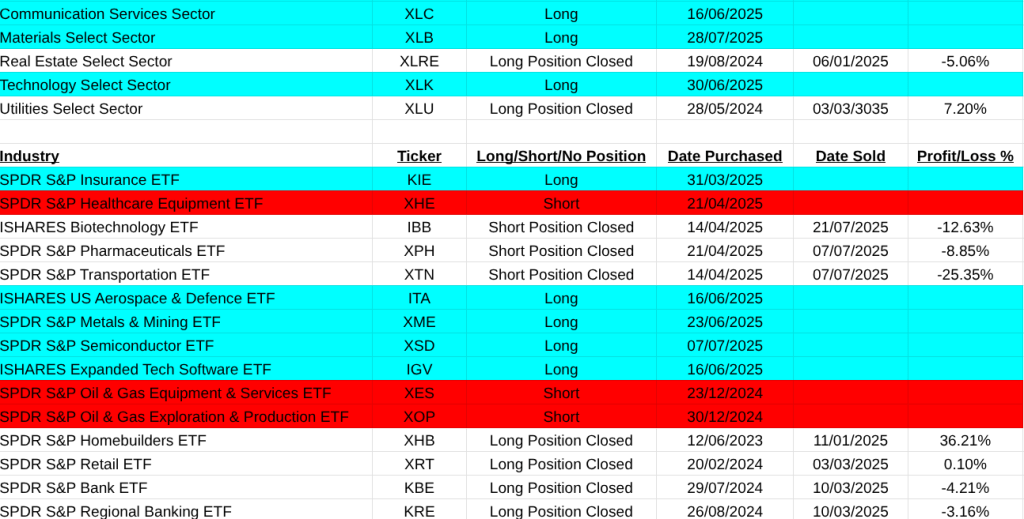

On the main asset list there are only two changes, South Africa(EZA) is now a buy and US Natural Gas(UNG) a short. The tariffs have not changed much so far.

On the MSCI World Large Cap Stocks, were back in business again. Best trades were Oriental Land Co.(4661:TSE +27.45%), Berkshire Hathaway(BRK.B +19.92%) and Occidental Petroleum(OXY +29.39%). worst trades were Vertex Pharmaceuticals(VRTX -11.32%), Chugai Pharmaceuticals(4519:TSE -13.45%) and Fanuc Corp(6954:TSE -12.00%). Overall up 39.83%.

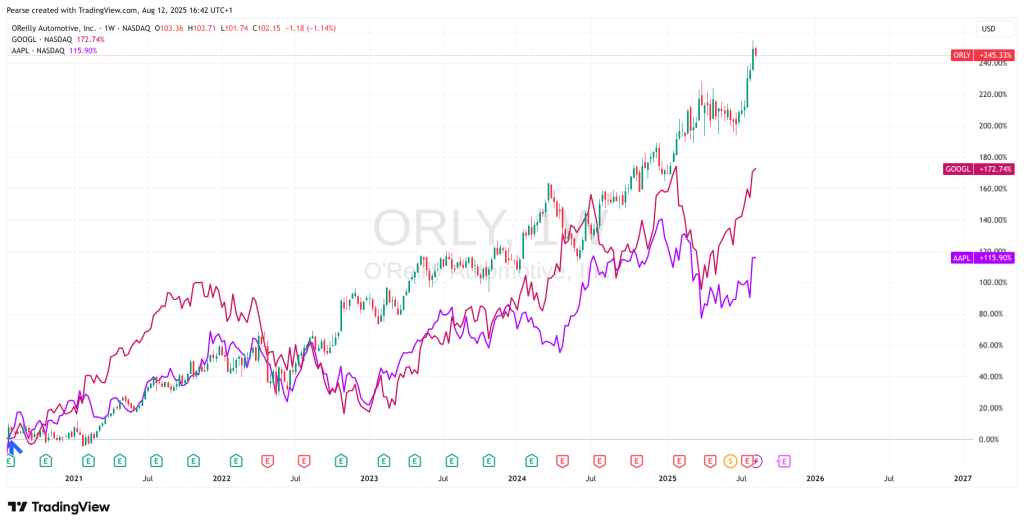

Regarding stocks we always hear about the MAG7 stocks, like Apple and Google. Well I was happy to see that one of my recommendations from August 2020 has blown a lot of them away, not them all. And its a boring car company that sells automotive parts through dealers. Its called O’Reilly Automotive. Since its buy signal is now up 245%. Compare this to Apple at 115% and Google at 172%. Slow and steady. The kind of company that Warren Buffet would like. Its chart is below.

On the list of companies that are now buys two of them are Japanese Train Companies, so something is happening there. I was surprised to see that Barrick Mining has now only become a buy. I thought it would have happened sooner as its the worlds largest gold miner?

