Hi all, I havn’t sent anything in a while. Have been very busy. Well well todays the day that Mr.Trump becomes the 45th United States president.

At Davos last week George Soros described him as an “imposter and a con man and a would-be dictator”. He also said that Mr. Trump was “definitely gearing up for a trade war” with China. “You can’t have a trade war and a well-functioning international system.” Finally he suggested that the British people will ultimately realise the Brexit vote was a “disaster” as inflation erodes living standards. All I know is that the man who broke the bank of England is someone I would listen to.

Mr. Trump a loud mouthed sexist and man of highly questionable business ethics reminds me of the founder of fascism, a man called Benito Mussolini “Il Duce”.

He blamed the liberals, the elite and the intelligentsia of holding the country back and of being unpatriotic. He harnessed the bitterness and anger of the least educated and older rural populations. Focused them against any liberal thought or minority. He unleashed ignorance and bigotry, preduce and resentment. If you were asked to guess who this was you would say Trump!

Well let us not all forget that ‘Il Duce’ ended up hung by his heels alongside his mistress in a gas station in Milan in April, 1945.

Now lets get back to business.

The DOW

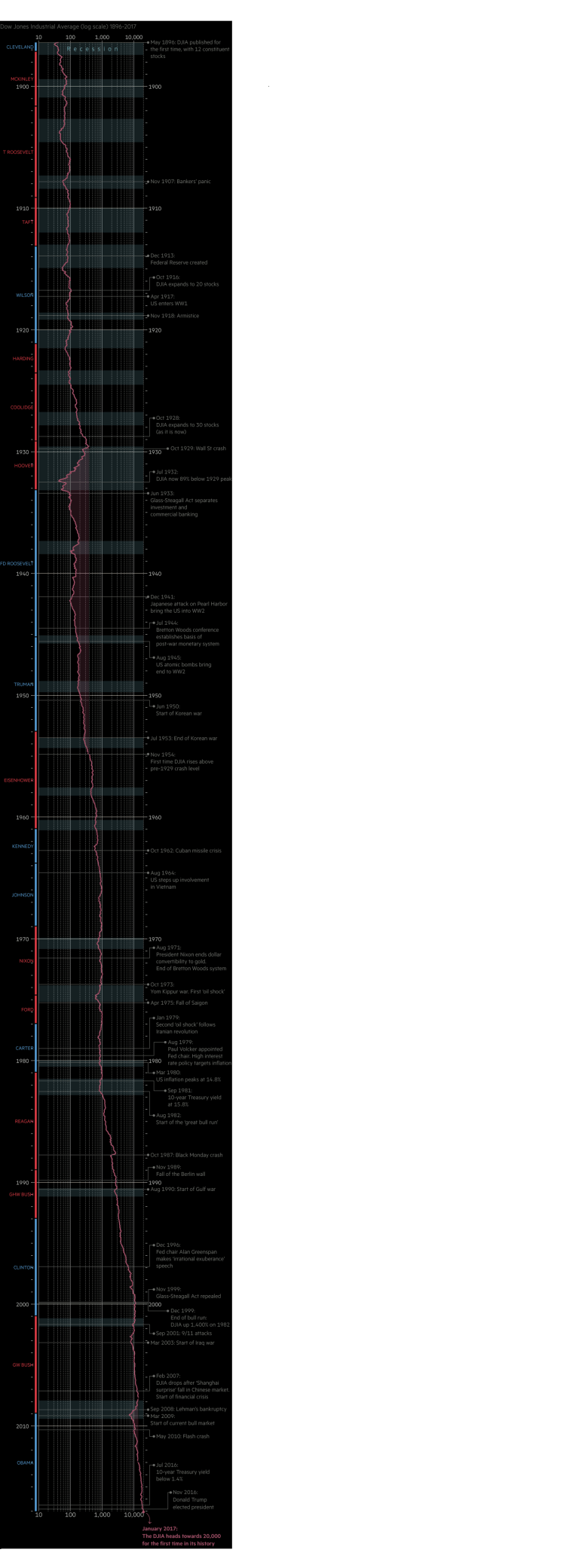

When the Dow was originally founded in May 26, 1896 it composed of only 12 companies. Made up of companies that do not exist today like National Lead and Tennessee Coal & Iron. The index increased to 20 stocks in 1916 and finally settled in 1928 to its current 30 companies. Not as popular as it once was as now the big daddy is the S&P500. But when someone asks you how did the market do today they they mean the DOW. Its like a walk down memory lane to look at the dates of notable events like the Wall Street Crash in 1929, The Pearl Harbour attack or the fall of the Berlin wall in 1989. Note the presidents on the side as well. Its trying unsuccessfully to break through the 20,000 level at the moment. I wonder what Mr.Trump will do for it??

