Friday was a real eye-opener for me. Usually Monday and Friday are not profitable to trade.

Trumps tweets are a gift to traders that keep’s on giving.

The S&P500 chart has closed below its 200 day moving average. One of the most profitable monthly methods I came across some time ago is to simply sell it when it drops below the 200 week moving average on the last day of the month and simply buy back when it goes above it at the last day of the month. A link is attached below that shows how profitable it has been over the last 25 years. It blows buy and hold out of the water.

I think its time to get out of the market in individual shares unless your going short.

WWW.NEWTRADERU.COM/2022/02/10/a-monthly-trading-strategy-that-crushes-buy-and-hold-2/

All eyes are on for this Wednesday’s so called Liberation Day when Trump finalises and announces tariff levels. For me it will be Doomsday Day!

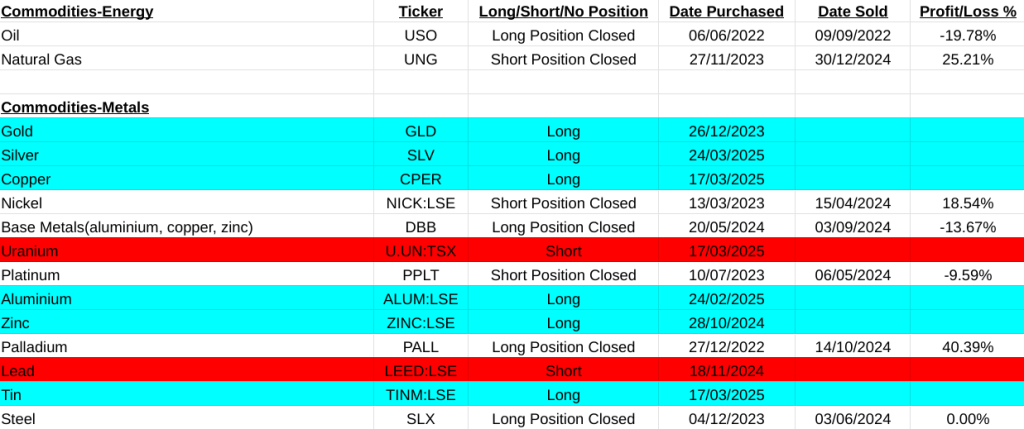

Everyone talks about Gold but Copper(CPER) is up 27% since the start of the year leaving gold behind at 15%.

It’s the sneaky ones that creep up on you if you don’t watch the charts. This has also lifted Chile(ECH) and Peru(EPU).

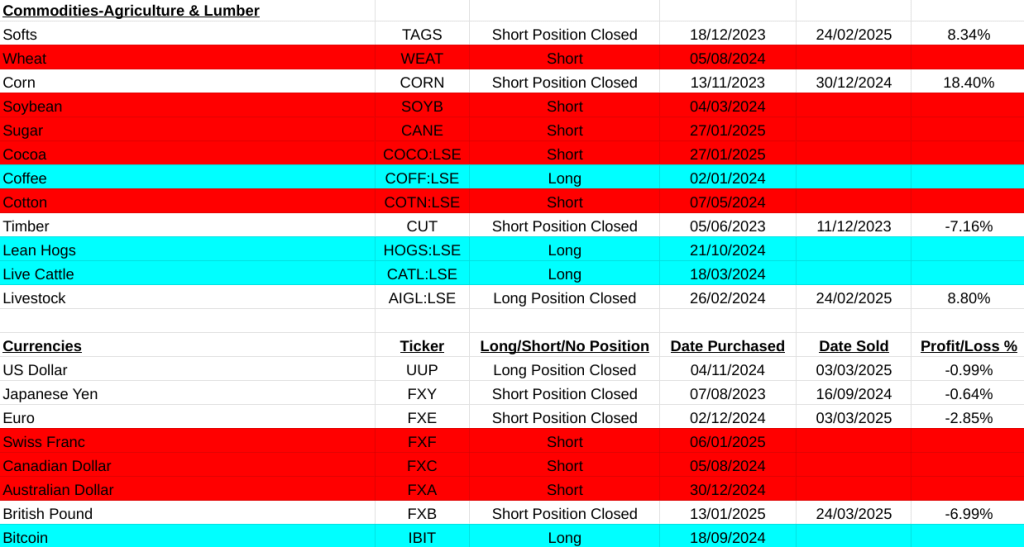

On the main asset list there were three closed trades, Core S&P500 ETF(IVV, +26.62%), UK sterling(FXB, -6.99%)

and Transformational Data ETF(BLOK, +23.57%). So that’s +43.20% in total.

Insurance(KIE) is now a buy and Global Timber ETF(CUT) is a short. I forgot to mention last week that the UK ETF(EWU) is now a buy.

Note that as I mentioned the US indices are selling off every week. So of the eight major ETF’s I track below there are only two left. All that’s left standing is the DOW(DIA) and the S&P500(SPY). This does not look good at all.

However as I profit from assets going down(going short) as well as buying them(going long) I can profit from declines.

On the share front there was a solid gain of 97.39% this week spread over the globe. The largest gain was in closing Aristocrat Leisure Ltd.(ALL:ASX) with a profit of 59.61% and Humana Inc.(HUM) with a gain of 27.30%.

The full list is below.

This week will be very interesting, all the best, regards, Pearse.

