I have to slap my every morning to make sure I’m not dreaming. I turn my PC, read something about what Trump has tweeted during the night and then slap myself again. You really couldn’t make this madness up.

Trump promised a golden age for America. His reckless vandalism is playing havoc with the markets. Gold has surged past $3,000 an ounce for the first time ever on Friday. A triumph for the gold bugs. However it’s a bad omen for the market.

Usually when you get a correction in the market the US dollar gets stronger. But it’s getting weaker, something I have never seen before.

I was looking at the MAG 7 stocks during the week and trying to understand why they have dropped. My conclusion is that they will be the easiest way for countries to retaliate against US tariffs. You only have to look at Tesla’s sales in Europe which are down over 50% since January.

Last week the University of Michigan released its inflation survey that had an inflation expectation of 4.9%.

Up to this point the FED was factoring more interest rate cuts by the end of the year.

The FOMC meeting is this Wednesday. On the basis of these inflation results I don’t think they will lower interest rates but it will be interesting to hear Powell’s comments. It’s only a matter of time before Trump turns on the FED to lower interest rates. I think Powell will stand firm.

This week metals led the charge with gold, silver and copper making strong gains.

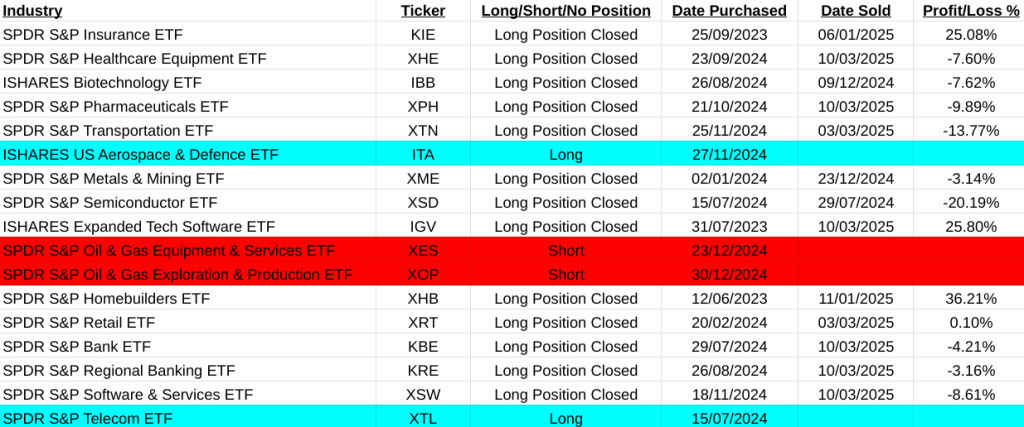

On my main asset list below there were 20 changes. Most notable were the US midcap(MDY) position was closed for a gain of 16.42%. Cloud Computing(SKYY) closed with a profit of 29.48%. Consumer discretionary(XLY) was closed with a profit of 12.4%. Also closed were Pharmaceuticals(XPH)-9.89% and Healthcare(XHE)-7.60%. Banks(KBE)-4.21%, Regional Banks(KRE)-3.61%, Tech Software(IGV)+25.80%, Software & Services(XSW)-8.61%, Global Jets(JETS)+6.52%

