Hi all, the last two weeks saw the S&P500 really rally. I’m not fully convinced as I said in a previous post that this will last. It’s playing havoc with some of my trades as I initiated some trades on this dip.

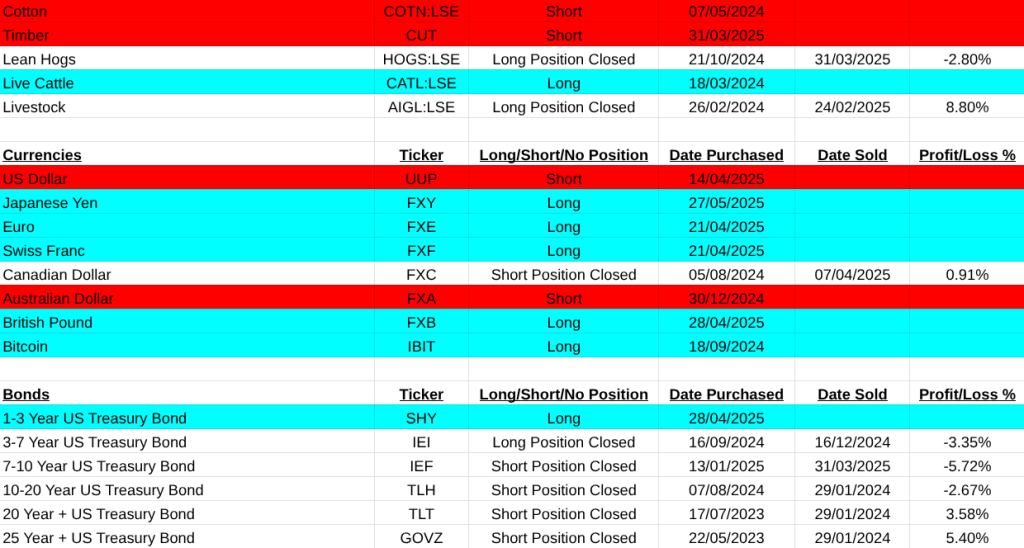

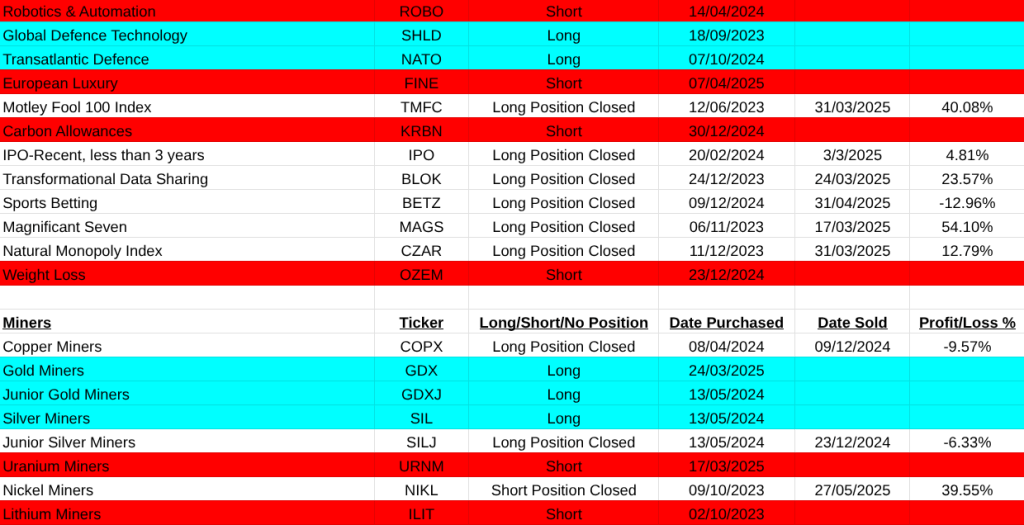

I have a system so I must stick with it and events like this will produce losses when you are a trend follower. On the main asset list shorts on countries South Korea(EWY:NYSE -3.01%), Australia(EWA:NYSE -22.98%) and Brazil(EWZ:NYSE -2.74%) were closed. In the themes list Wind Energy(FAN:NYSE -12.54%), Sea to Sky Cargo(SEA:NYSE -6.53%) were closed.

