Well well, what a year! The coverage in the press has been overwhelming so anything I say you have probably heard already. So don’t worry I’m not going to repeat what you already know, that the markets have performed exceptionally well. I keep hearing the words ‘j-curve’ and ‘melt-up’. As a contrarian and a bear I look for weakness and signs of change to existing momentum.

Usually, I give a little rant and then hit the markets but as this year has been so exceptional I’ll start off with what I see now and maybe how we can make some shekels in the next year.

All the key indices look great and without being negative they also look very unsustainable. Take for example the monthly chart for the DOW. I could well be the S&P500, Nasdaq or the Russell 2000. This quite simply defies logic and a simple correction to the mean must happen, this year.

Take a look at the weekly chart of the US Dollar Index(DXY). It has just retested and looks like it will continue and break its neck-line of 91. If this plays out it potentially looks like a potential 12% drop in the US dollar. This will make US shares cheaper for us and pension funds all over the world to load up on more Apple, Google and so forth. What makes this so interesting is that in light of the Trump tax cuts will push funds in the same direction. So if the S&P usually gains about 9% on average a year, the tax cuts could easily bump this up to 12-15%. So the 2 combined could add another 24% to an existing frothy market. Resulting in a S&P of 3,400-3,500 and a DOW of 30,000-31,000. This is only speculation. Forgive me for being so positive but really the outcome will not be good for anyone.

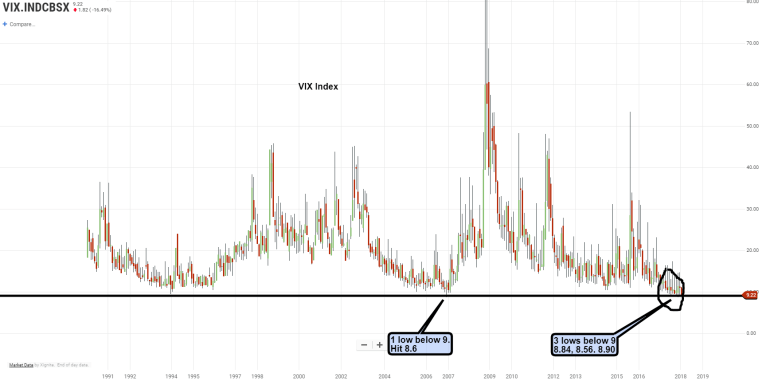

Now, this is where I think it gets really interesting. The VIX that we all hear talked about. Take a look at the monthly chart below going back to January 1990. Based on its history you can see the black line which is 9.0, it has only dropped below that historically for 2 periods since its inception, December 2006 and very unusually 3 periods at present. It has never clustered like this before. Telling us that since its inception that there has never been a period of such little fear of a drop in equity prices. This does not signify that anything will happen tomorrow but based on the past the previous low of 8.8 was hit on 18/Dec/2006, the S&P500 topped on 11/Oct/2007. So it gave a very accurate 10-month warning that something serious was going to happen. Now we have 3 monthly hits. That tells me to get ready for something big this year.

Here in Europe the Euro Stoxx 50 and Stoxx Europe 600 Indices seem to be forming a double top head. This is not imminent of definitive and could take another 2 months to play out. Below is the weekly chart.

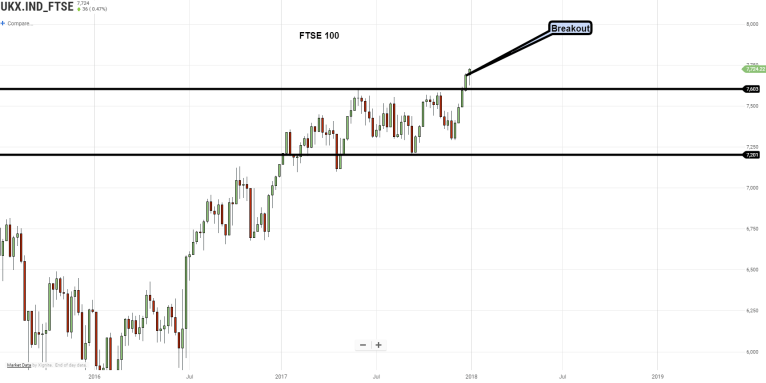

The FTSE 100 looks like its going to take off after breaking out of its key 7,600 level.

Sectors & Industries

Materials:

Metals and Mining(XME) have broken out from resistance, stick to the ETF or the big boys like Rio Tinto(RIO.L) or BHP Billiton(BLT.L).

Healthcare:

Conventional pharmaceutical companies have been beaten down, simply buy the ETF called XPH. Perrigo(PRGO) looks like a good play as it is recovering nicely. Also, Novo Nordisk has caught my attention, ticker NOVO B:CPH.

