Were back on track this week. In the main asset list I am up 29.95% with the closure of long positions in Livestock(AIGL:LSE, +8.80%), Dow Jones Transportation Index(DJT, -10.49%), Russell 2000(IWM, +9.05%) and most importantly the equally weighted S&P500(RSP, +14.25%). Short position closed on Agriculture(TAGS, +8.34%). My main conclusion from this is that cracks are beginning to become very obvious with the US market. If you take away the distortions of the MAG7 list of companies in the S&P500 index you clearly see that it is beginning to falter. Compound that with a close signal on the Russell 2000 index of smaller companies and the Dow Jones Transportation Index selling off. There is something not so good beginning to work its way out.

The gains and losses on indices, commodities and large ETF’s that represent large groups of companies are slower than individual shares but you can see structural changes happen.

It’s so obvious how the US is under performing Europe especially in banking and heavy industries like steel production. I received a few e-mails on investing in US steel industries. I laughed so much I nearly cried. The US is so far behind even developing countries like India in making something like steel they couldn’t believe it. The US is not even in the top 10, its number 15! Trump can huff and puff and impose tariffs on steel and other essential products but the dope doesn’t seem to understand it’s mainly going to hurt the US.

Manufacturing is coming alive in Europe. Take Arcelor Mittal the worlds second largest producer of steel. And its based in Luxembourg one of Europe’s smallest countries. Over the last fifty years Europe kept alive essential industries, unlike the US. I visited Toulouse a few years ago to see the Airbus factory. It’s now the largest supplier of aircraft in the world while Boeing should have gone bust if it did not have US military contracts. It will take more than tariff’s to stimulate the backward and inefficient US industrial complex. You would be better investing in India, Malaysia and Vietnam. I put the list of steel companies at the end of the e-mail.

Tesla cars in Europe were always a status symbol for wealthy environmental elites. With sales down nearly 50% in Europe I think that any entrepreneur who meddles in politics like Musk will learn a serious lesson. Ford and Edison learnt this a long time ago. I have to admit I am looking forward to seeing that stupid smile wiped off his face. An Irish saying my grandmother would sometimes say was that “even the smartest hens lay out”. Basically when you stop doing what your good at which is laying eggs then the pot awaits!

Following the atrocious treatment of Zelensky last Friday you can feel that we are at one of those moments in history that we read about in history books. The US is no longer seen as the leader of the free world but tyrant Trump and his attack dog Vance really let their great country down.

I can see in the next two weeks that the European governments will appropriate all the Russian frozen money in European banks to assist Ukraine. The banking sector in Europe is making serious gains that I have not seen for over 25 years.

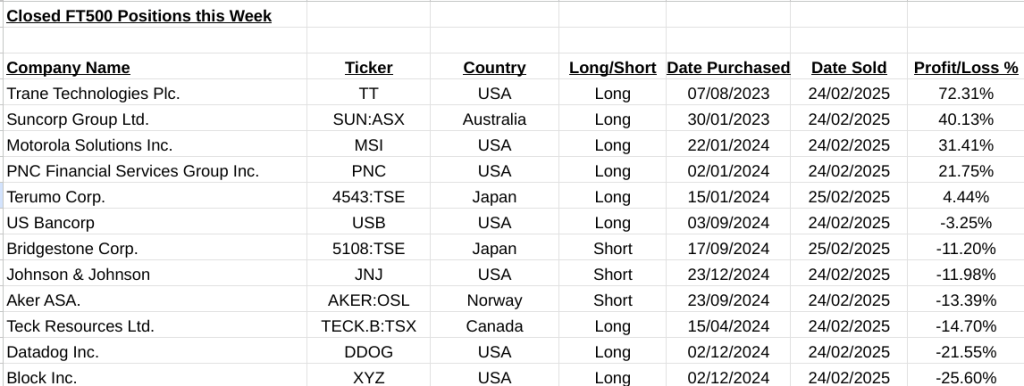

On the stock front a healthy profit of 68.37% was made. I expect that the worse that markets get the better this will be as a lot of positions have been open for over two years.