When the Dow was originally founded in May 26, 1896 it composed of only 12 companies. Made up of companies that do not exist today like National Lead and Tennessee Coal & Iron. The index increased to 20 stocks in 1916 and finally settled in 1928 to its current 30 companies. Not as popular as it once was as now the big daddy is the S&P500. But when someone asks you how did the market do today they they mean the DOW. Its like a walk down memory lane to look at the dates of notable events like the Wall Street Crash in 1929, The Pearl Harbour attack or the fall of the Berlin wall in 1989. Note the presidents on the side as well. Its trying unsuccessfully to break through the 20,000 level at the moment. I wonder what Mr.Trump will do for it??

Correction from my last Blog

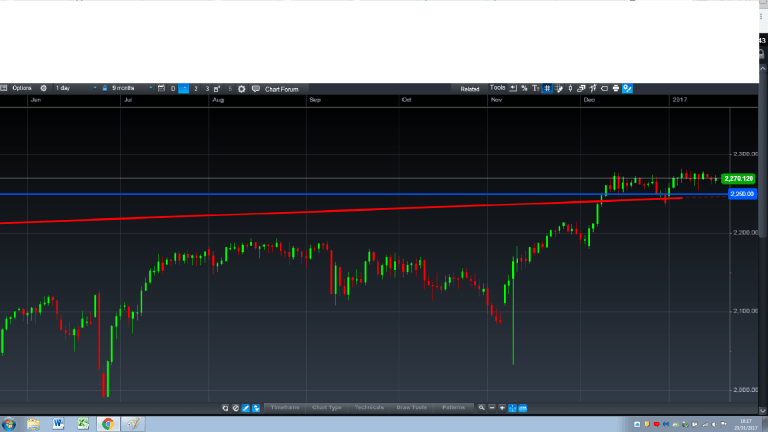

Regarding that large Megaphone pattern I mentioned the last time. The projection point is 2250 and not 2230. So what you might say, but look a little closer. Below is the monthly chart and below that is the daily chart.

Look very carefully at the right hand corner and you will see a double top forming with a neck line at exactly 2,250. Why is this relevant? As I said before this Megaphone pattern is nearly 30 years in forming to where we are now and as said before if this level of 2250 is not held then I believe there will be big trouble. The chart projects a level of 500. I am sure this will not happen but if it does I will be ready to take advantage.

So, What happened last year.

Don’t worry I’m not going to bore you silly. All the sectors were up except financial(real estate was taken out of the sector so not valid), healthcare and real estate. Only dropped by about 1% so nothing to worry about. Telecoms and energy up nearly 25%. The biggest Industry movers were Pharmaceuticals dropping about 25% and the greatest recovery in metals and mining by 110% followed by Oil and Gas services/exploration by about 30% and the banks by about 30%. With the new administration coming into the US this is where I would be for the next 3 to 6 months. Also as interest rates will rise in the US the US banks look really good value. As an aside the next person who asks me about Bank of Ireland needs their brains tested. Citibank traded at a P/E ratio of 7 earlier in the year against this flea bitten mangey dog on a multiple of 14.

Get out of utilities, property and large dividend paying stable companies like the big pharma companies.

What am I Watching

I know one thing this year for certain, there will be more volatility. With Trump in government you WILL get volatility. A nice way to play this is with an exchange traded note by iPath called VXX. So the 4 things I am watching are the S&P500 for a breakdown of 2250, the Vix, Gold and $/Yen.

Gold and Silver are in a downward trend(weekly). What I am waiting for is a drop to $1050 a troy ounce.

I ultimately think that the new US administration will need a cheaper US dollar to try and do some of the never never land stuff Trump wants to do and this will make all commodities really cheap as they are denominated in $. This won’t happen immediately and could take a few months but they will need it. At the moment 1$=€0.93566

They really need it to be below 0.9 and preferably below 0.80

It doesn’t really make sense for the dollar to get weaker if interest rates are to go up so I see a big battle with the FED. Will Janet Yellen be bullied. Lets see.

Finally, below is the S&P500 going back to 2000. We have had the best bull run in its history and looking at this it tells you we are at least 20 months overdue for some kind of correction, even a small one. What will be the petrol on the fire? China. If the S&P continues and Trump continues this massive bubble then one hell of a correction awaits. Keep your eye on the 2,250 level. Just like in the Wizard of Oz, Trump is now the man behind the curtain and if it does pop then buckle up as Kansas may be going bye bye.

All the best, have a great 2017, Pearse.