Hi all, I learnt a very good lesson recently. My pension has done well over the last few years and I decided to look for safety as I was nervous of the markets reaction to Trump.

I looked back to 2008 and noted that only two assets performed in this bear market. Short term US 1-3 year bonds and cash. Before you say gold, it dropped in 2008 from March 2008 to October 2008 by nearly 29%.

Gold took off when the US started QE.

Imagine the shock I got when I looked at my account and saw that it was down by over 8%. The bonds had gone up in value but are priced in US dollars and that was the reason as the $ had dropped against the Euro.

Usually when there is a shock to the system like say Trumps tariffs there is a move to safety and that’s usually the US dollar and the Japanese Yen in Asia.

But this time it was different. It got me thinking that money was looking for a safer home. I believe this is why European assets have done so well. What about Asia? For decades Asia’s powerhouses had a simple formula. Sell goods to the US and then invest in US assets. Even in little Ireland when someone invests in the market they mean the S&P500 not the Irish ISEQ20. This is changing. I think an unwind is developing.

The best example of this is Taiwan. After Trumps tariffs Taiwanese insurers lost $620 million alone in April. Then the Taiwan dollar surged by 8.5%. This compounded their losses as they were unhedged against the US dollar and have their legs open for an estimated $18 billion in un-hedged US investments.

Now that’s what I call government bailout territory. I suspect the larger Japanese, Australian and Chinese life insurance companies are moving out of the US bond market after significant losses. Remember these are the smart guys and they were totally caught off guard. I don’t feel so bad to be in such company.

The usage of the US dollar, the worlds reserve currency as a weapon in sanctions and the US getting stripped of its top credit rating on May 16th are making countries think that the US dollar and assets might not be as safe as once thought. Coupled with Trumps push to reduce taxes and increase the US debt further looks like madness that only a special kind of fool can rationalise.

So whats the outcome and who will be the big winners. Hoarding cash at the start, then turning $2.5 Trillion away from the US to Europe and Japan, then emerging markets, Canada and Australia. Their local currencies will increase against the US dollar. Countries are rewiring their traditional purchases of US assets. Do you think Canada and Denmark are buying US debt this year? Fund managers are re-balancing their portfolios away from the US.

Take China, last year China sold $172 Billion of US bonds and equities. I’d say that’s just a start.

The US is going from a safe haven to a source of volatility. Trumps policies are accelerating capital flight.

So what did I do with my pension, I put it into short dated European bonds denominated in Euros.

The lecture is over so lets get down to business.

Not many changes over the last few weeks. The main ‘World Asset List’ only has a few changes

Ireland short(EIRL -11.47%), China Large Cap long(FXI +7.13) and Agri-Business short(MOO +10.76%), so overall up +6.42%.

Livestock lead the way along with precious metals. I noted a breakout with Palladium.

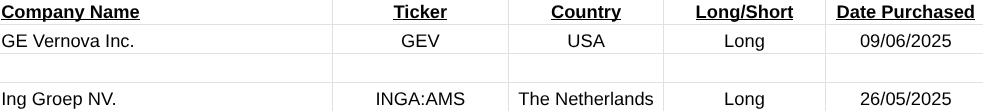

On the MCSI Large Cap World I’m up 289%. My best trade was a long on Boston Scientific(BSX +118.46%) and my worst was with Panasonic Holdings Corp.(6752:TSE -6.54%). Everything seems back on track. All trades are below,

MSCI Large World Cap. Closed Trades, Cumulative Gain in the last two weeks= +289%.