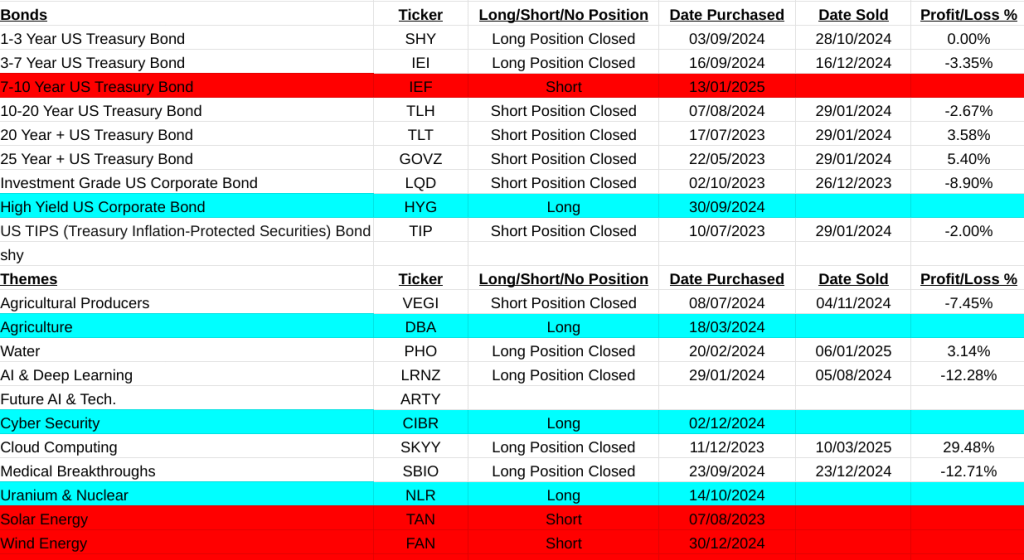

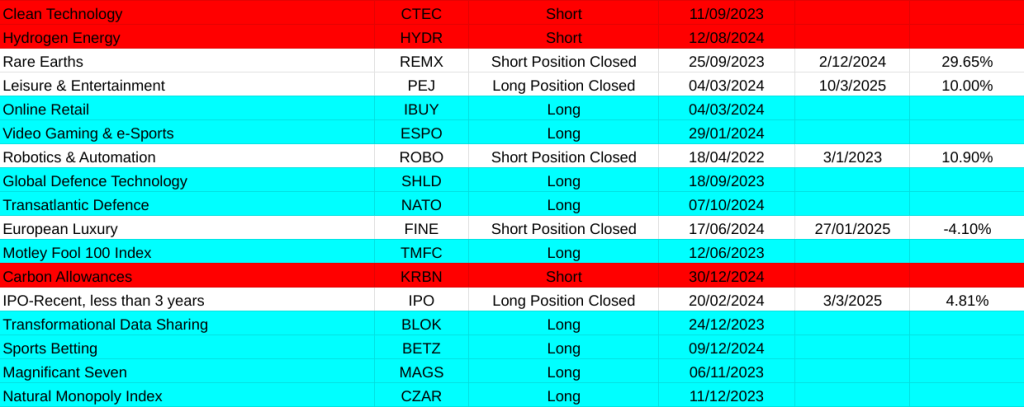

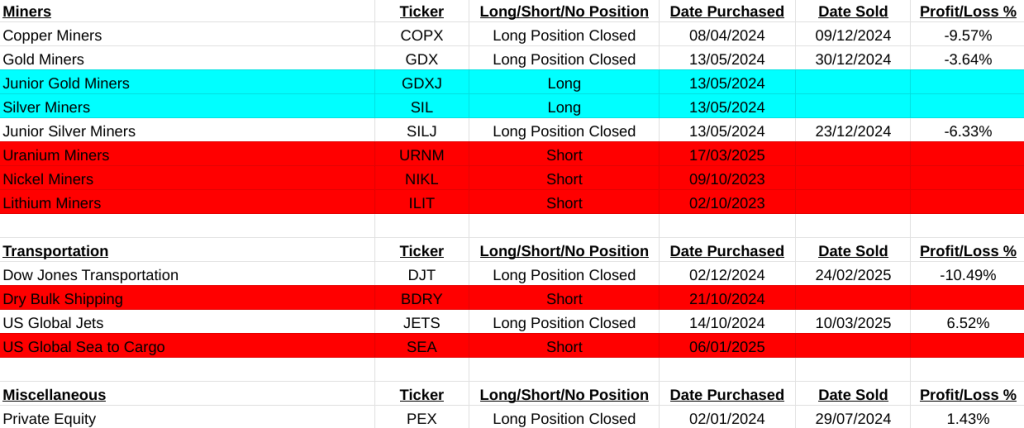

Notable are new short positions on uranium(U.UN:TSX) and uranium miners(URNM).

On a positive note new longs on Europe(IEUR), Chile(ECH), Copper(CPER) and Tin(TINM:LSE).

Slowly my long positions are being closed for profit. This week the main asset list has netted 66.70%. On the MSCI World Cap list of shares, a staggering profit of 582.76%. The best performer was a trade in Microstrategy(MSTR) with a profit of 361%, Walmart(WMT) +62.24% and American Express(AXP) +48.83%.

The total profit this week was a staggering 582.76%. The full list of trades are below, if you want a detailed copy of any trade let me know and I will forward on.

One of the great advantages of using a slow trend following method is that you can stay in a trade for years. When the market corrects like now these golden eggs just fall into your lap. Whether the market goes up or down it doesn’t really matter. Just follow the trend and the money.

It’s clear from the main asset list that money is moving out of all US banks, anything tech, anything related to healthcare and clearly flowing towards Europe and precious metals.

The out performance of European defense stocks and infrastructure is my main takeaway. European governments will spend 800Bn Euros over the next four years. Take a look at the companies on this week’s buy list.

Tomorrow is Saint Patricks day, with my profits this week I will enjoy a few pints of Guinness.

Best wishes, Pearse.

FT500 Closed Trades, Cumulative Gain this week= +582.76%

FT500 Long Signals

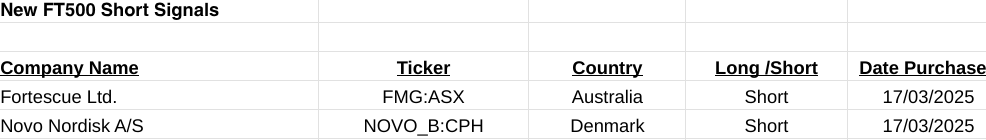

FT500 Short Signals

Short positions are marked in red and long in blue

Note:The above trades do not take into consideration dividends on shares or coupons on bonds. This is important because if you short a stock or bond the dividend will be taken from you. Therefore the safest strategy is never to short any instrument only buy an upwardly trending security and simply close your position when this ends. These trades are my view on the market and not me advising you to take any of these positions. Closed positions have losses and profits listed in percentages. Mainly as a record to myself so I keep honest in evaluating my strategy.

The list of stocks analysed are from the MSCI Large Cap list as of 01/01/2025.