The unhinged situation created by the Trump administration. Threats of tariffs, a sovereign wealth fund that manipulates the US dollar and replaces flows of capital from abroad, coercion on defense, putting pressure on the Federal Reserve to cut rates, cutting the federal budget blindly without foreseeing the longer term outcomes.

Abandoning Ukraine, humiliated allies, mounted an assault on Canada and puting commitment to NATO into doubt.

These are strong words but the retreat of US stocks in the last few weeks is driven by investors nervousness due to Trump’s policies. They will have one clear effect to “make America poor again.”

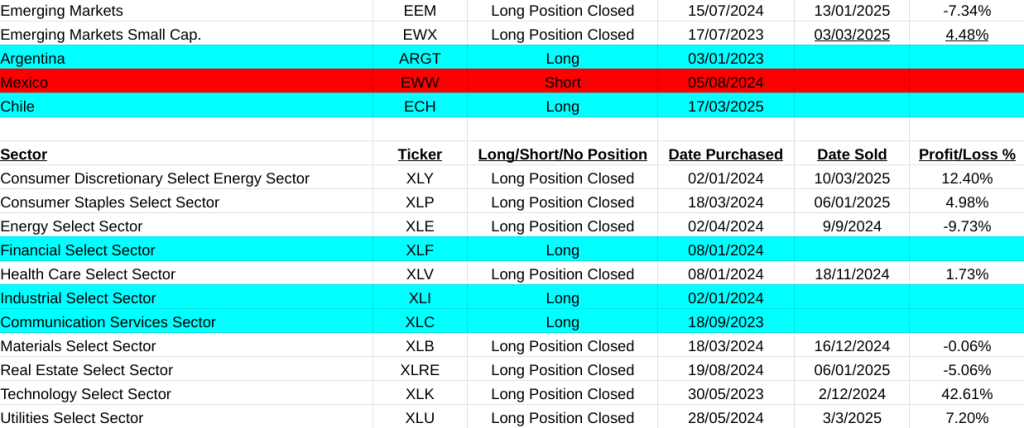

Take a look at the main asset list below and you will notice how most of the US indices are now closed. This week the Nasdaq(QQQ) was closed at a profit of 33.38%. I expect in the next two weeks the DOW(DIA) to follow suit.

This week the MAG7 etf (MAGS) was also closed for a profit of 54.10%. The foundations are being eaten away.

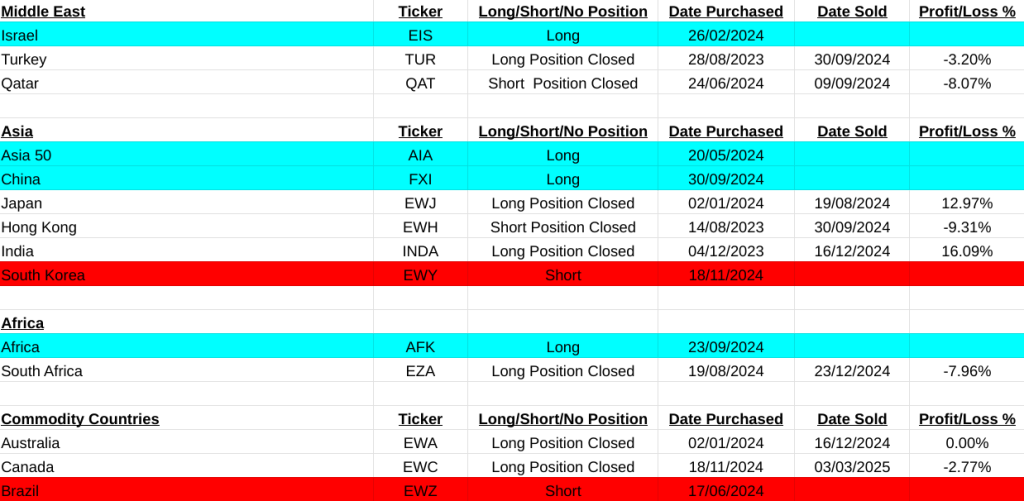

But as this happens note how the European indices are getting stronger and becoming strong buys. I added Poland(EPOL) to the main asset list during the week.

