Hi all not much action last week. It gave me time to look at the bigger picture.

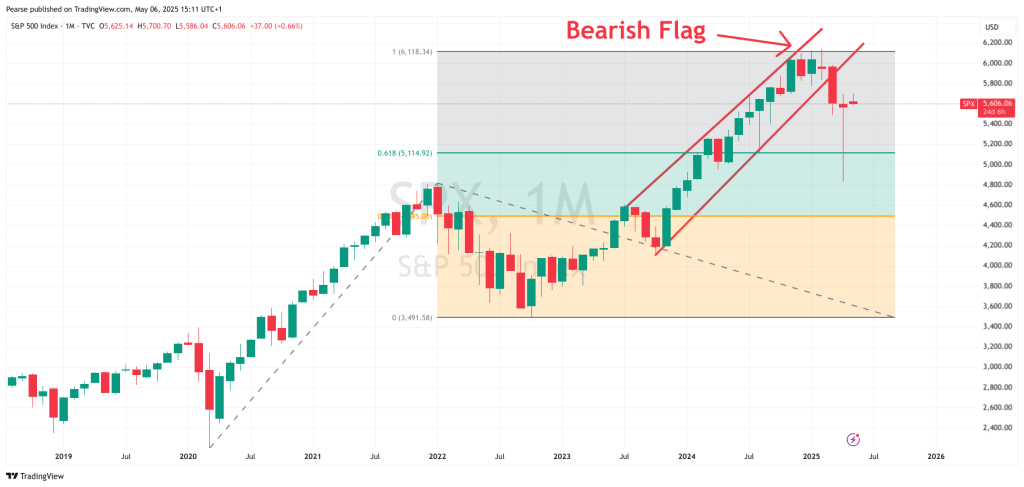

Looking at the monthly time frame on the S&P500 indice. There is a very clear bearish flag formation that broke down in March and we all know why. Anyway, whats interesting about is that if you overlay a Fibonacci projection using the clear low Covid low March 2020 and the clear high of January 2022 it projects to a high of 6,118.34 which is very close to the all time high of the S&P500 in February this year. The chart is below.

Now look at the daily time frame and you will see a bearish rising wedge. That hints to me that the rally that is taking place at the moment will not hold. Also notice the cloud which the price is below. I use a trend following method called Ichi-Moku to analyse potential future moves. This is also bearish.

My conclusion is that this rally will not hold and a second move downwards is imminent.

A lot will depend on this weeks FOMC meeting on Wednesday. I don’t see them budging as the employment figures for the US were good. Also the yield on the one and three year US bonds are increasing. All of these will blow a hard wind against the stock market. But who knows.

My trading last week was subdued. On the main asset list my long position in Tin was closed for a loss(TINM:LSE -15.88%). A short position was opened on Agricultural Softs(TAGS).

On the MSCI World list only three trades, a long on Anheuser-Busch Inbev(BUD). Closed were L’Oreal(OR:PAR +3.57%) and a large loss on Cellnex Telecom(CLNX:MAD -21.74%).

After my recent large gains I cannot complain. All trades below.

My advice is to get out of the market totally while you can. Usually the second leg down is the most destructive and I believe we are just about to experience one.

Have a good week and enjoy the sunshine, best wishes, Pearse.

MSCI Large World Cap. Closed Trades, Cumulative Gain in the last two weeks= -18.17%.

MSCI World Large Cap Long Signals

MSCI Large Cap Short Signals

No short signals this week.

