What a week! The sea of red the day after Trumps tariff speech. I noticed that there was only one world indice in the world that finished positive and it was the Chinese Hang Seng China A50 Index. It finished the day up 0.67%.

China is the obvious winner. Who has excess production capacity, China, Trump has destroyed the American brand and handed it to the Chinese.

The Chinese will take advantage of the US taking a lack of interest in leadership.

The US will pull out of the Paris Climate Accord, great. China will be the most important country at the COP.

The US wants to pull out of the WHO, great, China will fill the vacuum and call the shots.

The US wants to stop paying their UN dues, great, China will fill the vacuum and be the most important country with influence worldwide.

The US wants to stop spending on US aid, great China will pony up and dominate the global south.

Remember the Tsunami in 2004. US assistance was everywhere. The Americans had boots on the ground. The Chinese failed.

Now think of the recent massive earthquake in Myanmar? the Americans did nothing but the Chinese were on the ground.

Reputational power, soft power, diplomatic influence with countries around the world lost in the stroke of a pen. The Chinese are long term beneficiaries of what the US is doing right now. Trump has given them the opportunity they will not pass up. As the Chinese say, when you cross a river move slowly and make sure you can feel the stones below your feet.

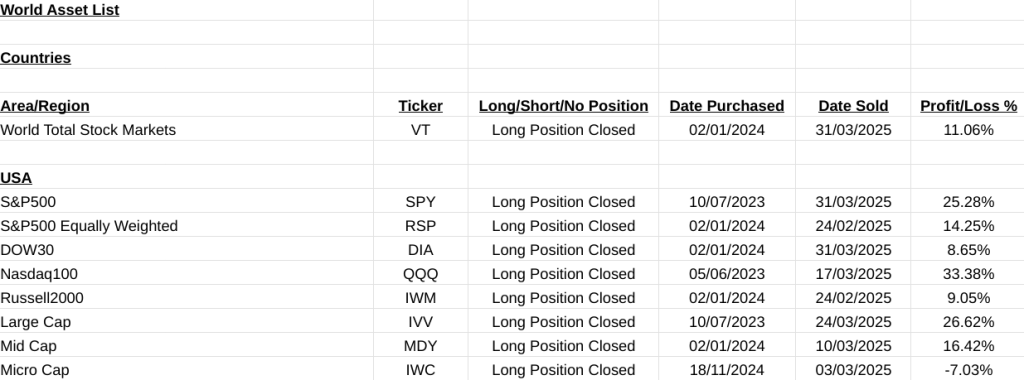

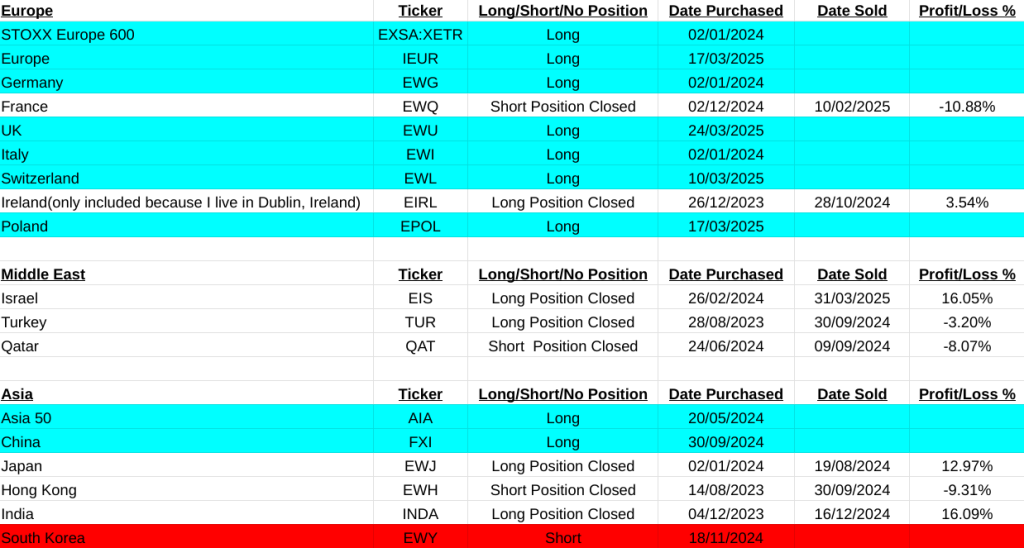

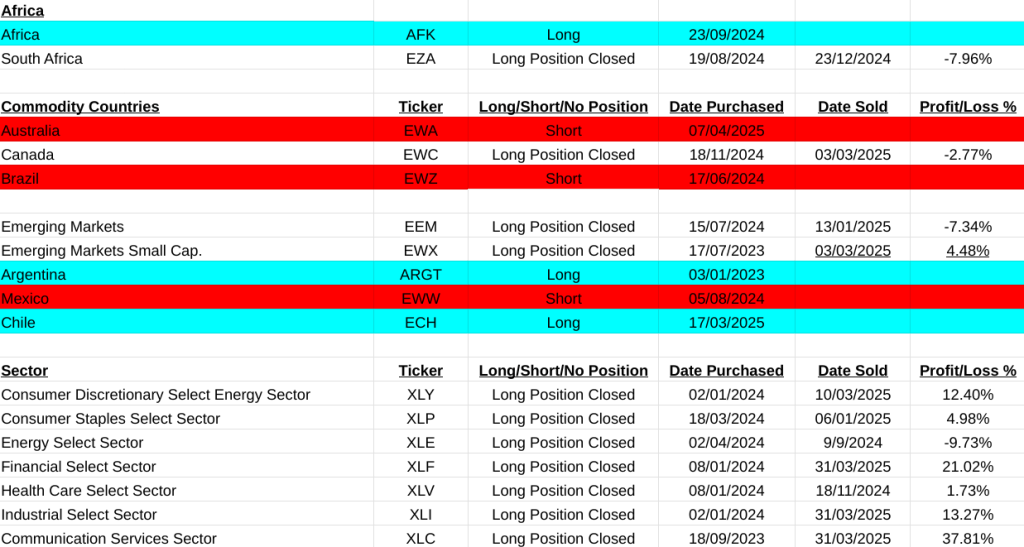

