Another good week, closed positions gave a very respectable 93.34% gain. The two outstanding performers were Otsuka the Japanese Pharma company and Kering, the French luxury owner of names like Gucci.

It’s interesting that since the start of the year that European markets have done considerably better than the US. Using the EuroStoxx50 as a base its gained 12.05% versus only 2.20% for the US S&P500. There is a noticeable lack of momentum in the US. I suspect this will get much worse, especially with inflation rising from last weeks figures and Trump’s policies.

It’s taken 25 years for the EuroStoxx 50 to get back to where it was in March 2000. The US is looking tired, I think that Europe holds better opportunities going forward.

Continued bullish trend in precious metals, supported by Nickel and Copper from the base metals sector.

The US dollar softened towards the Euro and Swiss Franc.

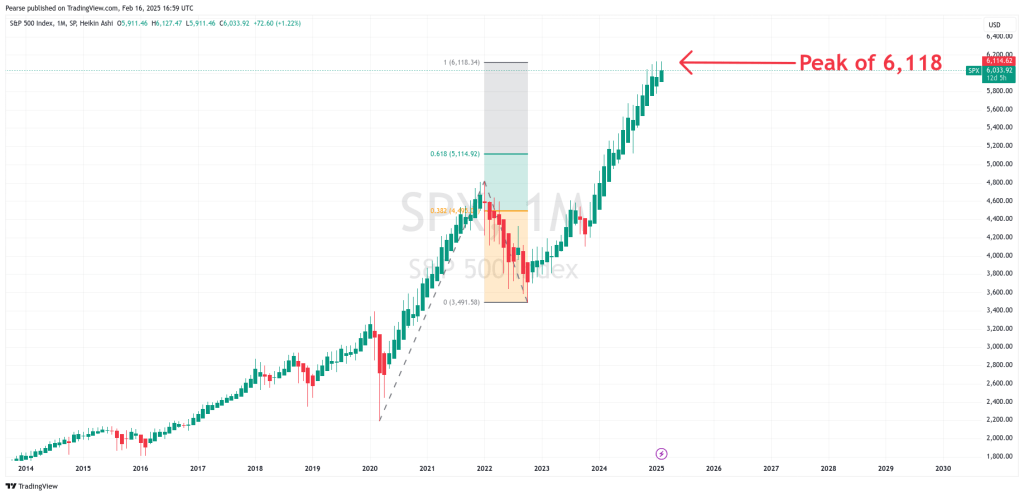

I use Fibonacci to project where the market will go for the long term and targets. In December 2022 I did this. The chart is at the end of the e-mail.

You can clearly see a projection the projected peak in the S&P500 of 6,118. Looking at an hourly chart during the week, you can see that everytime the price hits this level it bounces off. It’s too early to come to a conclusion but I’m beginning to think that this could be a peak.

Anyway time will tell, have a good week, Pearse.

FT500 Closed Trades, Cumulative Gain this week=+93.34%

| Closed FT500 Positions this Week | ||||||

| Company Name | Ticker | Country | Long/Short | Date Purchased | Date Sold | Profit/Loss % |

| Otsuka Holdings Co Ltd. | 4578:TSE | Japan | Long | 29/05/2023 | 10/02/2025 | 50.31% |

| Kering SA. | KER:PAR | France | Short | 25/09/2023 | 10/02/2025 | 43.71% |

| Prudential PLC. | PRU:LSE | UK | Short | 14/08/2023 | 10/02/2025 | 26.97% |

| Nestle SA. | NESN:SWX | Switzerland | Short | 17/07/2023 | 10/02/2025 | 21.20% |

| Bayerische Motoren Werke AG. | BMW:XETR | Germany | Short | 17/06/2024 | 10/02/2025 | 9.96% |

| Volkswagen AG. | VOW3:XETR | Germany | Short | 10/02/2025 | 10/02/2025 | -5.10% |