Energy:

Oil & Gas production is now a buy. The ETF called XOP is the easiest play. Also, I see amazing value in Russian oil and gas companies particularly Gazprom and Lukoil. Their main listing outside Russia is in London, denominated in US dollars.

Making them great buys is they have a primary listing outside Russia in London denominated in US dollars. The consolidated oil company Gazprom Neft has a ticker GAZ:LSE. This has a p/e of less than 5 and a dividend yield over 8%. Also Lukoil, ticker LKOD:LSE has a p/e less than 8 and a dividend yield over 5%.

All the other sectors and industries are humming along except for 2 sectors Utilities sector(XLU) is correcting sharply downwards and Telecommunications(XTL) looks like it has run out of steam.

So What Works Now. What To Buy

Extended duration US bonds greater than 20 years such as TLT. Step back and think. Interest rates are correlated to growth. In other words, you should pay more when future growth is high. Over the last 100 years, the expected future growth is as low today as compared to the price to earnings(P/E) of the market.

Are low-interest rates a sign of economic strength or economic weakness. Think, where in the world do we have low-interest rates? Where there’s low growth. Where do we have low-interest rates? Where there are bad demographics, bad debt, and deflation. Seems crazy but that’s exactly whats happening.

We have depression level interest rates and boom time share prices!

The day of reckoning has only been slowed down. The bubble is bigger and the crash will be stronger, all we did was delude ourselves. All that is required is one wobble and down the rollercoaster, we go. Central banks have interfered with the markets and only delayed reality. In actual fact, they are making the problem even worse.

Think about Switzerland, in the past, a thief took his money to Switzerland and got 0% interest for anonymity. Now, thats exactly what they are giving everyone, even the dogs on the street.

Growth plus inflation should equal the yield on Government bonds. So when the yield is nearly zero on bonds the only reason to own them is for capital protection. So that’s why I would buy long-dated government bonds over 20 years duration. I also like Vanguards extended duration treasury index fund ETF which has a 25-year duration. Ticker EDV in New York.

Where in the World can we find Growth & Value?

Europe:

The Americas

Chile is the big mover here, ticker ECH. My reasoning for this as mentioned before is because Chile has the largest Lithium production company in the world, Sociedad Quimica y Minera de Chile SA, (ticker SQM). I think a holding in a pure lithium play is essential and while other large companies talk about it this company is shipping more lithium to car makers than anyone else. For other Lithium ideas check out my last blog post.

Mexico had a good run but seems to be going negative. Maybe that self-acclaimed “very stable genius” north of their border is working some of his financial magic.

The Middle East

Qatar’s small stock market is betting really bashed. Great to see a government run by criminals who have tried to destabilise so many of its neighbours with extremism and dirty money get a taste of its own medicine.

Egypt is beginning to shine and well worth some attention, ticker EGPT.

Israel: The TA100 index has been badly hit mainly because its largest company Teva had a very bad 2017, losing over 50% of its value. The easiest way is to passively buy the TA100 with an ETF called ISRA. Not particularly cheap but a solid play on an economy with great innovation.

Asia

What hits me about Asia is that there so many value plays. The main ones that hit me are India(INDA+INDY), Japan(EWJ), Indonesia(EIDO), the Philippines(EPHE), Thailand(THD), Vietnam(VNM). In particular India and Japan! In India, I think the banks will do very well such as HDFC, ICICI, the State Bank of India. Very little bad debt on their books and starting to push out new products very rarely used in India before such as insurance. For a more risky play, check out Indian small cap company ETF’s SCIN and SCIF. Think it will be Modi’s year, “Go, Modi, Go.”

Regarding Japan, I noticed that its the industrial stocks that are outperforming such as Mitsubishi, Honda and Denso. The Nikkei 225 is waking up. At 23,700 it can easily break 30,000 if not 35,000 in a few months.

Africa

The largest and wealthiest country in Africa, Nigeria. When I say this so many people tell me I am mad and that it must be South Africa. Check it out for yourself. Its the one country I think that will boom in the future. The growing middle classes are fed up with corruption at all levels of their society. Mind you they learned this from their colonial masters which founded Nigeria in 1906. Take a little read of the book ‘Scramble for Africa’ by Thomas Pakenam to learn about the great models the British were in this part of the world. Their corporate ethics are no less questionable. Yes at home in Blighty but not in Africa. Ask yourself where the so-called corrupt ex-leaders of countries like Nigeria are living and what banks have facilitated this.

In May 2016 the British government hosted a landmark international anti-corruption summit in London. It came to light that the preferred home for corrupt Nigerian funds was the UK. There are over 100,000 homes owned by wealthy Nigerians in the UK alone, 44,000 of them in London. Also, it came to light that the British Virgin Islands, Jersey and the Isle of Man were the preferred safe havens for stolen cash and what did the British government do. Absolutely nothing. ‘Lick up the honey and ask no questions’.