MSCI World Large Cap Long Signals

MSCI Large Cap Short Signals

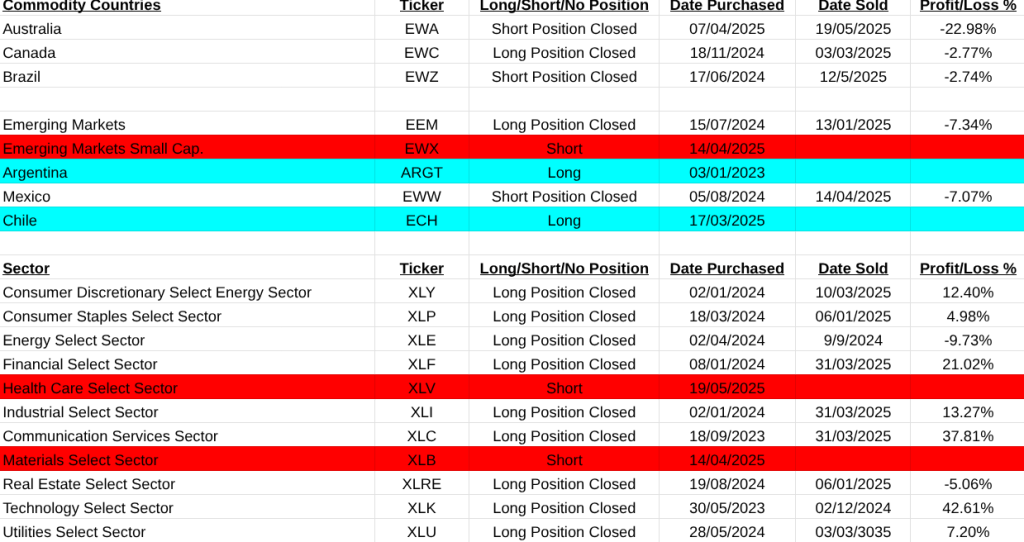

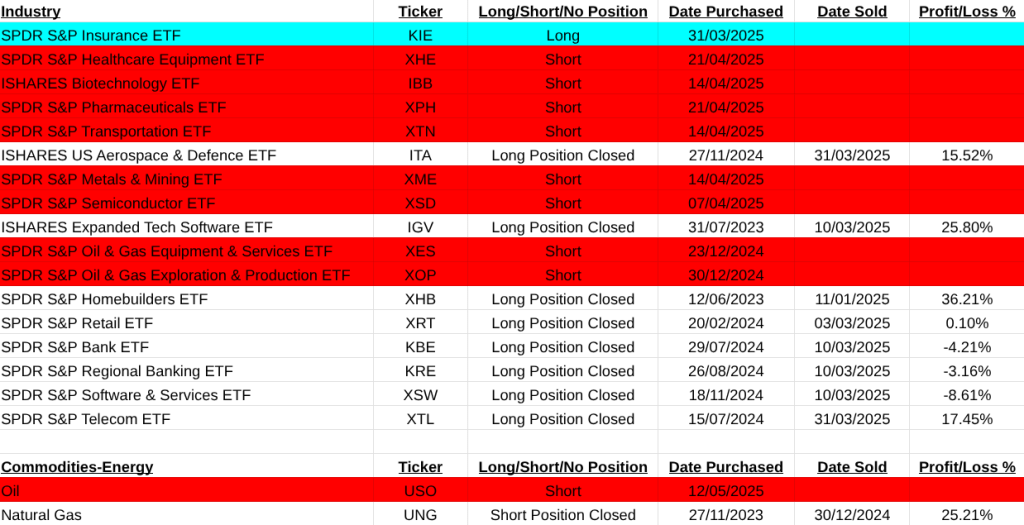

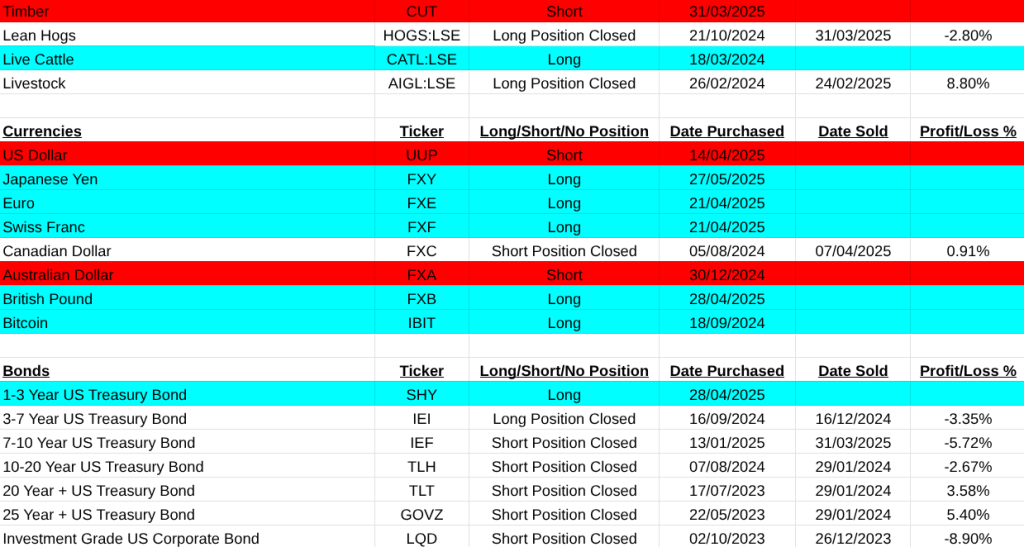

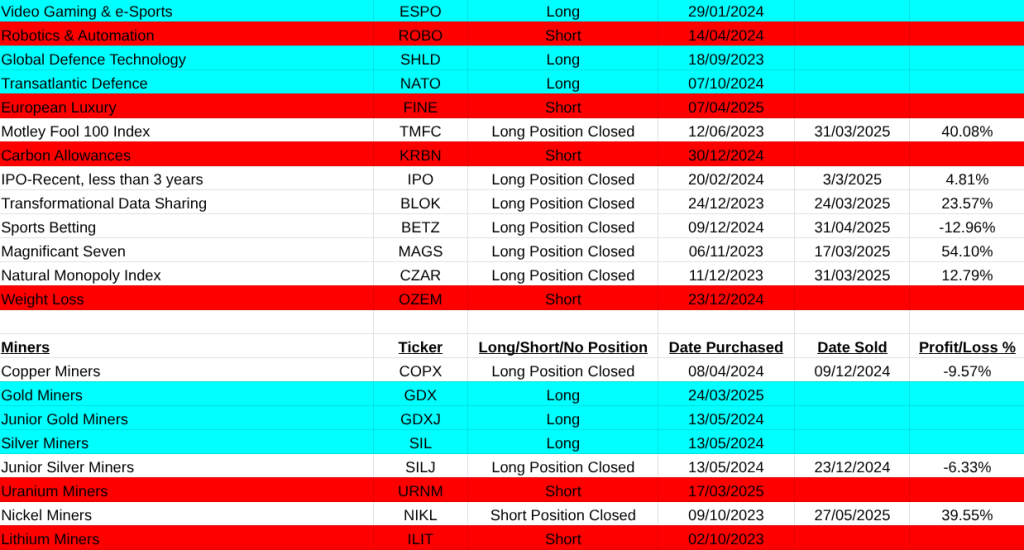

Main Asset ETF List. Short positions are marked in red, long in blue, neutral in white.

Note:The above trades do not take into consideration dividends on shares or coupons on bonds. This is important because if you short a stock or bond the dividend will be taken from you. Therefore the safest strategy is never to short any instrument only buy an upwardly trending security and simply close your position when this ends. These trades are my view on the market and not me advising you to take any of these positions. Closed positions have losses and profits listed in percentages. Mainly as a record to myself so I keep honest in evaluating my strategy.

The list of stocks analysed are from the MSCI Large Cap list as of 01/01/2025.