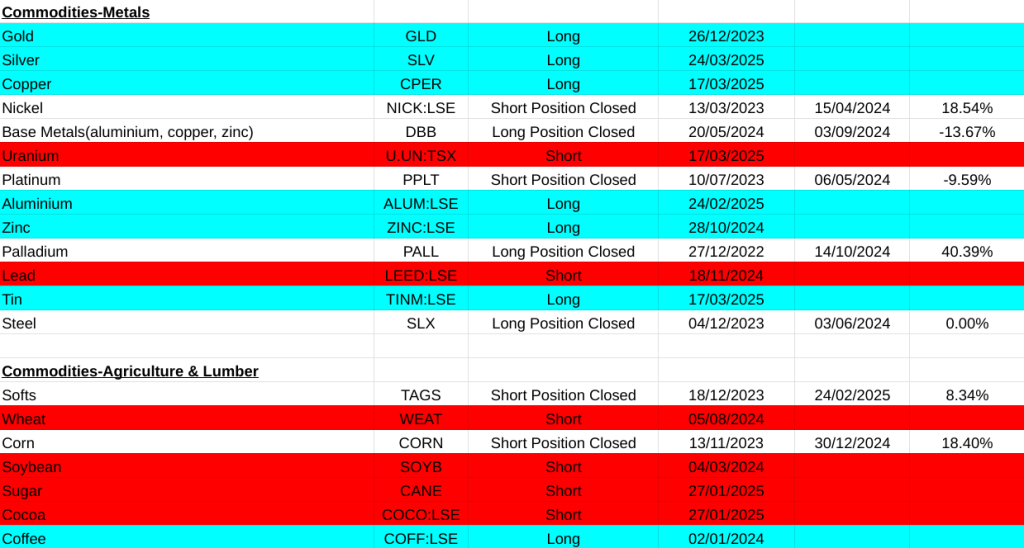

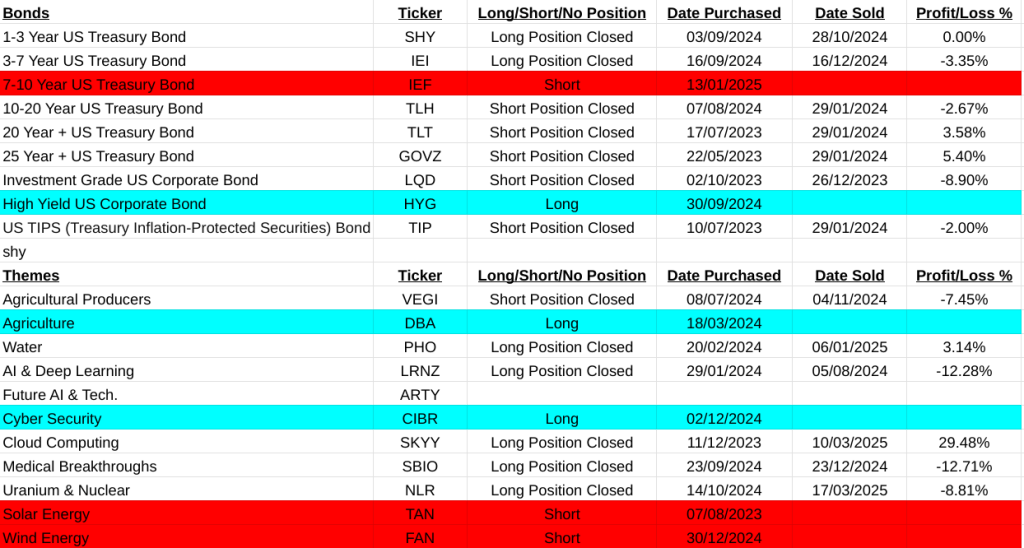

Other changes on this list are that Silver(SLV) is now a buy again and also the Gold Miners(GDX). Uranium & Nuclear(NLR) followed the sell in Uranium last week with a loss of 8.13%. Finally, Online Retail(IBUY) was closed for a profit of 8.13%. This brings the total gain in the main asset list to 86.80% this week.

