An interesting two weeks since my last post. I believed that the recent fall in the S&P 500 would continue. There has been a rally. Some call it a dead cat bounce. Last week’s good reception of Google’s results certainly buoyed the markets and reawakened animal spirits. Were not out of trouble yet and this week’s results from Microsoft, Apple, Meta and Amazon will give us the answer to confirm if this is a proper rally or a confirmed dead cat bounce.

Trumps performance in his first 100 days has been abysmal, it is the third worst in nearly 100 years. The three previous worst were Roosevelt’s in 1937, 1941 and Nixon’s in 1973. With the backdrop of World War 2 and the Yom Kippur war in the middle east.

The correction we just had is the seventh largest since 1929.

Trump’s bust up with Powell seems to have put some manner on him for the moment. A drop of over 20% in your retirement funds since February and impossible debt repayments through bond repayments will focus the mind of even the most ardent MAGA follower.

Tariffs have hurt the very businesses it was aimed at helping. US car companies and defence contracters saw the sharpest decline since tariffs were announced. Making America poor again is the clear outcome of his incompetence.

The overwhelming sentiment, particularly outside the US but also on Wall Street is that a rubicon has been crossed.

Trust in the US has been irretrievably damaged. For me last weeks bounce was an opportunity to continue positioning for a gradual decline in American exceptionalism.

Ok, the rant is over. Now lets see what happened.

As all the US market indices are now all sold I can see that gradually they are becoming short positions. Last week the first two to fall were the Russell 2000(IWM) and the Microcaps(IWC) along with Healthcare(XHE) and Pharmaceuticals(XPH).

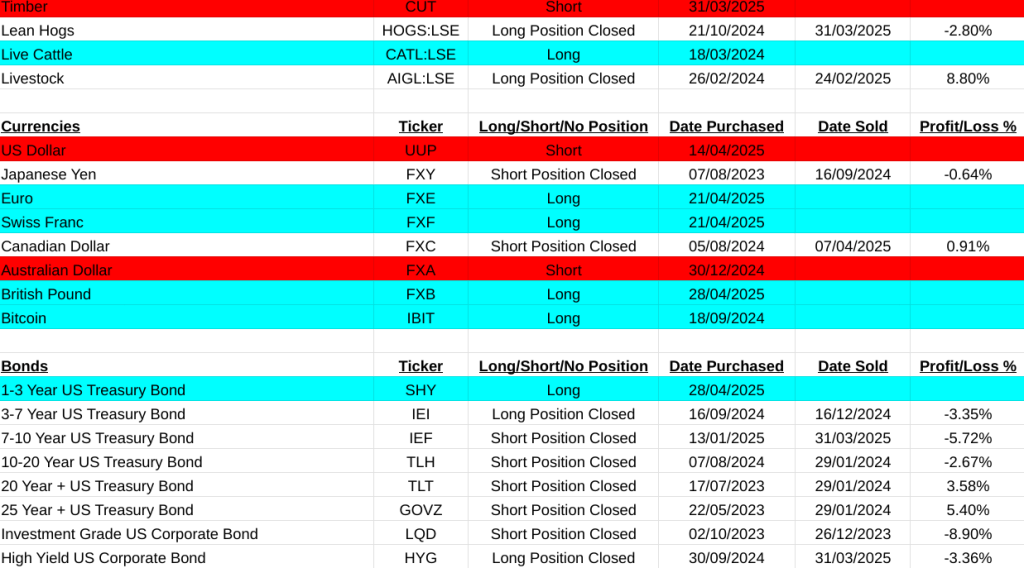

On the currency front the Euro(FXE), Swiss Franc(FXF) and Sterling(FXB) are now buys.

Regarding bonds, the 1-3 year US Treasury bond(SHY) is now a buy.

On the share front there was a net gain of 28.38% over the last two weeks. The best trade was Fiserve Inc.(FI +46.7%) and the worst being Bristol-Myers Squibb Co.(BMY -18.47%).

All my trade results are below. If you want a copy of any of them I can forward on.