I shouldn’t voice my opinions but when you look at nearly 1000 charts a week you see certain patterns and connect the dots.

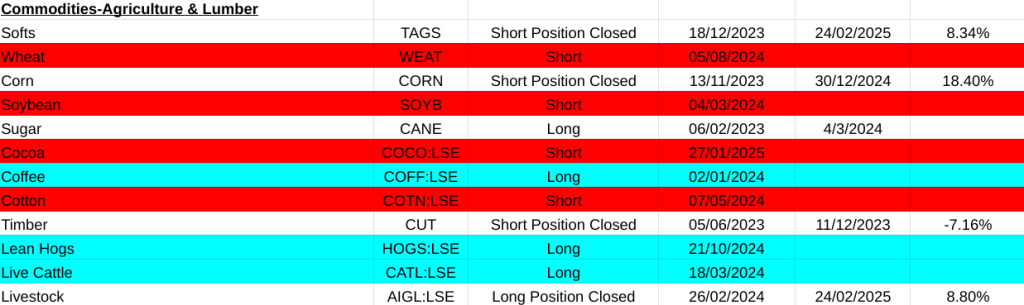

My main take away this week is diversify away from the US to Europe, soft commodities are coming back and don’t forget short-term government bonds.

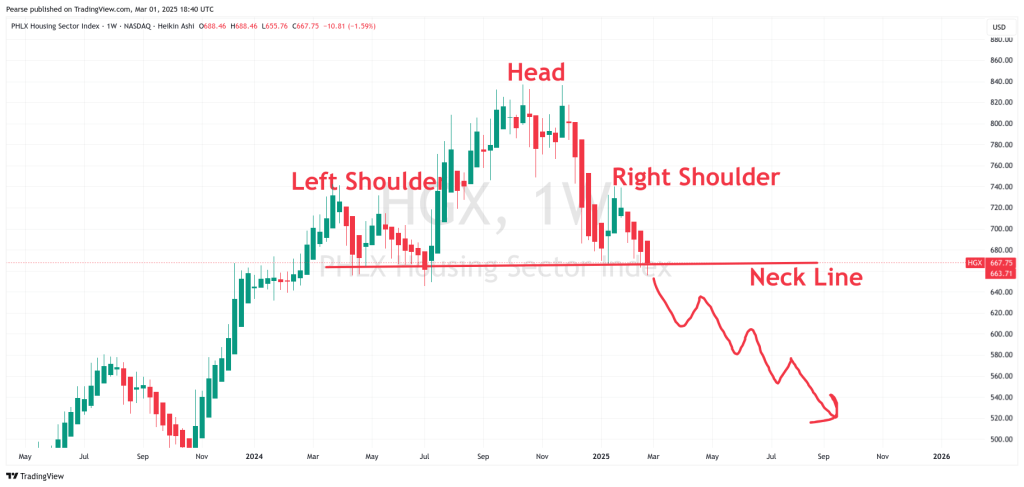

One final thing I came across was the US PHLX Housing Sector Index(HGX). There is a very noticeable bearish pattern that has nearly full formed called a head and shoulders pattern. It does not look good for US housing. Chart is at the end.

Have a good week, regards, Pearse.