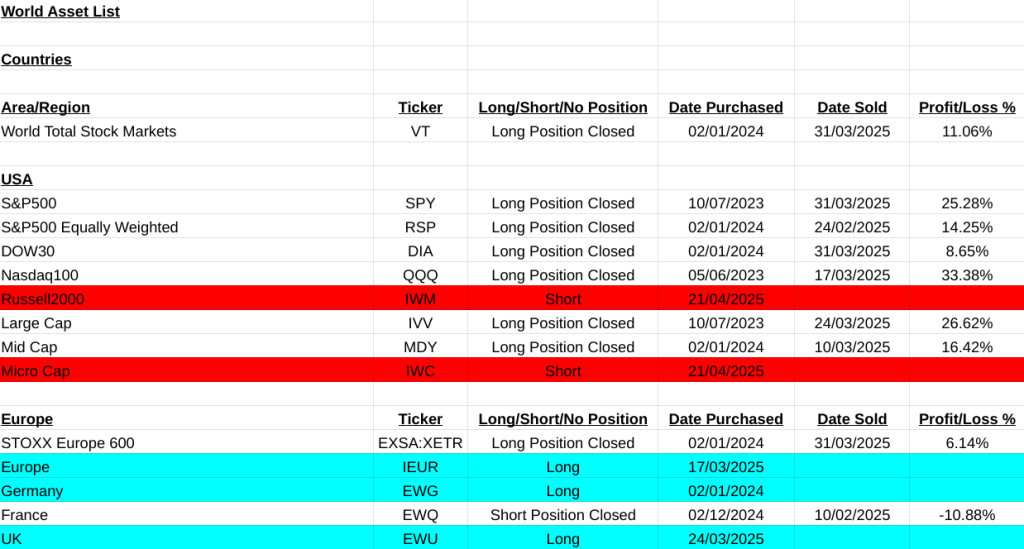

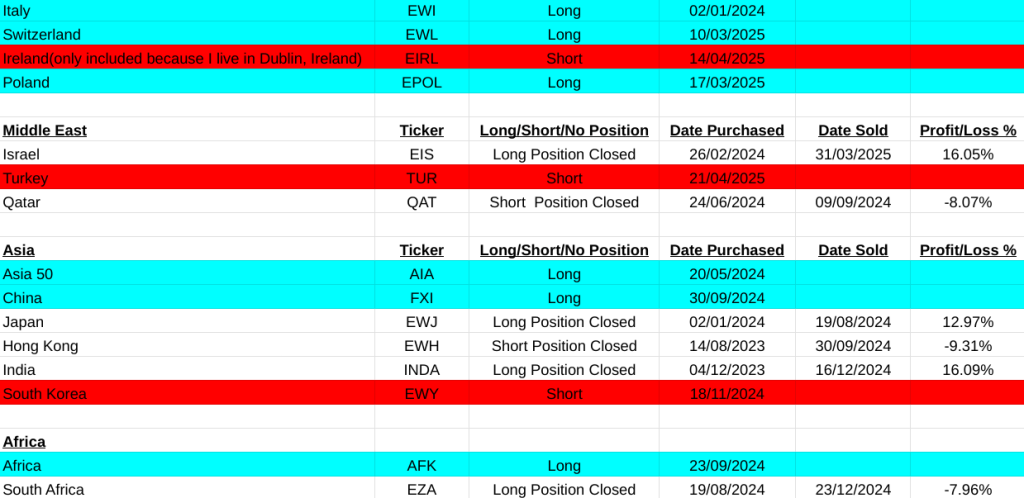

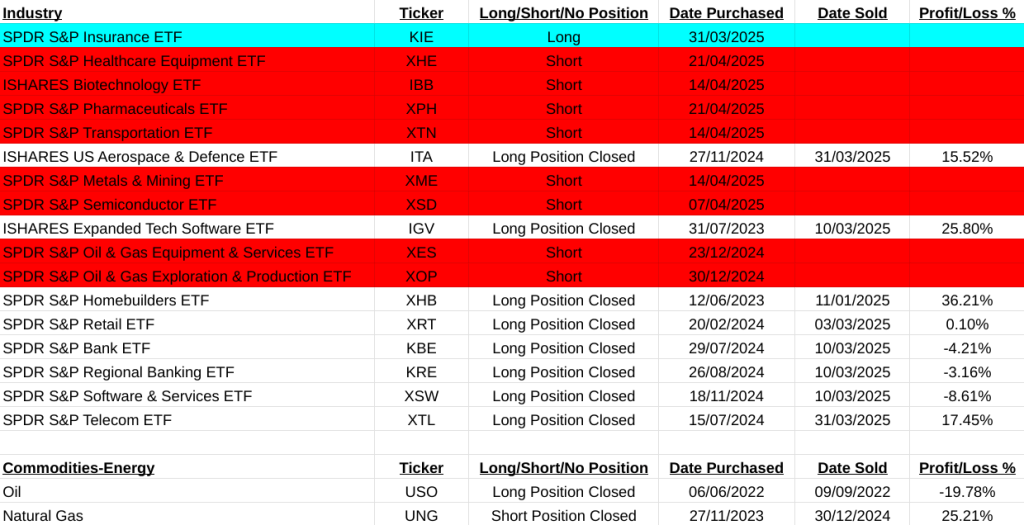

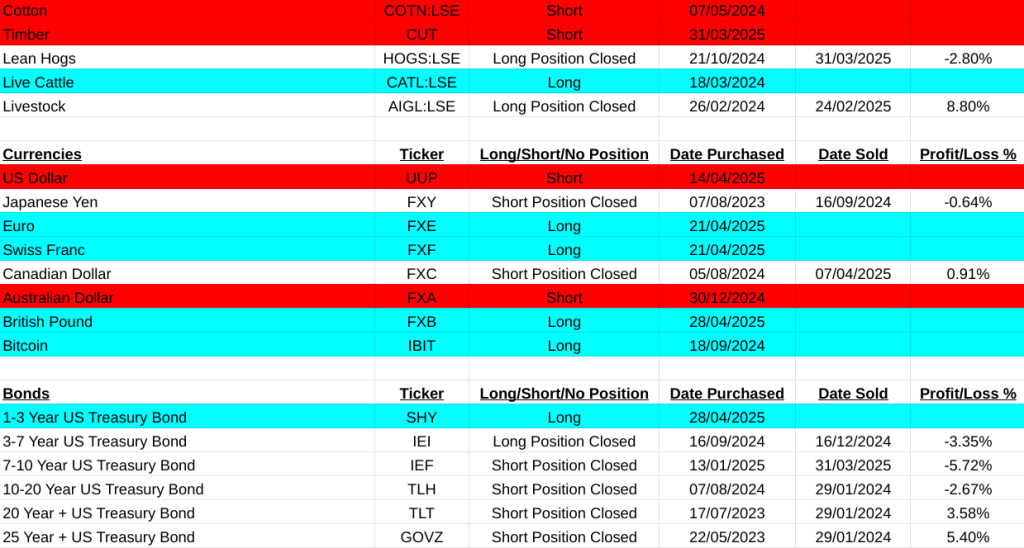

Main Asset ETF List. Short positions are marked in red, long in blue, neutral in white.

Note:The above trades do not take into consideration dividends on shares or coupons on bonds. This is important because if you short a stock or bond the dividend will be taken from you. Therefore the safest strategy is never to short any instrument only buy an upwardly trending security and simply close your position when this ends. These trades are my view on the market and not me advising you to take any of these positions. Closed positions have losses and profits listed in percentages. Mainly as a record to myself so I keep honest in evaluating my strategy.

The list of stocks analysed are from the MSCI Large Cap list as of 01/01/2025.