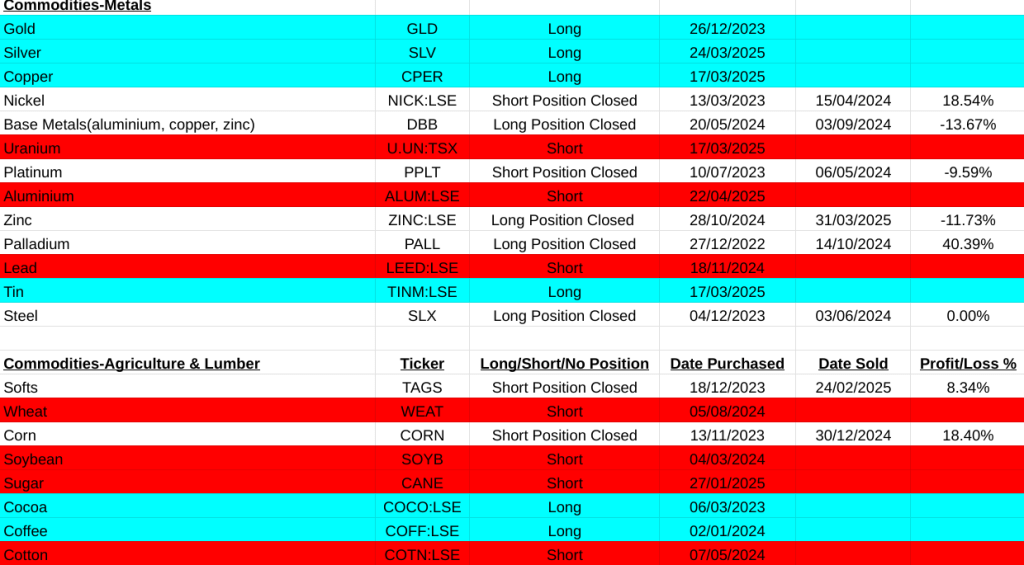

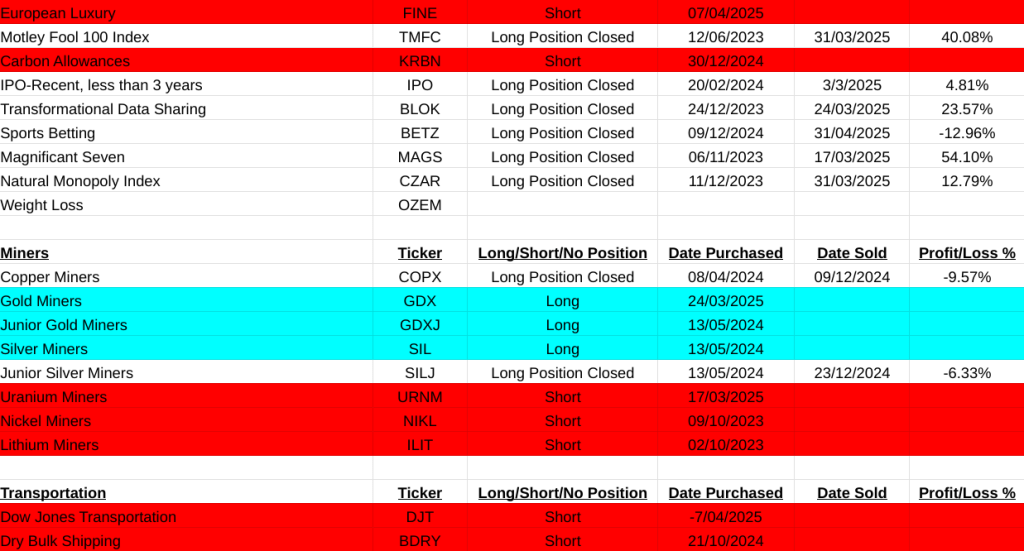

Even if you don’t go down individually on the main asset list, just look at the colours to draw some conclusions.

All the best for the week, regards, Pearse.

MSCI Large World Cap. Closed Trades, Cumulative Gain in the last two weeks= +28.38%.

MSCI World Large Cap Long Signals

MSCI Large Cap Short Signals

Main Asset ETF List. Short positions are marked in red, long in blue, neutral in white.

Note:The above trades do not take into consideration dividends on shares or coupons on bonds. This is important because if you short a stock or bond the dividend will be taken from you. Therefore the safest strategy is never to short any instrument only buy an upwardly trending security and simply close your position when this ends. These trades are my view on the market and not me advising you to take any of these positions. Closed positions have losses and profits listed in percentages. Mainly as a record to myself so I keep honest in evaluating my strategy.

The list of stocks analysed are from the MSCI Large Cap list as of 01/01/2025.