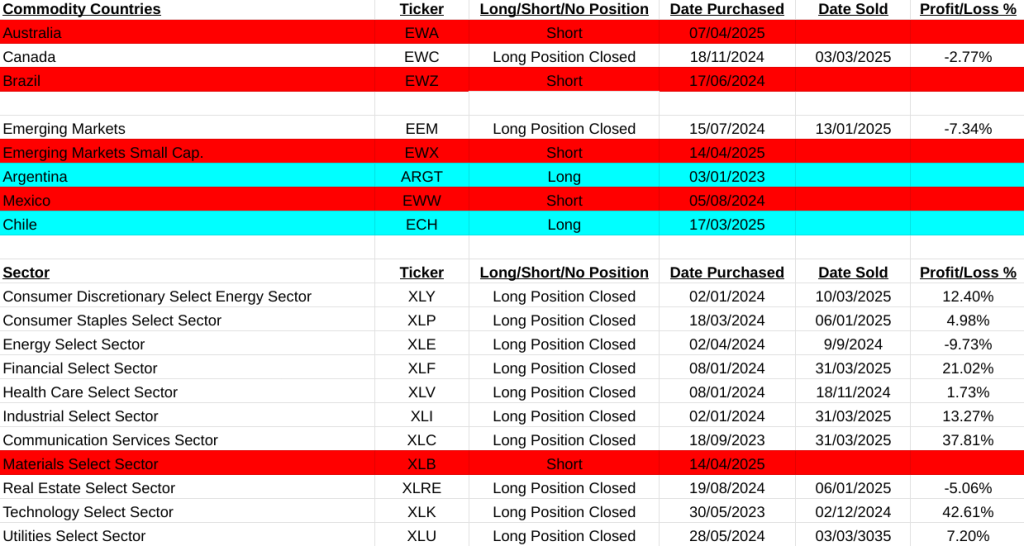

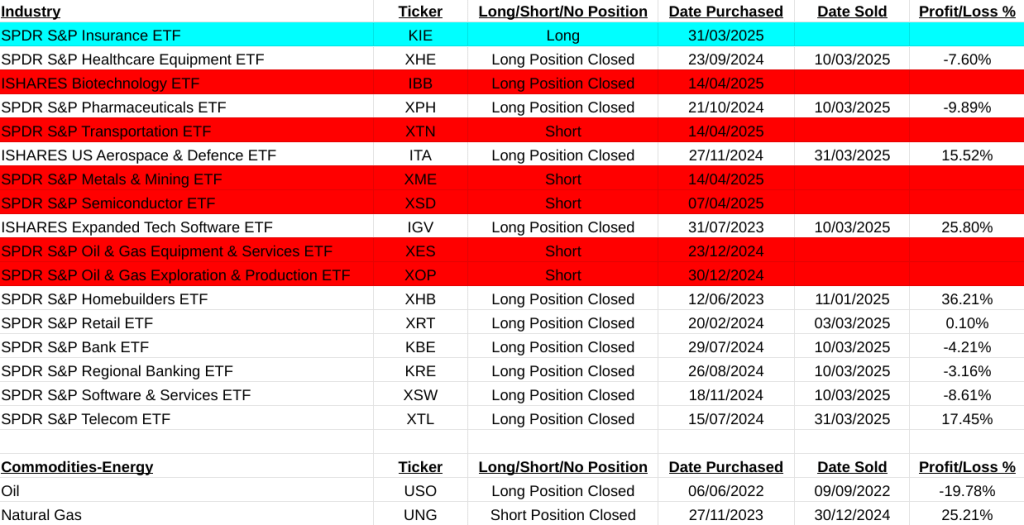

On the ‘World Asset List’. The only item sold was a short position on the Canadian Dollar(FXC) for a very small gain of only 0.91%. The main action was the starting of short positions on Materials(XLB), Metals & Mining(XME), Transportation(XTN), Biotechnology(IBB), Ireland(EIRL), Small Cap. Emerging Markets(EWX), Global Robotics(ROBO), Global Listed Private Equity(PEX) and the US Dollar(UUP).

There were no buys at all.

I noticed that the US dollar sold off and also US bonds. The rumour I heard was that a large country was selling US bonds and and purchasing Gold. Probably China?

I think that Gold has nearly run its course and will correct in the next month.

I am convinced that this S&P500 market rally is a ‘dead cat bounce’.

On the stocks list last week was spent closing 19 positions and entering 21 short positions.