Emerging(EEM) and Frontier(FM) markets are motoring away.

Suggested Buys and Sells around the World

Some interesting buys and sells I came across were.

In the US Cree, a led lighting manufacturer in the US, Periggo(PRGO) 20 year US government bonds(TLT), Twitter(TWTR). Firstrand Bank in South Africa, Mitsubishi-8050.tks. Pilbara mines, Ardea Resources, Orocobre, Cobalt Blue in Australia. Potash Corporation of Saskatchewan, Sociedad Quimica y Minara de Chile SA(SQM) of Chile, Infosys on India. FBD(EG7.ISE) and Aryzta(YZA.ISE) Cairn Homes(C5H) of Ireland. Russian oil companies Gazprom Neft(GAZ.LSE), Lukoil(LKOD.LSE). India(INDA+INDY). Small-cap Indian companies(SCIN+SCIF). Danish Novo Nordisk(NOVO B:CPH).

On the Sell side, I think the following companies are not going to do well.

In the US, Nvidea(NVDA) and Tesla(TSLA), GE(GE)Junk Bonds(JNK). Irish companies Glanbia(GL9.ISE), Ryanair(RYA.LSE), C&C Group(GCC.ISE). German chemical companies Henkel(HEN3.GER). Swedish banks like Skandinaviska Enskilda Banken(SEB A.STO). Pakistan(PAK).

Little Rant

I don’t use a so-called smartphone. Why because I’m surrounded by computers and when I’m on my own it’s nice to get a break away from all the endless chatter. If I meet someone for a coffee for a chat, a pint or anything even in the cinema anyone I meet has a smart phone glued to their hands. I’m at the stage that I ask someone if they will turn off their phone for a few minutes. They look at me incredulously as if I’m asking them for a load of a few hundred euros. Guess what, they would rather part than simply turn it off for even 2 or 3 minutes. What interests me is that these people are all over 50 so I’m not having a go at a generation but at the addictive nature of the technology itself. In Scott Galloway’s recent book called ‘The rise of Addictive Technology,’ he talks about how companies like Facebook, Google, and Twitter have employed the smartest psychologists that have specialised in the psychology of manipulation to create behavioral addictions.

One of the first big investors in Facebook was Roger McNamee he met Mark Zuckerberg in the Summer of 2006. He subsequently convinced him not to take an offer of around $750 million from Yahoo for his company. He saw Facebook’s potential. Roger McNamee is the founding partner of the venture capital firm Elevation Partners. They managed the band U2’s money and made a large investment in Facebook at its IPO. So here we have a very wealthy person who has no axe to grind but he is now saying that the addictive effects of using such platforms are that we are being manipulated. The effect on children is profound.

It basically takes over your life, they basically create behavioral addictions. They have hacked people’s brains. Check out this article in The Atlantic magazine, Has the Smartphone destroyed a Generation.

Society is turning, governments are waking up. Just as happened with Standard Oil in 1911, an antitrust law required Standard Oil to be broken into smaller, independent companies. This I see coming with these companies. They simply are becoming too powerful and in storing its cash offshore the US has no way of getting at it. Let’s see how much cash these companies repatriate with the nice friendlier US tax laws. There is at the moment a backlash happening particularly in Europe.

Also, people are waking up to the addiction of social media. Society is turning against big technology. An inflexion point is coming. Just consider how predatory sexual bullies like Harvey Weinstein are being taken on and outed. Amazon is seen as a large corporate bully on the block. Just like a big bully they are all powerful. These big bullies will become targets as they are seen as all powerful.

Research from the University of California by Professor Gloria Mark argues that reorientating yourself after an interruption tends to take between 20 and 25 minutes. She points out that once we get in the habit of being interupted by others then we start to interupt ourselves, constantly checking our social media and e-mail. That reassuring feel when we hear those little clicks. Check out the interesting article in this weekends FT.

https://www.ft.com/content/5788fb32-efb9-11e7-ac08-07c3086a2625

Finally, a little bit on cryptocurrencies. Where the light shines brightest the shadows are darkest still! When everything looks wonderful, leave the party. You don’t set the price the crowd does. Media reflects the mood. The squad of lemmings is going to run off the cliff together. Recently a taximan told me he was going to buy a bitcoin.

As Joe Kennedy his signal to get out of the market and keep his fortune was when, “Taxi drivers told you what to buy. The shoeshine boy could give you a summary of the day’s financial news as he worked with rag and polish. An old beggar who regularly patrolled the street in front of my office now gave me tips and, I suppose, spent the money I and others gave him in the market. My cook had a brokerage account and followed the ticker closely. Her paper profits were quickly blown away in the gale of 1929.”

Anyway stay safe out there, this is going to be a very interesting year. Next month I have some interesting ideas on how to play a correction, all the best,

Pearse Coughlan.

Zohar Trading.