What really saved me was a long term short on the Nickel Miners(NIKL:NYSE +39.55%).

So overall this was only a loss of 8.25%.

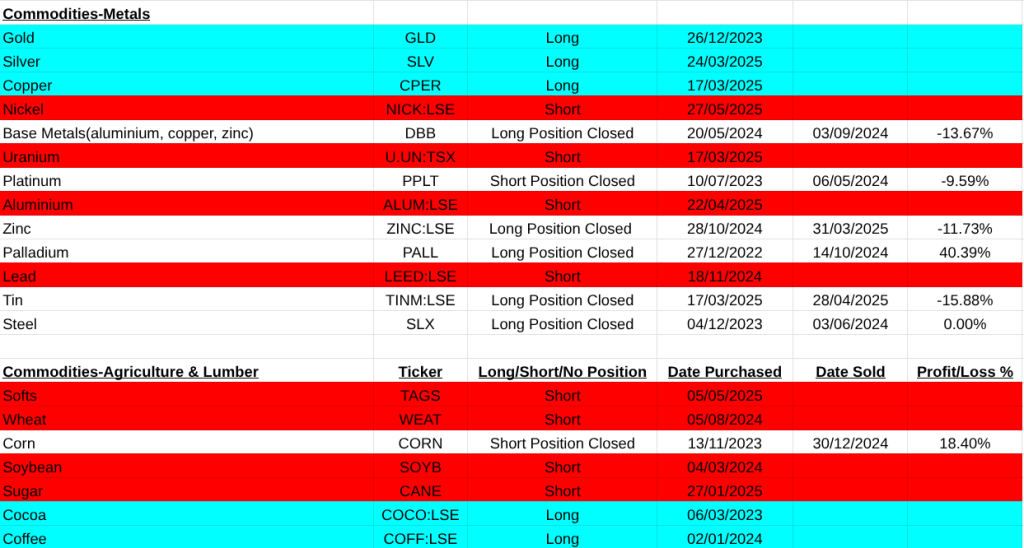

New short positions initiated on the Health Care Sector(XLV:NYSE), Nickel(NICK:LSE), and very surprisingly Rare Earths(REMX:NYSE).

Regarding currencies the Japanese Yen is now a buy(FXY:NYSE). The US dollar continues to weaken, especially against the Euro.

On the World MSCI World list the performance was similiar with an overall loss of 8.68%. My best trade was Deutsche Telekom(+44.10%) and my worst was a short on Walt Disney(-31.11%). All the details are below.

The instability caused by Trumps tariff threats are showing a clear way of how to deal with him. After China acted strong, Trump backed down. Making India wonder what it was getting by capitulating.

Trump Always Chickens Out(TACO). Markets crave certainty and now as they see a bully backing down when he is confronted, the market feels that we will be all getting back to business as normal. I think not. The next cold wind starting to blow will be inflation which is getting ready to come back with vengeance!

Enjoy your summer and if you have any ideas of how I can improve this newsletter please send me a note, regards, Pearse.

MSCI Large World Cap. Closed Trades, Cumulative Gain in the last two weeks= -8.62%