Anyway, I hope your all enjoying your summer where ever you are, regards, Pearse.

ps. You might wonder who the person’s picture on the blog is. It’s the fictitious character called Flashman from George MacDonald Fraser’s books by the same name. He had a saying which was “Lick up the honey stranger and ask no questions”.Reading the news and then acting on it puts you at a serious disadvantage. By the time you hear about a stock its already taken off months ago. Do yourself a favour and the next time you get a tip or recommendation on anything, check out the chart. No-one likes those that arrive late to a party, especially the market!

MSCI Large World Cap. Closed Trades

MSCI Large Cap Long Signals

MSCI Large Cap Short Signals

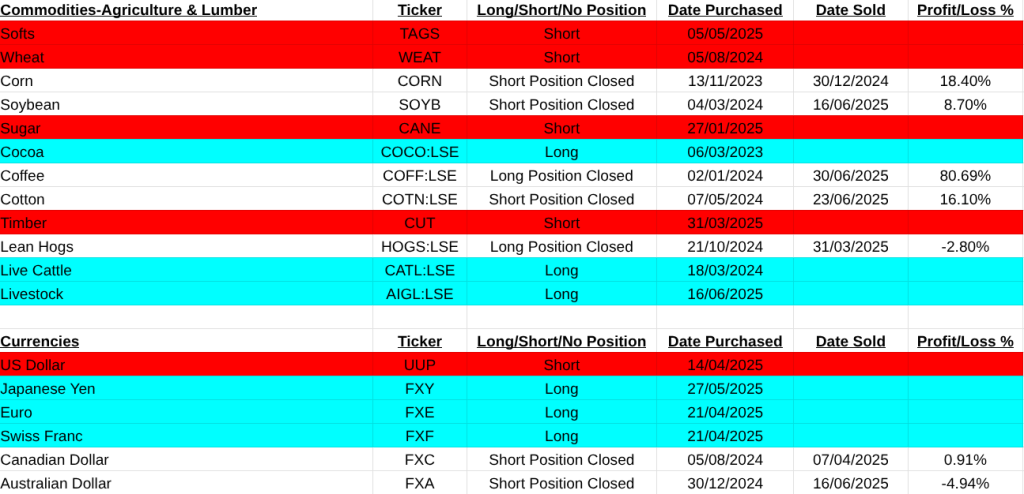

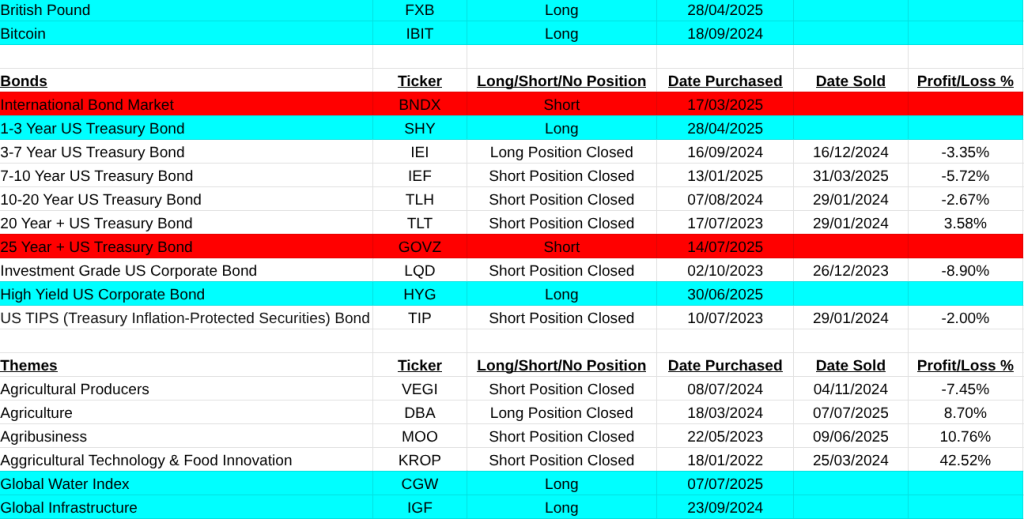