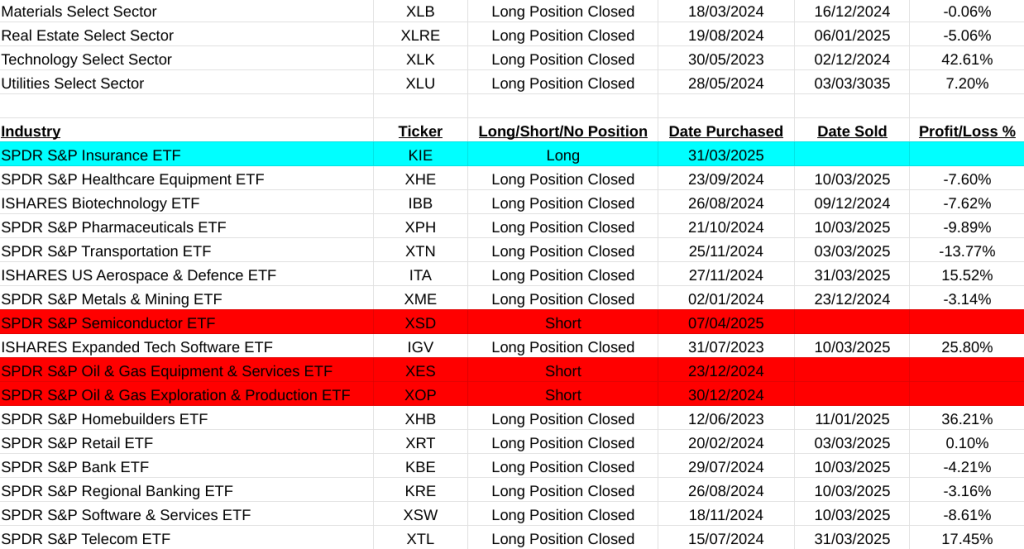

Ok, that’s the lecture over. On my main asset list there was a gain of 161.28%. I must explain that as I use a slow trend following method of trading some of the positions have been open for years. One of the great advantages of this method is that when you get major corrections these positions are closed at large profit. The full list is below. Most notable is that now all the US sectors are fully closed along with the last remaining of the US indices, the S&P500(SPY +25.28%) and the DOW(DIA +8.65%). Note on the list below that the European indices have not sold off to the same extent and are still buys.

Other closed positions are Financial(XLF +21.02%), Industrial(XLI +13.27%), Communications(XLC +37.81%), Telecommunications(XTL +17.45%), US Aerospace & Defence(ITA +15.42%), Israel(EIS +16.05%), and the Motley Fool 100 Index(TMFC +40.08%). The full list is below.

Assets that are now shorts are Semiconductors(XSD), Australia(EWA), Medical Breakthroughs(SBIO), European Luxury(FINE), and the DOW Transportation Index(DJT).

The Total World Stock Market Indice(VT +11.06%) is now also closed. This tells me that something very serious is happening at a deep level worldwide that won’t be fixed quickly with a vax shot.

On the stock front the totals are astounding. The total % gain is 1,295.51%. The best being Nvidia(NVDA +280.84%) and the worst being Infinion Technologies(INX:XETR -22.56%). If anyone wants a copy of any trade I can forward it on. At times like this trend following certainly works.