Anyone who watched Powell’s speech after the FOMC meeting on Wednesday should have noted how confused everyone felt. On one hand the economy is great and on the other “uncertainty around the economic outlook has increased.” The FED makes decisions on so called ‘hard data’. But this information can have long delays of 3 to 6 months but takes into account ‘soft data’ such as individual surveys by respected bodies which has a only a delay of 1 to 3 months. So he is basically saying that the hard long term view, everything’s ok but the short term data is beginning to worry us. I’m putting words into his mouth which I shouldn’t do but that’s what I understood.

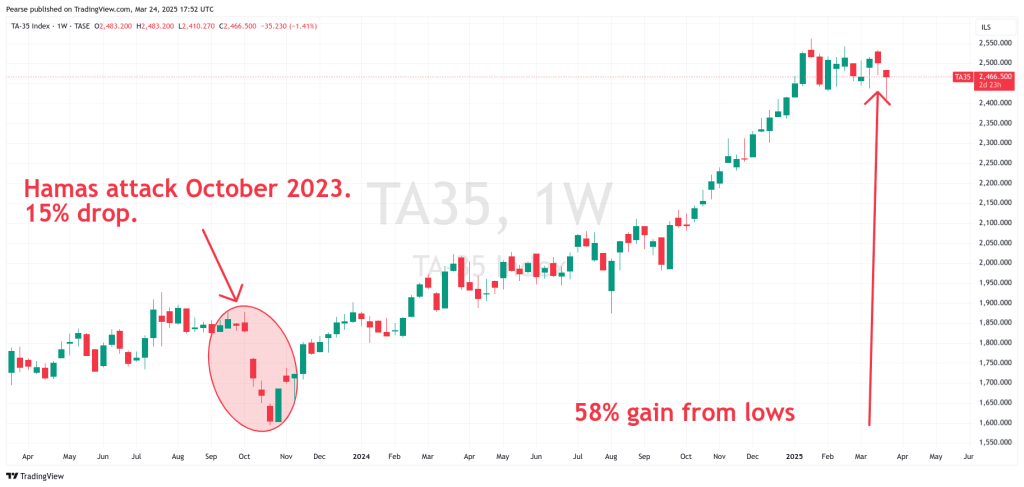

It’s always comforting when you close a position even at a loss and then months later see it getting hammered like Turkey last week down 19.74%. Compare it to Israel where the Tel Aviv stock market has rallied 58% since the Hamas terrorist attack. Now that’s resilience! I put the chart at the end of this.

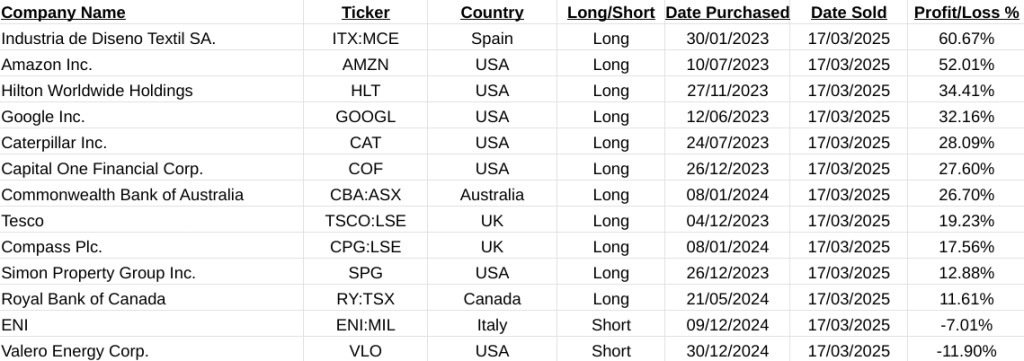

Now onto stocks. Another solid week with gains all over the board. Total gain 304.01%.

Industria de Diseno Textil(ITX:MCE +60.67%), Amazon(AMZX +52.01%), Hilton(HLT +34.41%) and Google(GOOGL +32.16%)

Note that two of these are two of the so called MAG stocks. This mirrors the closure of the MAGs etf (MAGS).

Finally take a look at the US sectors and industries below. Note that there are only 3 sectors which are a buy and only 2 industries which are a buy. This does not bode well. Well I’m not going to complain either way.

