Hi all, hope everyone is well. Usually when I look at the markets every month I try to get a feel for whats going on. What most of us don’t realise is that we are constantly being bombarded by news, most of it rubbish and some of it sticks. So to get the big picture I look at long term bonds, gold/silver, transportation, the main indices then sectors and industries. Trying to drill down in a systematic way instead of picking stuff out of the last thing I have just heard on Bloomberg or Reuters.

Doing this I have found some interesting changes.

- Firstly looking at transportation. The Dow Jones Transportation index has made a key week reversal. The last this this happened was June of 2014. As you can see below there is a simple head and shoulders forming. If its neck line of 8,800 is broken it could drop to 8,000.

2) Bonds, the 20 year government bond has broken out on a weekly chart above its neck line and looks like to pop to 130. Everytime I listen to the media I hear about a bond bubble, well looks to me like it will increase significantly. Why would you buy a 20 year bond basically making nothing unless you saw a big storm coming. I just can’t figure out why?

3) US Dollar Index. Its just about to break very strong support at 100. Waiting to see what happens on it. If it drops below this it could give increased impetus to gold and silver as they will be cheaper. 4)The S&P 500 has broken out of a symmetrical triangle as of the last trading day of last week. The minimum target drop is to 2,190. Note what I said in my last months blog. If 2,250 is broken I believe there will be very severe repercussions.

4)The S&P 500 has broken out of a symmetrical triangle as of the last trading day of last week. The minimum target drop is to 2,190. Note what I said in my last months blog. If 2,250 is broken I believe there will be very severe repercussions.

5) Sectors. All the 11 sectors are still a buy except Consumer Staples, Health Care, Utilities and Real Estate REITs which are all neutral. I am watching them to see and big changes to a sell.

5) Sectors. All the 11 sectors are still a buy except Consumer Staples, Health Care, Utilities and Real Estate REITs which are all neutral. I am watching them to see and big changes to a sell.

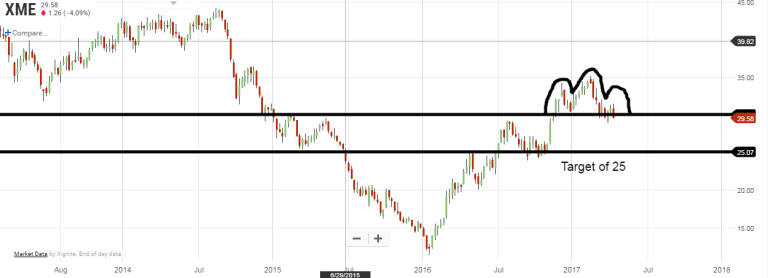

6) Industries. The one that caught my eye here was Metals and Mining. It looks like it has broken down. I notice that copper, copper miners(COPX), steel(SLX) and Rare Earths(REMX) have also nearly capitulated. I could drill into the likes of the big materials companies but believe they will follow down this track.

This is just a quick roundup of what I see. I think we are now into a 94/95 month bull market. The above are signalling to me to protect yourself because the smart money seems to be doing just that. Next week when you turn on the TV you probably won’t hear much of this but I think the next few weeks will be very interesting. I heard a great quote that from Carl Icahn, “Some people get rich studying artificial intelligence. Me, I make money studying natural stupidity.”

All the best, enjoy your summer wherever you are, regards, Pearse.