MSCI Large World Cap. Closed Trades, Cumulative Gain this week= +1,295.51%.

| Company Name | Ticker | Country | Long/Short | Date Purchased | Date Sold | Profit/Loss % |

| Nvidia Corp. | NVDA | USA | Long | 03/04/2023 | 31/03/2025 | 280.84% |

| Broadcom Inc. | AVGO | USA | Long | 06/02/2023 | 31/03/2025 | 180.58% |

| Meta Platforms Inc. | META | USA | Long | 15/05/2023 | 31/03/2025 | 135.13% |

| SAP SE. | SAP:XETR | Germany | Long | 13/03/2023 | 31/03/2025 | 111.24% |

| Hitachi | 6501:TSE | Japan | Long | 29/05/2023 | 31/03/2025 | 95.04% |

| Parker Hannifin Corp. | PH | USA | Long | 17/01/2023 | 31/03/2025 | 86.95% |

| UCB | UCB:BRU | Belgium | Long | 19/02/2024 | 31/03/2025 | 71.33% |

| Taiwan Semiconductor Manufacturing | 2330:TWSE | Taiwan | Long | 11/12/2023 | 31/03/2025 | 65.38% |

| CRH Plc. | CRH:NYSE | Ireland | Long | 06/03/2023 | 31/03/2025 | 65.20% |

| JP Morgan Chase & Co. | JPM | USA | Long | 17/07/2023 | 31/03/2025 | 52.69% |

| Amphenol Corp. | APH | USA | Long | 17/01/2023 | 31/03/2025 | 49.93% |

| The Bank Of New York Mellon Corp. | BK | USA | Long | 18/12/2023 | 31/03/2025 | 43.95% |

| Investor AB. | INVE_B:STO | Sweden | Long | 30/01/2023 | 31/03/2025 | 39.71% |

| Goldman Sachs Group Inc. | GS | USA | Long | 04/03/2024 | 31/03/2025 | 36.30% |

| UBS Group | UBSG:SWX | Switzerland | Long | 30/01/2023 | 31/03/2025 | 31.50% |

| Brookfield Corp. | BN:TSX | Canada | Long | 29/01/2024 | 31/03/2025 | 30.33% |

| Standard Chartered Plc. | STAN:LSE | UK | Long | 20/05/2024 | 31/03/2025 | 28.65% |

| Argenx SE. | ARGX:AMS | The Netherlands | Long | 15/07/2024 | 31/03/2025 | 25.26% |