| BP PLC. | BP.:LSE | UK | Short | 09/09/2024 | 10/02/2025 | -7.12% |

| General Motors Corp. | GM | USA | Long | 28/10/2024 | 10/02/2025 | -11.25% |

| Orange SA | ORA:PAR | France | Short | 16/12/2024 | 10/02/2025 | -12.05% |

| DexCom Inc. | DXCM | USA | Short | 05/08/2024 | 10/02/2025 | -21.29% |

FT500 Long Signals

New Long Positions FT500 Company Name Ticker Country Long/Short Date Purchased Nomura Research Institute Ltd. 4307:TSE Japan Long 17/02/2025 Konatsu Ltd. 6301:TSE Japan Long 17/02/2025 Banco Bilbao Vizcaya Argentaria SA BBVA:MCE Spain Long 17/02/2025 Franco Nevada Corp. FNV:TSX Canada Long 18/02/2025 Infineon Technologies Inc. IFX:XETR Germany Long 17/02/2025 Prosus PRX:AMS The Netherlands Long 17/02/2025 Banco Santander SA. SAN:MCE Spain Long 17/02/2025 Swedbank AB. SWED_A:STO Sweden Long 17/02/2025 FT500 Short Signals

New FT500 Short Signals Company Name Ticker Country Long /Short Date Purchased Colorplast A/S COLO_B:CPH Denmark Short 17/02/2025 Danaher Corp. DHR USA Short 18/02/2025 Ford Motor Co. F USA Short 18/02/2025