MSCI Large World Cap. Closed Trades, Cumulative Gain this week= +97.39%

MSCI Large Cap Long Signals

MSCI Large Cap Short Signals

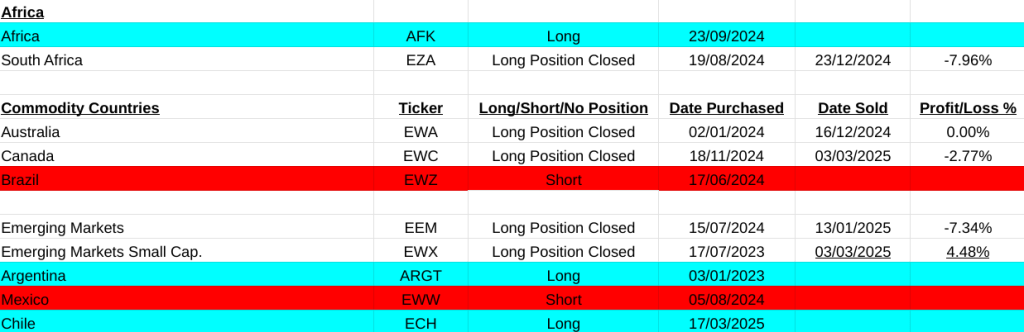

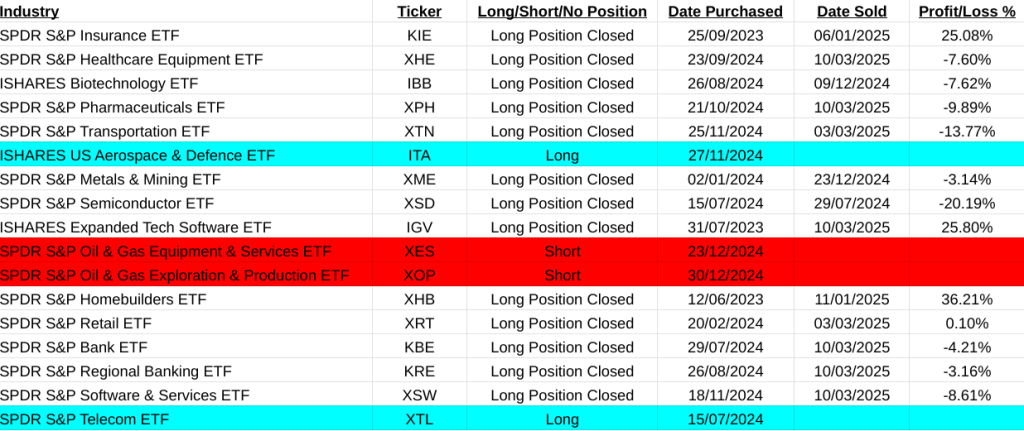

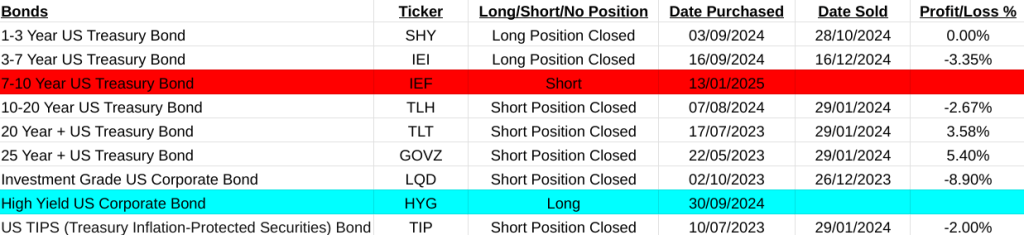

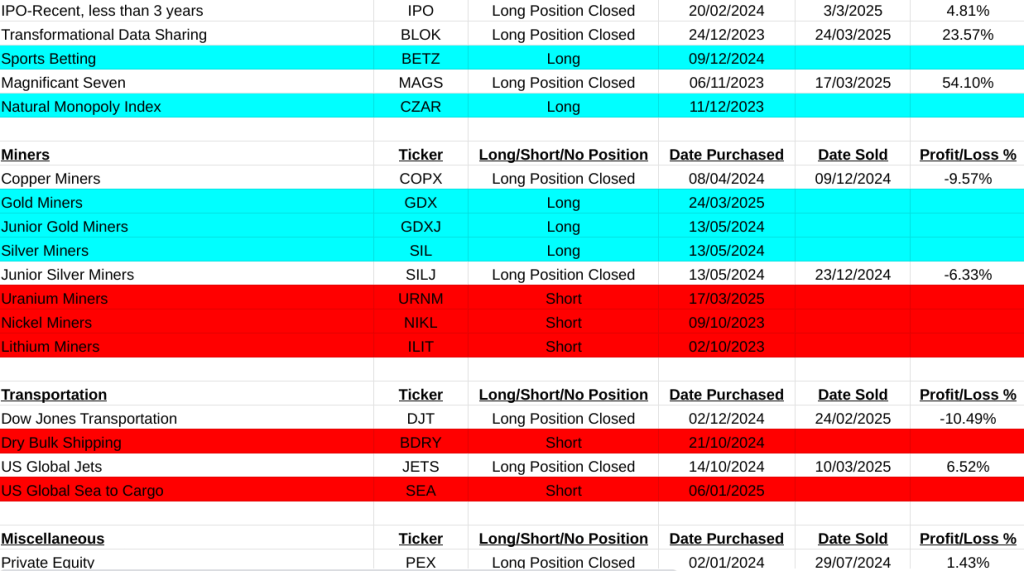

Main Asset ETF List. Short positions are marked in red, long in blue, neutral in white.

Note:The above trades do not take into consideration dividends on shares or coupons on bonds. This is important because if you short a stock or bond the dividend will be taken from you. Therefore the safest strategy is never to short any instrument only buy an upwardly trending security and simply close your position when this ends. These trades are my view on the market and not me advising you to take any of these positions. Closed positions have losses and profits listed in percentages. Mainly as a record to myself so I keep honest in evaluating my strategy.

The list of stocks analysed are from the MSCI Large Cap list as of 01/01/2025.