| Corning Inc. | GLW | USA | Long | 13/05/2024 | 31/03/2025 | 25.08% |

| Citigroup Inc. | C | USA | Long | 08/01/2024 | 31/03/2025 | 24.67% |

| Saint Gobain | SGO:PAR | France | Long | 02/01/2024 | 31/03/2025 | 24.57% |

| Ameriprise Financial Inc. | AMP | USA | Long | 08/01/2024 | 31/03/2025 | 23.42% |

| Wells Fargo & Co. | WFC | USA | Long | 28/10/2024 | 31/03/2025 | 17.31% |

| Moodys Corp. | MCO | USA | Long | 29/01/2024 | 31/03/2025 | 11.67% |

| KBC Groep NV. | KBC:BRU | Belgium | Long | 11/03/2024 | 31/03/2025 | 9.94% |

| Morgan Stanley | MS | USA | Long | 15/07/2024 | 31/03/2025 | 9.28% |

| Adidas AG. | ADS:XETR | Germany | Long | 25/03/2024 | 31/03/2025 | 7.35% |

| Blackrock Inc. | BLK | USA | Long | 29/007/2024 | 31/03/2025 | 6.44% |

| Siemens AG. | SIE:XETR | Germany | Long | 21/10/2024 | 31/03/2025 | 3.53% |

| Fortinet Inc. | FTNT | USA | Long | 14/10/2024 | 31/03/2025 | 3.11% |

| Cisco Systems Inc. | CSCO | USA | Long | 14/10/2024 | 31/03/2025 | 2.28% |

| Metlife Inc. | MET | USA | Long | 11/03/2024 | 31/03/2025 | 2.06% |

| Emerson Electric Company | EMR | USA | Long | 20/02/2024 | 31/03/2025 | 1.98% |

| Advantest Corp. | 6857:TSE | Japan | Long | 30/09/2024 | 31/03/2025 | 1.30% |

| Mastercard Inc. | MA | USA | Long | 07/10/2025 | 31/03/2025 | -0.41% |

| Sun Life Financial Inc. | SLF:TSX | Canada | Long | 15/10/2024 | 31/03/2025 | -2.15% |

| S&P Global Inc. | SPGI | USA | Long | 22/07/2024 | 31/03/2025 | -3.79% |

| Mitsubishi UFJ Financial Group Inc. | 8306:TSE | Japan | Long | 09/12/2023 | 31/03/2025 | -4.15% |

| Mizuho Financial Group | 8411:TSE | Japan | Long | 18/11/2024 | 31/03/2025 | -4.94% |

| Cognizant Technology Solutions Corp. | CTSH | USA | Long | 18/11/2024 | 31/03/2025 | -5.40% |

| RWE AG. | RWE:XETR | Germany | Short | 19/02/2024 | 31/03/2025 | -5.47% |

| Roche Holding AG. | ROG:SWX | Switzerland | Long | 29/07/2024 | 31/03/2025 | -7.17% |

| Air Products and Chemicals Inc. | APD | USA | Long | 30/09/2024 | 31/03/2025 | -8.03% |

| Bank of Montreal | BMO:TSX | Canada | Long | 16/12/2024 | 31/03/2025 | -8.48% |

| Sumitoma Mitsui Financial Group Inc. | 8316:TSE | Japan | Long | 23/12/2024 | 31/03/2025 | -9.37% |

| Swedbank AB. | SWED_A:STO | Sweden | Long | 17/02/2025 | 31/03/2025 | -9.55% |

| Adyen | ADYEN:AMS | The Netherlands | Long | 16/12/2024 | 31/03/2025 | -11.34% |

| Nordea Bank | NDA_FI:HEX | Finland | Long | 24/02/2025 | 31/03/2025 | -11.70% |

| Atlassian Corp. | TEAM | USA | Long | 18/11/2024 | 31/03/2025 | -11.90% |

| Honeywell International Inc. | HON | USA | Long | 18/11/2024 | 31/03/2025 | -12.17% |