Short positions are marked in red and long in blue

Countries USA Ticker Long/Short/No Position Date Purchased Date Sold Profit/Loss % S&P500 SPY Long 10/07/2023 S&P500 Equally Weighted RSP Long 02/01/2024 DOW30 DIA Long 02/01/2024 Nasdaq100 QQQ Long 05/06/2023 Russell2000 IWM Long 02/01/2024 Large Cap IVV Long 10/07/2023 Mid Cap MDY Long 02/01/2024 Micro Cap IWC Long 18/11/2024 Europe Ticker Long/Short/No Position Date Purchased Date Sold Profit/Loss % Europe IEUR Long Position Closed 02/01/2024 16/12/2024 1.24% Germany EWG Long 02/01/2024 France EWQ Short 02/12/2024 10/02/2025 -10.88% UK EWU Long Position Closed 30/01/2023 25/09/2023 -1.87% Italy EWI Long 02/01/2024 Switzerland EWL Long Position Closed 08/01/2024 18/11/2024 -1.34% Ireland(only included because I live in Dublin, Ireland) EIRL Long Position Closed 26/12/2023 28/10/2024 3.54% Middle East Ticker Long/Short/No Position Date Purchased Date Sold Profit/Loss % Israel EIS Long 26/02/2024 Turkey TUR Long Position Closed 28/08/2023 30/09/2024 -3.20% Qatar QAT Short Position Closed 24/06/2024 09/09/2024 -8.07% Asia Ticker Long/Short/No Position Date Purchased Date Sold Profit/Loss % Asia 50 AIA Long 20/05/2024 China FXI Long 30/09/2024 Japan EWJ Long Position Closed 02/01/2024 19/08/2024 12.97% Hong Kong EWH Short Position Closed 14/08/2023 30/09/2024 -9.31% India INDA Long Position Closed 04/12/2023 16/12/2024 16.09% South Korea EWY Short 18/11/2024 Africa Africa AFK Long 23/09/2024 South Africa EZA Long Position Closed 19/08/2024 23/12/2024 -7.96% Commodity Countries Ticker Long/Short/No Position Date Purchased Date Sold Profit/Loss % Australia EWA Long Position Closed 02/01/2024 16/12/2024 0.00% Canada EWC Long 18/11/2024 Brazil EWZ Short 17/06/2024 Emerging Markets EEM Long Position Closed 15/07/2024 13/01/2025 -7.34% Emerging Markets Small Cap. EWX Long 17/07/2023 Argentina ARGT Long 03/01/2023 Mexico EWW Short 05/08/2024 Chile ECH Short Position Closed 20/05/2019 7/12/2020 25.75% Sector Ticker Long/Short/No Position Date Purchased Date Sold Profit/Loss % Consumer Discretionary Select Energy Sector XLY Long 02/01/2024 Consumer Staples Select Sector XLP Long Position Closed 18/03/2024 06/01/2025 4.98% Energy Select Sector XLE Long Position Closed 02/04/2024 9/9/2024 -9.73% Financial Select Sector XLF Long 08/01/2024 Health Care Select Sector XLV Long Position Closed 08/01/2024 18/11/2024 1.73% Industrial Select Sector XLI Long 02/01/2024 Communication Services Sector XLC Long 18/09/2023 Materials Select Sector XLB Long Position Closed 18/03/2024 16/12/2024 -0.06% Real Estate Select Sector XLRE Long Position Closed 19/08/2024 06/01/2025 -5.06% Technology Select Sector XLK Long Position Closed 30/05/2023 2/12/2024 42.61% Utilities Select Sector XLU Long 28/05/2024 Industry Ticker Long/Short/No Position Date Purchased Date Sold Profit/Loss % SPDR S&P Insurance ETF KIE Long 25/09/2023 SPDR S&P Healthcare Equipment ETF XHE Long 23/09/2024 ISHARES Biotechnology ETF IBB Long Position Closed 26/08/2024 09/12/2024 -7.62% SPDR S&P Pharmaceuticals ETF XPH Long 21/10/2024 SPDR S&P Transportation ETF XTN Long 25/11/2024 ISHARES US Aerospace & Defence ETF ITA Long 27/11/2024 SPDR S&P Metals & Mining ETF XME Long Position Closed 02/01/2024 23/12/2024 -3.14% SPDR S&P Semiconductor ETF XSD Long Position Closed 15/07/2024 29/07/2024 -20.19% ISHARES Expanded Tech Software ETF IGV Long 31/07/2023 SPDR S&P Oil & Gas Equipment & Services ETF XES Short 23/12/2024 SPDR S&P Oil & Gas Exploration & Production ETF XOP Short 30/12/2024 SPDR S&P Homebuilders ETF XHB Long Position Closed 12/06/2023 11/01/2025 36.21% SPDR S&P Retail ETF XRT Long 20/02/2024 SPDR S&P Bank ETF KBE Long 29/07/2024 SPDR S&P Regional Banking ETF KRE Long 26/08/2024 SPDR S&P Software & Services ETF XSW Long 18/11/2024 SPDR S&P Telecom ETF XTL Buy 15/07/2024 Commodities-Energy Ticker Long/Short/No Position Date Purchased Date Sold Profit/Loss % Oil USO Long Position Closed 06/06/2022 09/09/2022 -19.78% Natural Gas UNG Short Position Closed 27/11/2023 30/12/2024 25.21% Commodities-Metals Gold GLD Long 26/12/2023 Silver SLV Long Position Closed 22/04/2024 13/01/2025 8.41% Copper CPER Long Position Closed 08/04/2024 16/12/2024 -2.90% Nickel NICK:LSE Short Position Closed 13/03/2023 15/04/2024 18.54% Base Metals(aluminium, copper, zinc) DBB Long Position Closed 20/05/2024 03/09/2024 -13.67% Uranium U.UN:TSX Long Position Closed 12/06/2023 03/06/2024 61.03% Platinum PPLT Short Position Closed 10/07/2023 06/05/2024 -9.59% Aluminium ALUM:LSE Long Position Closed 28/05/2024 10/9/2024 -2.72% Zinc ZINC:LSE Long 28/10/2024 Palladium PALL Long Position Closed 27/12/2022 14/10/2024 40.39% Lead LEED:LSE Short 18/11/2024 Tin TINM:LSE Long