19 stock positions sold with a total profit of 342.63%. The best was Transdigm Group Inc.(TDG +80.70%) and the worst was Basf SE(BAS:XETR -21.98%). A full list of all the trades are below.

All the best for the week, regards, Pearse.

MSCI Large World Cap. Closed Trades, Cumulative Gain this week= +342.63%.

MSCI World Large Cap Long Signals

No signals this week

MSCI Large Cap Short Signals

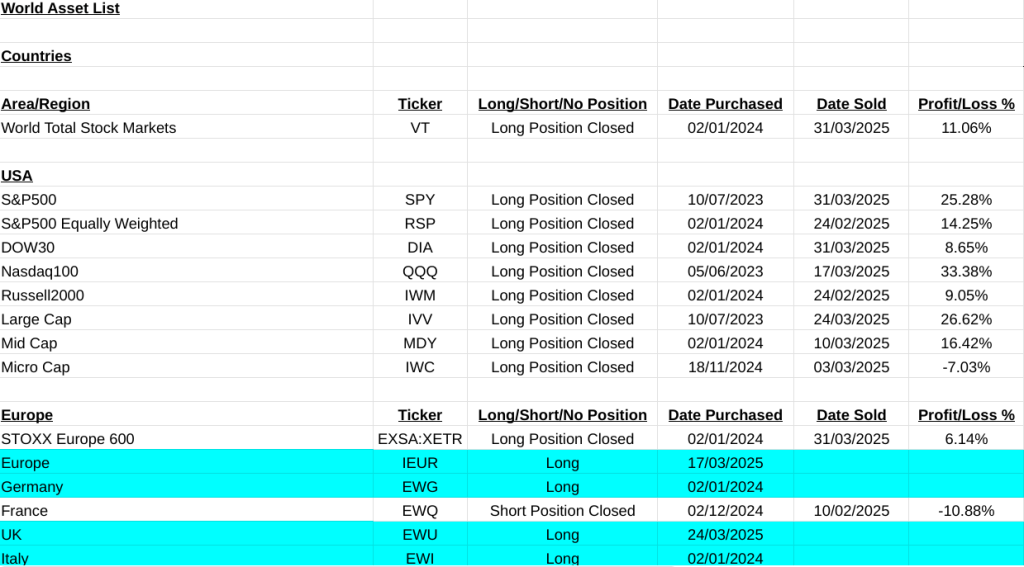

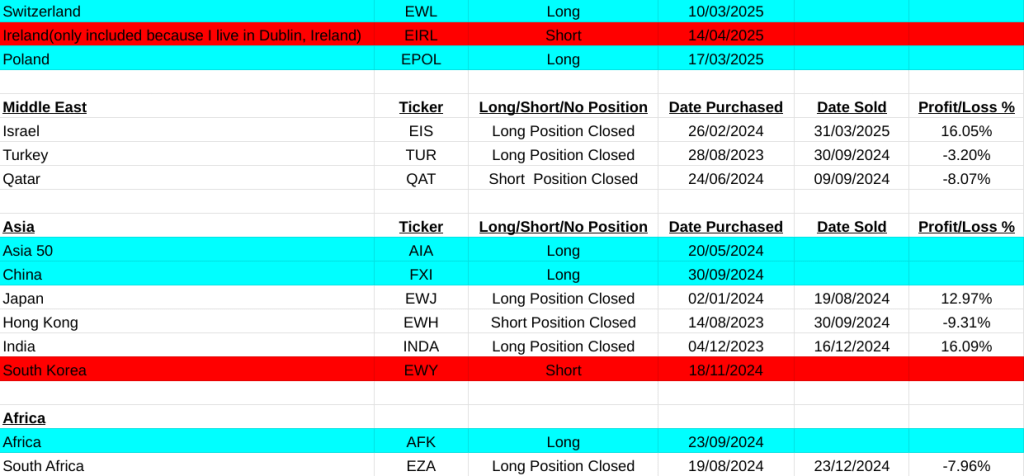

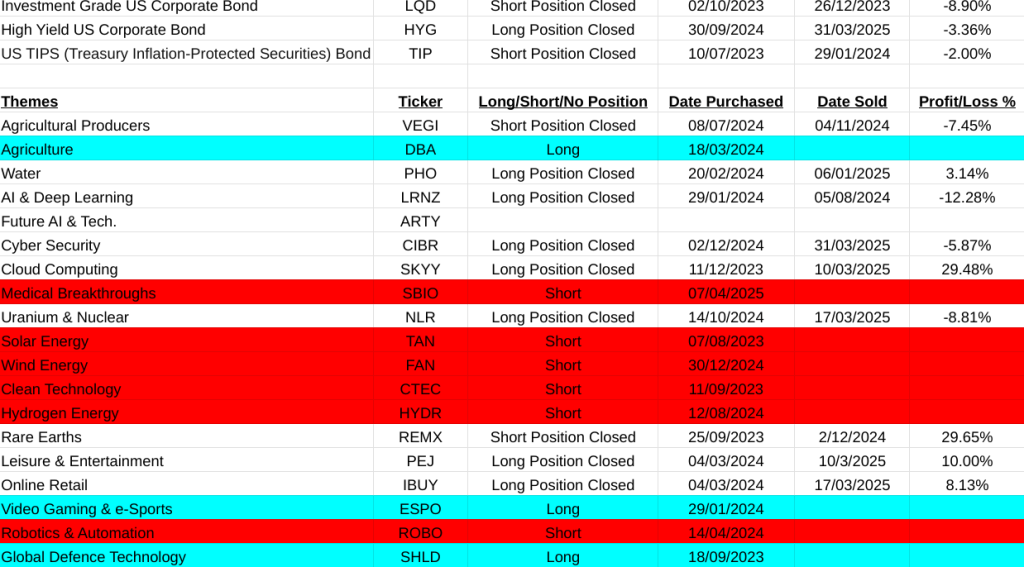

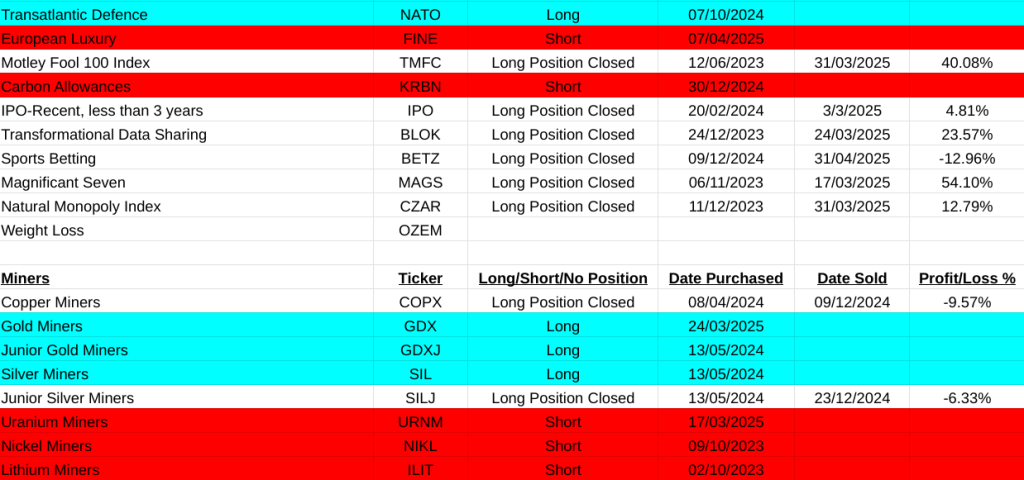

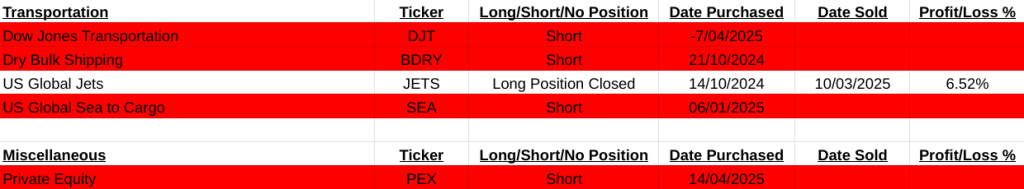

Main Asset ETF List. Short positions are marked in red, long in blue, neutral in white.

Note:The above trades do not take into consideration dividends on shares or coupons on bonds. This is important because if you short a stock or bond the dividend will be taken from you. Therefore the safest strategy is never to short any instrument only buy an upwardly trending security and simply close your position when this ends. These trades are my view on the market and not me advising you to take any of these positions. Closed positions have losses and profits listed in percentages. Mainly as a record to myself so I keep honest in evaluating my strategy.

The list of stocks analysed are from the MSCI Large Cap list as of 01/01/2025.