| Starbusks Corp. | SBUX | USA | Long | 03/02/2025 | 31/03/2025 | -13.28% |

| Experian Plc. | EXPN:LSE | UK | Long | 03/02/2025 | 31/03/2025 | -13.42% |

| GE Healthcare Technologies Inc. | GEHC | USA | Long | 24/02/2025 | 31/03/2025 | -14.02% |

| Legrand SA. | LR:PAR | France | Long | 28/10/2024 | 31/03/2025 | -14.58% |

| Bank of America | BAC | USA | Long | 18/11/2024 | 31/03/2025 | -14.58% |

| Walt Disney Company | DIS | USA | Long | 03/02/2025 | 31/03/2025 | -14.63% |

| ArcelorMittal | MT:LUX | Luxembourg | Long | 10/02/2025 | 31/03/2025 | -14.92% |

| Skandinaviska Enskilda Banken | SEB_A:STO | Sweden | Long | 10/03/2025 | 31/03/2025 | -15.78% |

| Fast Retailing Co. Ltd. | 9983:TSE | Japan | Long | 21/10/2024 | 31/03/2025 | -17.26% |

| Volvo AB. | VOLV_B:STO | Sweden | Long | 24/02/2025 | 31/03/2025 | -17.86% |

| Hexagon AB. | HEXA_B:STO | Sweden | Long | 03/02/2025 | 31/03/2025 | -19.58% |

| Infineon Technologies AG. | IFX:XETR | Germany | Long | 17/02/2025 | 31/03/2025 | -22.56% |