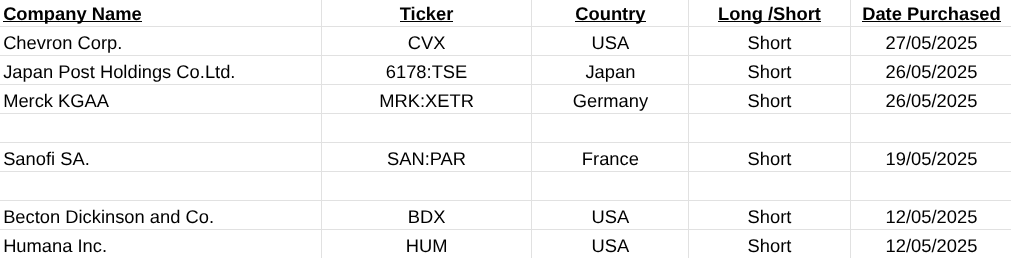

MSCI Large Cap Short Signals

MSCI World Large Cap Long Signals

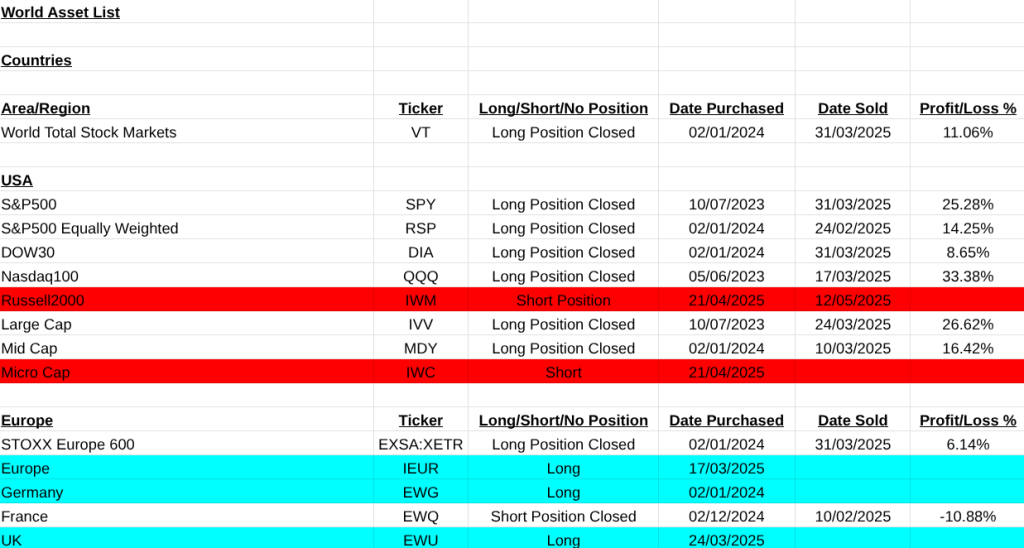

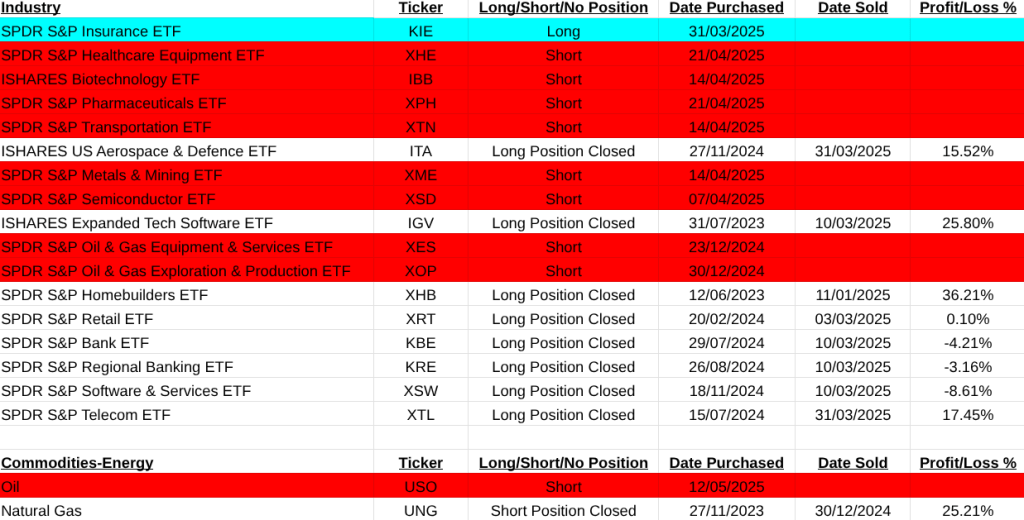

Main Asset ETF List. Short positions are marked in red, long in blue, neutral in white.

Note:The above trades do not take into consideration dividends on shares or coupons on bonds. This is important because if you short a stock or bond the dividend will be taken from you. Therefore the safest strategy is never to short any instrument only buy an upwardly trending security and simply close your position when this ends. These trades are my view on the market and not me advising you to take any of these positions. Closed positions have losses and profits listed in percentages. Mainly as a record to myself so I keep honest in evaluating my strategy.

The list of stocks analysed are from the MSCI Large Cap list as of 01/01/2025.