Good luck this week, regards, Pearse.

MSCI Large World Cap. Closed Trades, Cumulative Gain this week= +304.01%

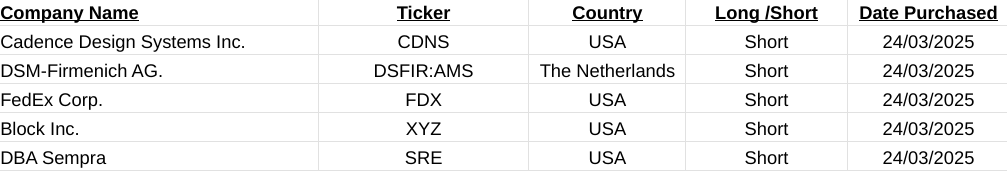

MSCI Large Cap Long Signals

MSCI Large Cap Short Signals

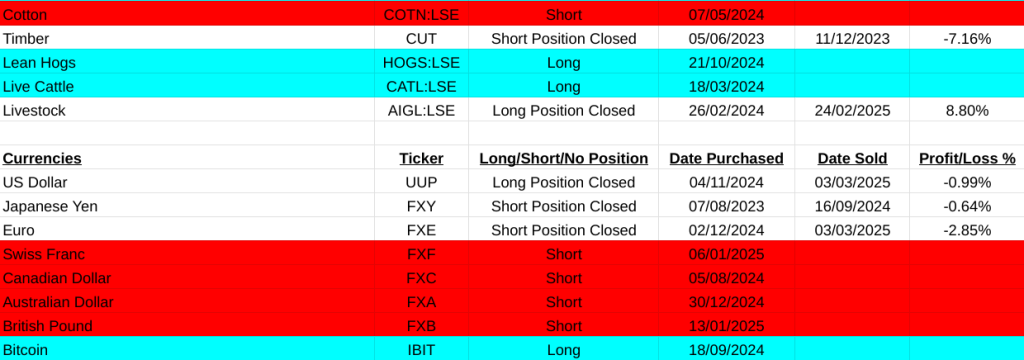

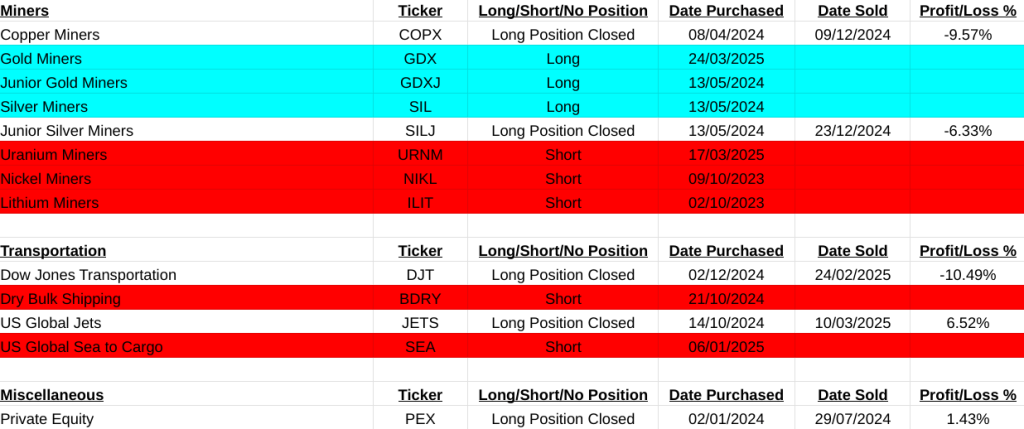

Short positions are marked in red, long in blue, neutral in white.

Note:The above trades do not take into consideration dividends on shares or coupons on bonds. This is important because if you short a stock or bond the dividend will be taken from you. Therefore the safest strategy is never to short any instrument only buy an upwardly trending security and simply close your position when this ends. These trades are my view on the market and not me advising you to take any of these positions. Closed positions have losses and profits listed in percentages. Mainly as a record to myself so I keep honest in evaluating my strategy.

The list of stocks analysed are from the MSCI Large Cap list as of 01/01/2025.

TA-35 Israeli Stock Market