European stocks had a great week, especially Germany after a massive fiscal expansion plan totaling 800bn. Sending the Euro up 4.5% on the week. To put this into perspective, a gain like this against the US dollar has not happened since 2008. Shares in industrial companies and defense soared on the spending pledge. On my MSCI large cap list Rheinmetall(RHM:XETR) is up 91% since January this year. Not one US company makes the top 10 gainers. I put a list at the end of this post.

I was caught on the wrong side of this with some short positions on German companies. But overall last week was the best week I have ever had. A staggering 472.57% gain on stocks. The largest gainers being Arista Networks(+133.44%) and KKR(+102.09%). On the main asset classes list there was a loss of 10.82% with the main changes being Micro Cap US stocks(EWC), Retail(XRT), Transportation(XTN), Utilities(XLU), Small Cap Emerging Markets(EWX), Canada(EWC) and £(UUP) closed. Short position on Euro(FXE) closed and Switzerland(EWL) is now a buy.

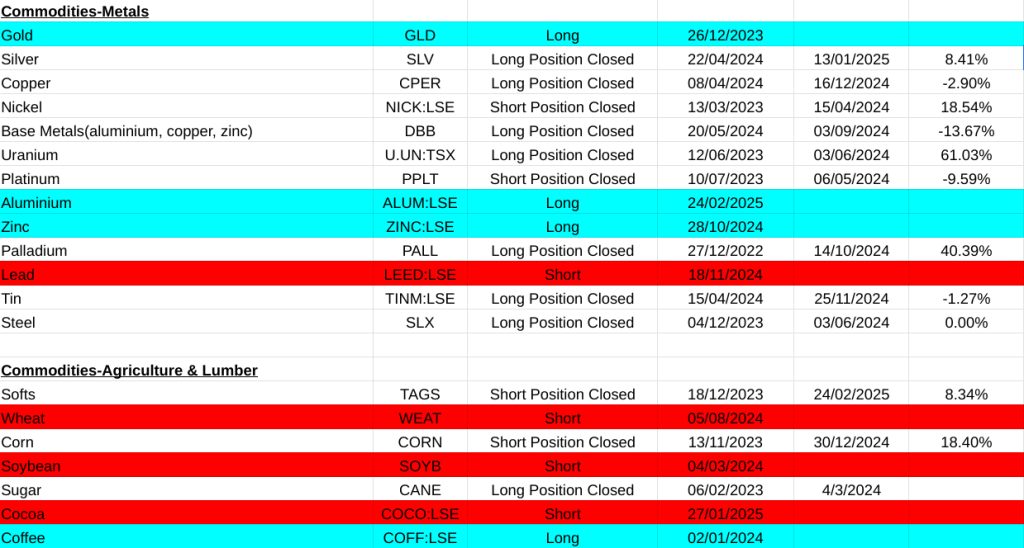

So far this year Trumps tariffs have adversely affected US equities, energy and industrial metals and been positive for precious metals.

If you want a copy of any of my trades I can e-mail them to you.

Have a good week, regards, Pearse.

FT500 Closed Trades, Cumulative Gain this week= +472.57%

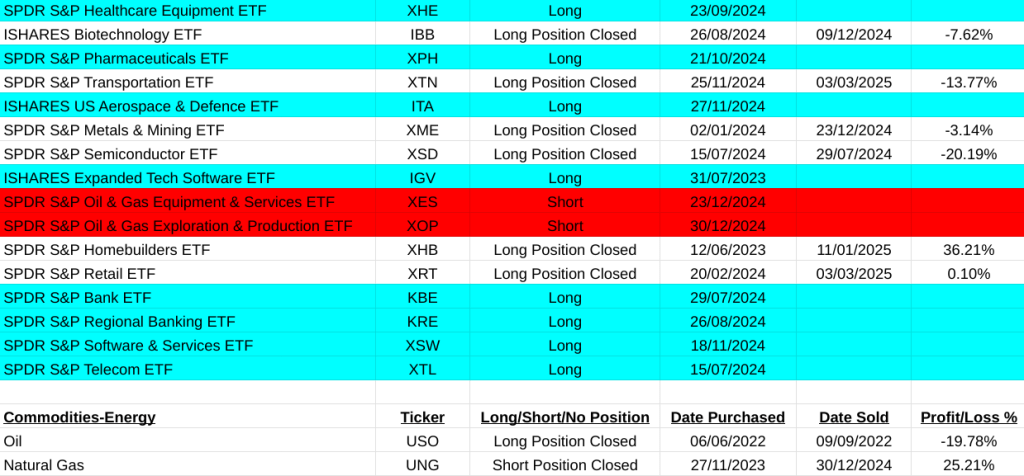

FT500 Long Signals

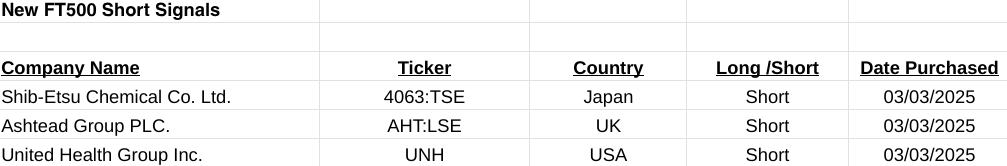

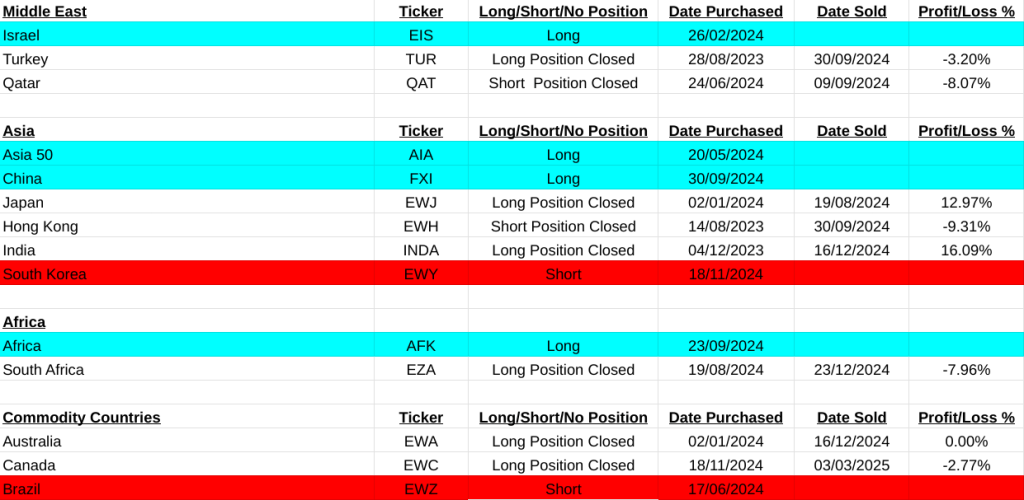

FT500 Short Signals

Short positions are marked in red and long in blue

Note:The above trades do not take into consideration dividends on shares or coupons on bonds. This is important because if you short a stock or bond the dividend will be taken from you. Therefore the safest strategy is never to short any instrument only buy an upwardly trending security and simply close your position when this ends. These trades are my view on the market and not me advising you to take any of these positions. Closed positions have losses and profits listed in percentages. Mainly as a record to myself so I keep honest in evaluating my strategy.

The list of stocks analysed are from the MSCI Large Cap list as of 01/01/2025.