FT500 Closed Trades, Cumulative Gain this week=-45.75%

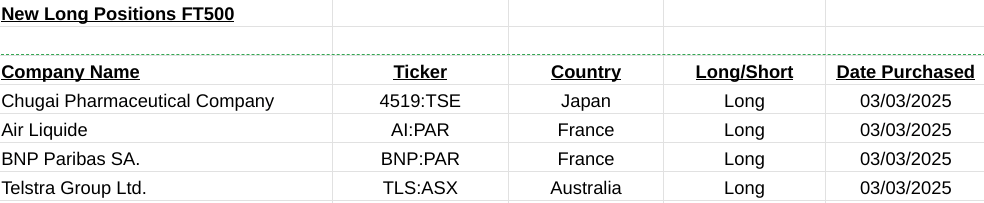

FT500 Long Signals

FT500 Short Signals

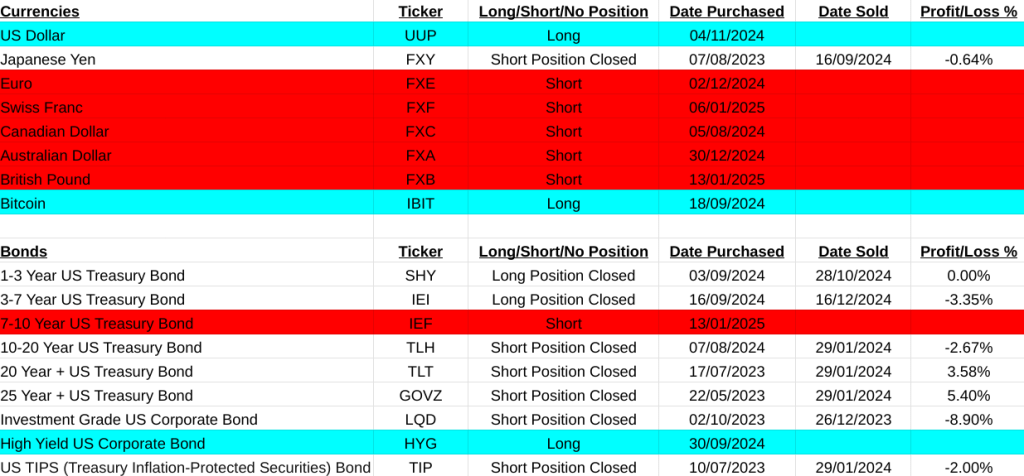

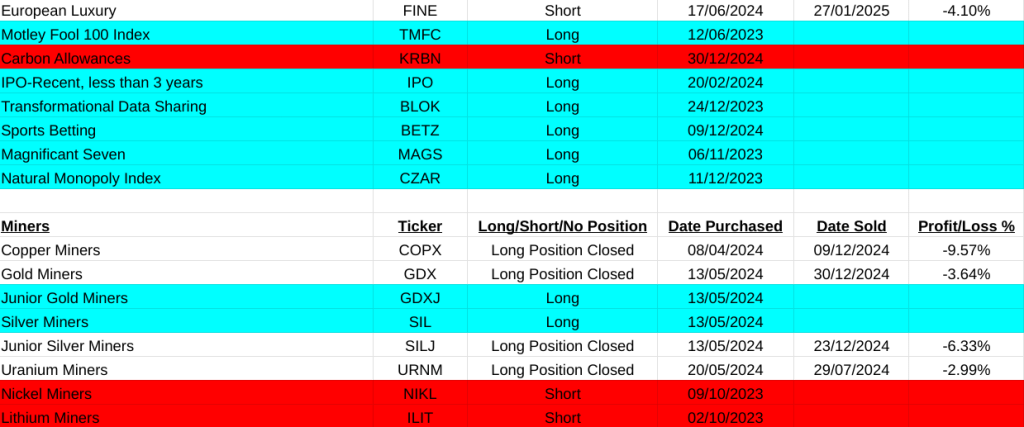

Short positions are marked in red and long in blue

Note:The above trades do not take into consideration dividends on shares or coupons on bonds. This is important because if you short a stock or bond the dividend will be taken from you. Therefore the safest strategy is never to short any instrument only buy an upwardly trending security and simply close your position when this ends. These trades are my view on the market and not me advising you to take any of these positions. Closed positions have losses and profits listed in percentages. Mainly as a record to myself so I keep honest in evaluating my strategy.

The list of stocks analysed are from the MSCI Large Cap list as of 01/01/2025.