MSCI World Large Cap Long Signals

| Company Name | Ticker | Country | Long/Short | Date Purchased |

| Monster Beverage Corp. | MNST | USA | Long | 07/04/2025 |

MSCI Large Cap Short Signals

| Company Name | Ticker | Country | Long /Short | Date Purchased |

| FujiFilm Holdings Corp. | 4901:TSE | Japan | Short | 07/04/2025 |

| Disco Corp. | 6146:TSE | Japan | Short | 07/04/2025 |

| Keyence Corp. | 6861:TSE | Japan | Short | 07/04/2025 |

| Honda Motor Co. | 7267:TSE | Japan | Short | 07/04/2025 |

| Tokyo Electron | 8035:TSE | Japan | Short | 07/04/2025 |

| Applied Materials Inc. | AMAT | USA | Short | 07/04/2025 |

| ASM International NV. | ASM:AMS | The Netherlands | Short | 07/04/2025 |

| ASML Holding | ASML:AMS | The Netherlands | Short | 07/04/2025 |

| Datadog Inc. | DDOG | USA | Short | 07/04/2025 |

| Lam Research Corp. | LRCX | USA | Short | 07/04/2025 |

| LVMH Moet Hennessy Louis Vuitton SE. | MC:PAR | France | Short | 07/04/2025 |

| Thermo Fisher Scientific Inc. | TMO | USA | Short | 07/04/2025 |

| United Parcel Service Inc. | UPS | USA | Short | 07/04/2025 |

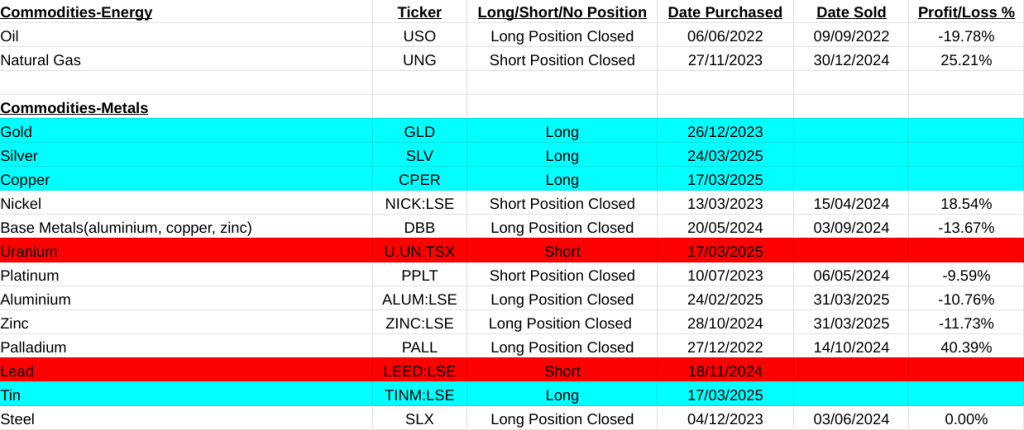

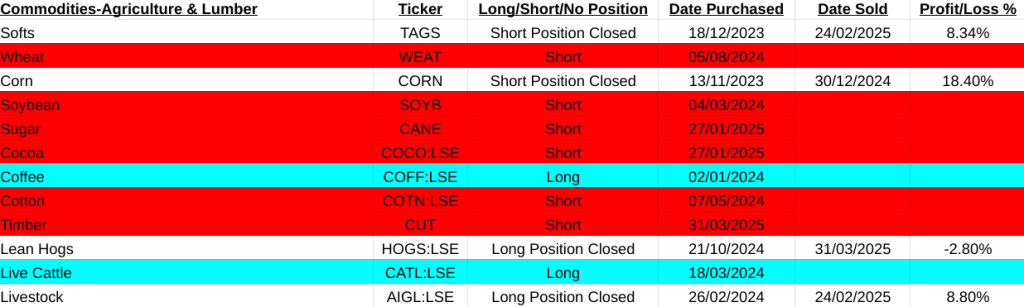

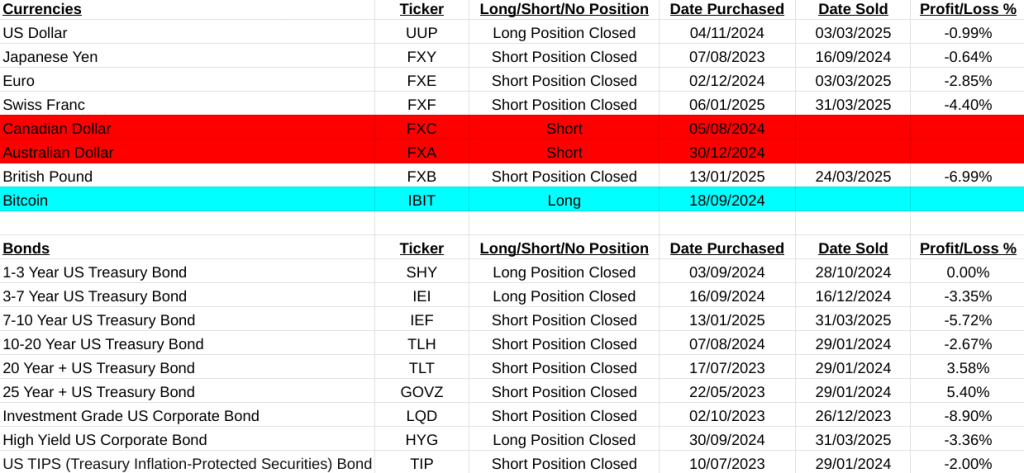

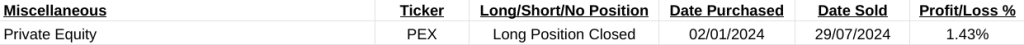

Main Asset ETF List. Short positions are marked in red, long in blue, neutral in white.

Note:The above trades do not take into consideration dividends on shares or coupons on bonds. This is important because if you short a stock or bond the dividend will be taken from you. Therefore the safest strategy is never to short any instrument only buy an upwardly trending security and simply close your position when this ends. These trades are my view on the market and not me advising you to take any of these positions. Closed positions have losses and profits listed in percentages. Mainly as a record to myself so I keep honest in evaluating my strategy.

The list of stocks analysed are from the MSCI Large Cap list as of 01/01/2025.