Position Closed 15/04/2024 25/11/2024 -1.27% Commodities-Agriculture & Lumber Softs TAGS Short 18/12/2023 Wheat WEAT Short 05/08/2024 Corn CORN Short Position Closed 13/11/2023 30/12/2024 18.40% Soybean SOYB Short 04/03/2024 Sugar CANE Short 27/01/2025 Cocoa COCO:LSE Long 06/03/2023 Coffee COFF:LSE Long 02/01/2024 Cotton COTN:LSE Short 07/05/2024 Timber CUT Short Position Closed 05/06/2023 11/12/2023 -7.16% Lean Hogs HOGS:LSE Long 21/10/2024 Live Cattle CATL:LSE Long 18/03/2024 Livestock AIGL:LSE Long 26/02/2024 Currencies Ticker Long/Short/No Position Date Purchased Date Sold Profit/Loss % US Dollar UUP Long 04/11/2024 Japanese Yen FXY Short Position Closed 07/08/2023 16/09/2024 -0.64% Euro FXE Short 02/12/2024 Swiss Franc FXF Short 06/01/2025 Canadian Dollar FXC Short 05/08/2024 Australian Dollar FXA Short 30/12/2024 British Pound FXB Short 13/01/2025 Bitcoin IBIT Long 18/09/2024 Bonds Ticker Long/Short/No Position Date Purchased Date Sold Profit/Loss % 1-3 Year US Treasury Bond SHY Long Position Closed 03/09/2024 28/10/2024 0.00% 3-7 Year US Treasury Bond IEI Long Position Closed 16/09/2024 16/12/2024 -3.35% 7-10 Year US Treasury Bond IEF Short 13/01/2025 10-20 Year US Treasury Bond TLH Short Position Closed 07/08/2024 29/01/2024 -2.67% 20 Year + US Treasury Bond TLT Short Position Closed 17/07/2023 29/01/2024 3.58% 25 Year + US Treasury Bond GOVZ Short Position Closed 22/05/2023 29/01/2024 5.40% Investment Grade US Corporate Bond LQD Short Position Closed 02/10/2023 26/12/2023 -8.90% High Yield US Corporate Bond HYG Long 30/09/2024 US TIPS (Treasury Inflation-Protected Securities) Bond TIP Short Position Closed 10/07/2023 29/01/2024 -2.00% Themes Ticker Long/Short/No Position Date Purchased Date Sold Profit/Loss % Agricultural Producers VEGI Short Position Closed 08/07/2024 04/11/2024 -7.45% Agriculture DBA Long 18/03/2024 Water PHO Long Position Closed 20/02/2024 06/01/2025 3.14% AI & Deep Learning LRNZ Long Position Closed 29/01/2024 05/08/2024 -12.28% Future AI & Tech. ARTY Cyber Security CIBR Long 02/12/2024 Cloud Computing SKYY Long 11/12/2023 Tomorrow Medical Treatments SBIO Long Position Closed 23/09/2024 23/12/2024 -12.71% Uranium & Nuclear NLR Long 14/10/2024 Solar Energy TAN Short 07/08/2023 Wind Energy FAN Short 30/12/2024 Clean Technology CTEC Short 11/09/2023 Hydrogen Energy HYDR Short 12/08/2024 Rare Earths REMX Short Position Closed 25/09/2023 2/12/2024 29.65% Leisure & Entertainment PEJ Long 04/03/2024 Online Retail IBUY Long 11/11/2024 Video Gaming & e-Sports ESPO Long 29/01/2024 Robotics & Automation ROBO Short Position Closed 18/04/2022 3/1/2023 10.90% Global Defence Technology SHLD Long 16/10/2023 Transatlantic Defence NATO Long 07/10/2024 European Luxury FINE Short 17/06/2024 27/01/2025 -4.10% Motley Fool 100 Index TMFC Long 12/06/2023 Carbon Allowances KRBN Short 30/12/2024 IPO-Recent, less than 3 years IPO Long 20/02/2024 Transformational Data Sharing BLOK Long 24/12/2023 Sports Betting BETZ Long 09/12/2024 Magnificant Seven MAGS Long 30/10/2023 Natural Monopoly Index CZAR Long 11/12/2023 Miners Ticker Long/Short/No Position Date Purchased Date Sold Profit/Loss % Copper Miners COPX Long Position Closed 08/04/2024 09/12/2024 -9.57% Gold Miners GDX Long Position Closed 13/05/2024 30/12/2024 -3.64% Junior Gold Miners GDXJ Long 13/05/2024 Silver Miners SIL Long 13/05/2024 Junior Silver Miners SILJ Long Position Closed 13/05/2024 23/12/2024 -6.33% Uranium Miners URNM Long Position Closed 20/05/2024 29/07/2024 -2.99% Nickel Miners NIKL Short 09/10/2023 Lithium Miners ILIT Short 02/10/2023 Transportation Ticker Long/Short/No Position Date Purchased Date Sold Profit/Loss % Dow Jones Transportation DJT Long 02/12/2024 Dry Bulk Shipping BDRY Short 21/10/2024 US Global Jets JETS Long 14/10/2024 US Global Sea to Cargo SEA Short 06/01/2025 Miscellaneous Ticker Long/Short/No Position Date Purchased Date Sold Profit/Loss % Private Equity PEX Long Position Closed 02/01/2024 29/07/2024 1.43%

Note:The above trades do not take into consideration dividends on shares or coupons on bonds. This is important because if you short a stock or bond the dividend will be taken from you. Therefore the safest strategy is never to short any instrument only buy an upwardly trending security and simply close your position when this ends. These trades are my view on the market and not me advising you to take any of these positions. Closed positions have losses and profits listed in percentages. Mainly as a record to myself so I keep honest in evaluating my strategy.

The list of stocks analysed are from the MSCI Large Cap list as of 01/01/2025.

Monthly Chart of the S&P500 with Fibonacci levels

1 Hour Chart of the S&P500 with Fibonacci levels