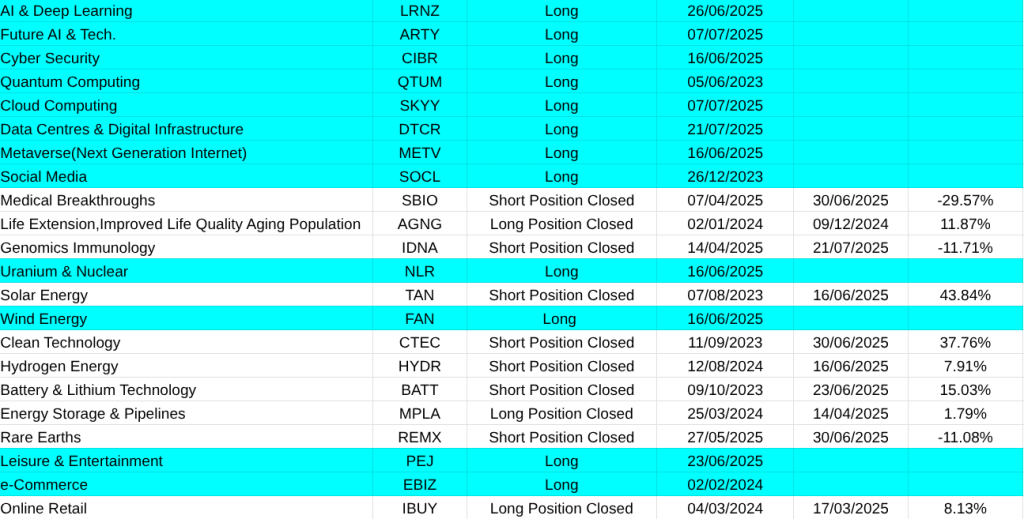

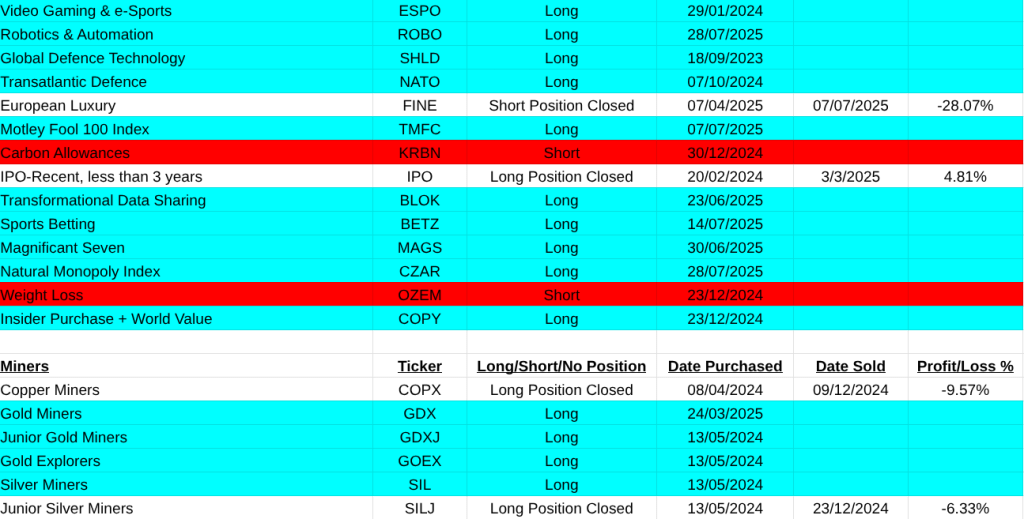

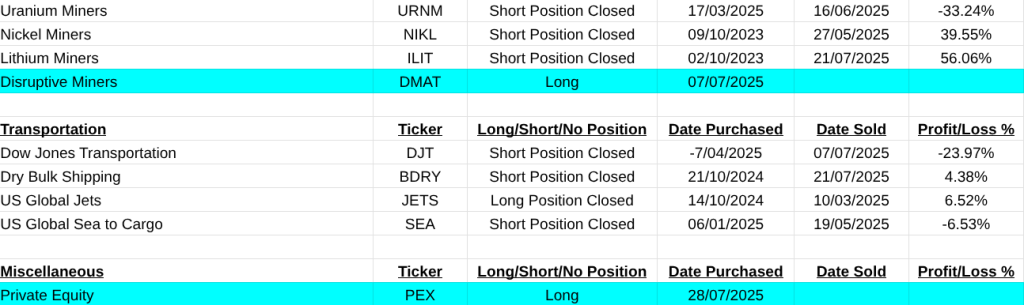

Main Asset List, Short positions are marked in red, long in blue, neutral in white.

Note:The above trades do not take into consideration dividends on shares or coupons on bonds. This is important because if you short a stock or bond the dividend will be taken from you. Therefore the safest strategy is never to short any instrument only buy an upwardly trending security and simply close your position when this ends. These trades are my view on the market and not me advising you to take any of these positions. Closed positions have losses and profits listed in percentages. Mainly as a record to myself so I keep honest in evaluating my strategy.

The list of stocks analysed are from the MSCI Large Cap list as of 01/01/2025.